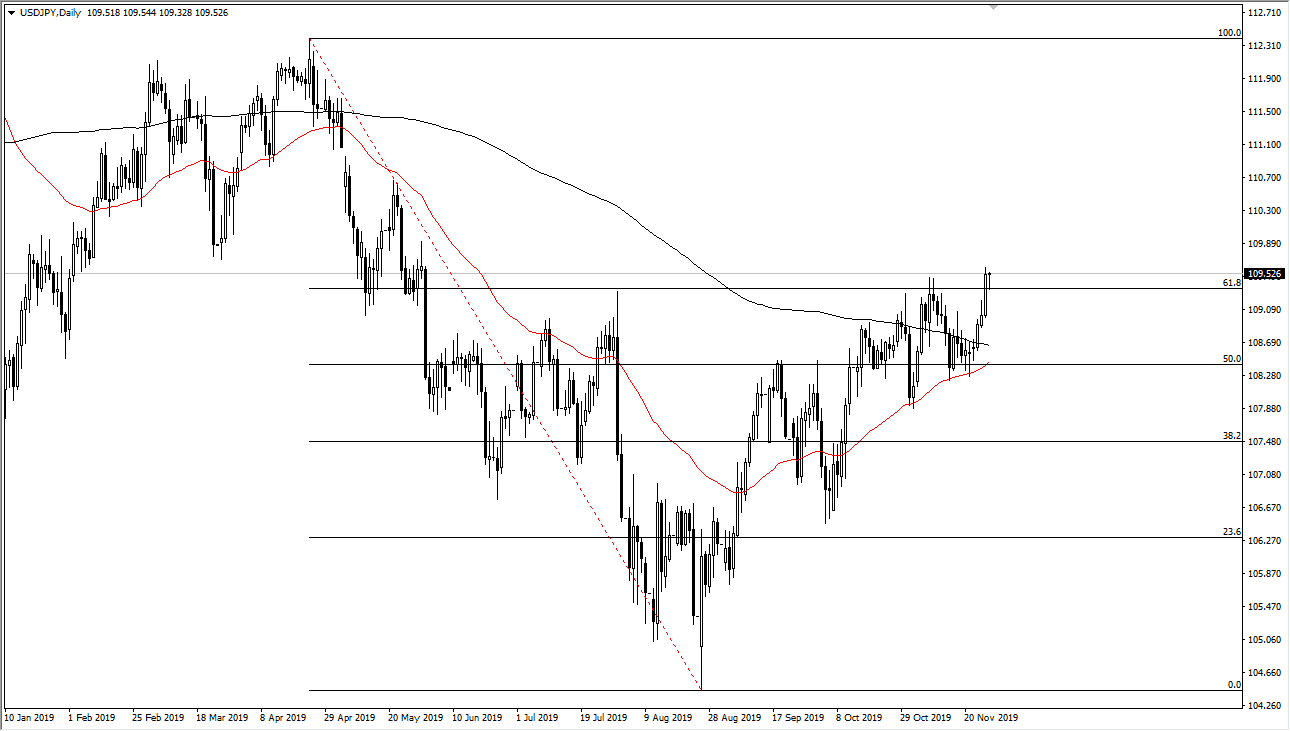

It's obvious that the USD/JPY pair is trying to break out, and it’s probably only a matter of time before it actually occurs. The ¥110 level above is a major barrier to pay attention to, and if we can clear that level it’s likely that we will reach towards the gap at the ¥111 level. The level will offer a bit of resistance, but quite frankly Fibonacci studies suggest that once we break above the 61.8% level, we then go looking towards the 100% level.

That 100% Fibonacci retracement level is the ¥112.50 level, an area that will more than likely be targeted given enough time. We need some type of action with the US/China trade talks to firmly cement this move, and in a sense, we may have already received that signal. After all, Donald Trump signed the so-called “Hong Kong Bill” that was put forth by the U.S. Congress supporting the protesters in Hong Kong. This initially caused a bit of a panic in Asia, but since then we have seen something that a lot of traders didn’t expect: China did nothing.

Yes, the Chinese Communist Party ranted and raved about it, but at the end of the day they didn’t do anything. This suggests that perhaps the Chinese need this trade just as much as the United States does, if not more. This means that both sides might be motivated to do something going forward, and the market is trying to get more of a “risk on” feel to it. The fact that the Chinese didn’t retaliate right away suggests that perhaps we are closer to the “Phase 1 deal” then a lot of people had thought. Regardless, this should continue to drive money away from the Japanese yen and I think that once we break above the ¥110 level this will become more of a “buy-and-hold” proposition. As far as selling is concerned, I have no interest in doing so because the one thing that we have seen over the less several months is that every time this market falls, buyers come back to pick up bits of value. All things being equal, it seems as if the market is ready to continue to the upside, but it is obviously going to be irritated by the occasional headline via Twitter or the South China newspapers occasionally.