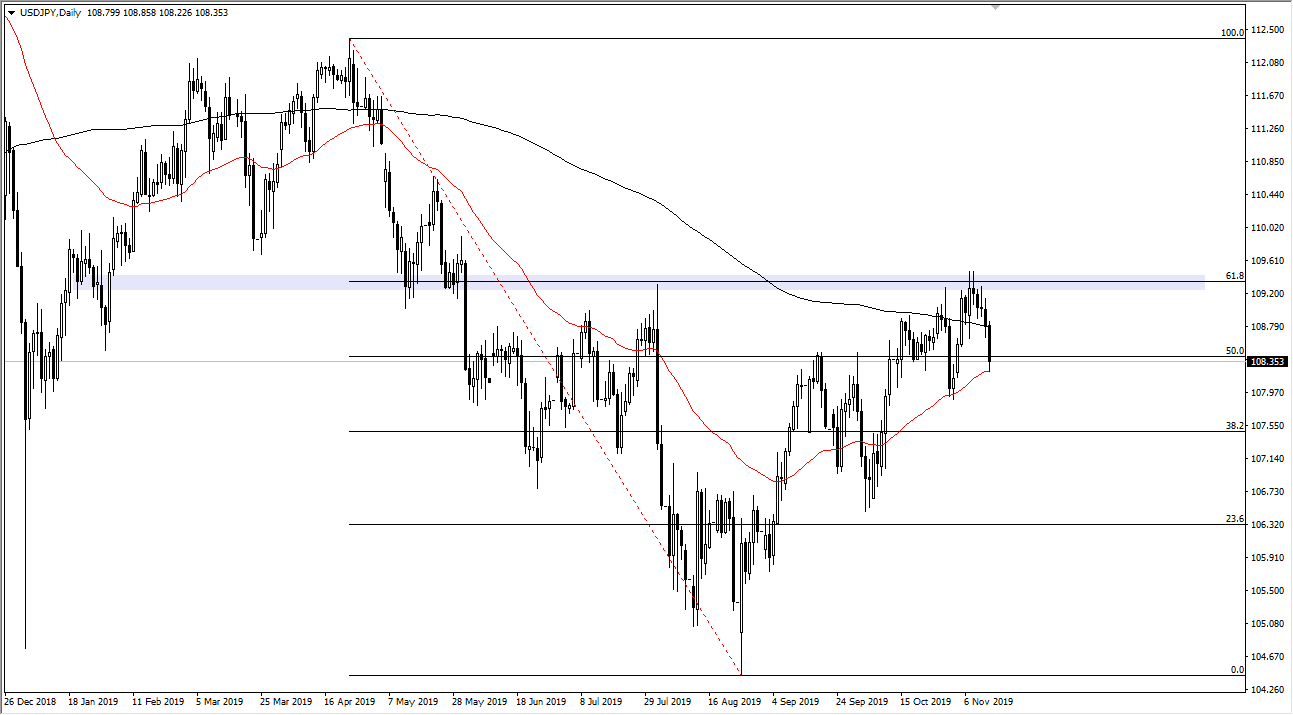

The US dollar fell significantly during the trading session on Thursday, reaching down towards the 50 day EMA as it was more of a “risk off” type of move. This being the case, the market tested the ¥108.25 level, an area that also features the 50 day EMA, meaning that there were at least a couple of different reasons for the market to find buyers here. Beyond that, the market has seen a lot of trading in this area in the past, so at this point it makes sense that the market would see a bit of support as we fall.

At this point in time, it’s likely that we will continue to squeeze between the 50 day EMA and the 200 day EMA, both of which will attract a lot of attention. Because of this, I expect that the Friday session will be relatively benign but should more than likely be a bit more on the positive side as value hunters will come back into the market. However, nothing is absolute so looking at the ¥108 level, if it gets broken down significantly it’s likely that the market drops another 50 pips, as there is a significant amount of noise at the ¥107.50 level.

All things being equal, this pair will probably move right along with the S&P 500 as per usual, and of course the risk appetite of traders around the world will be a major influence as to how the Japanese yen moves. The markets tend to move away from the Japanese yen when things are going well, driving this pair higher. I like the S&P 500 as a measuring stick of risk appetite, as the two markets are relatively strongly correlated.

At this point, it’s very likely that the market is probably going to find value hunters underneath, therefore I think it’s only a matter of time before we find value in the market and bounce. Above at the 61.8% Fibonacci retracement level, we have a lot of resistance that has yet to be broken. At this point, that is the huge barrier that the market has been dealing with. If we were to finally break above the ¥110 level, then we can get a longer run to the upside, possibly as high as the ¥112.50 level after that. Longer-term, we need a US/China trade deal or something close to that tab that move happen