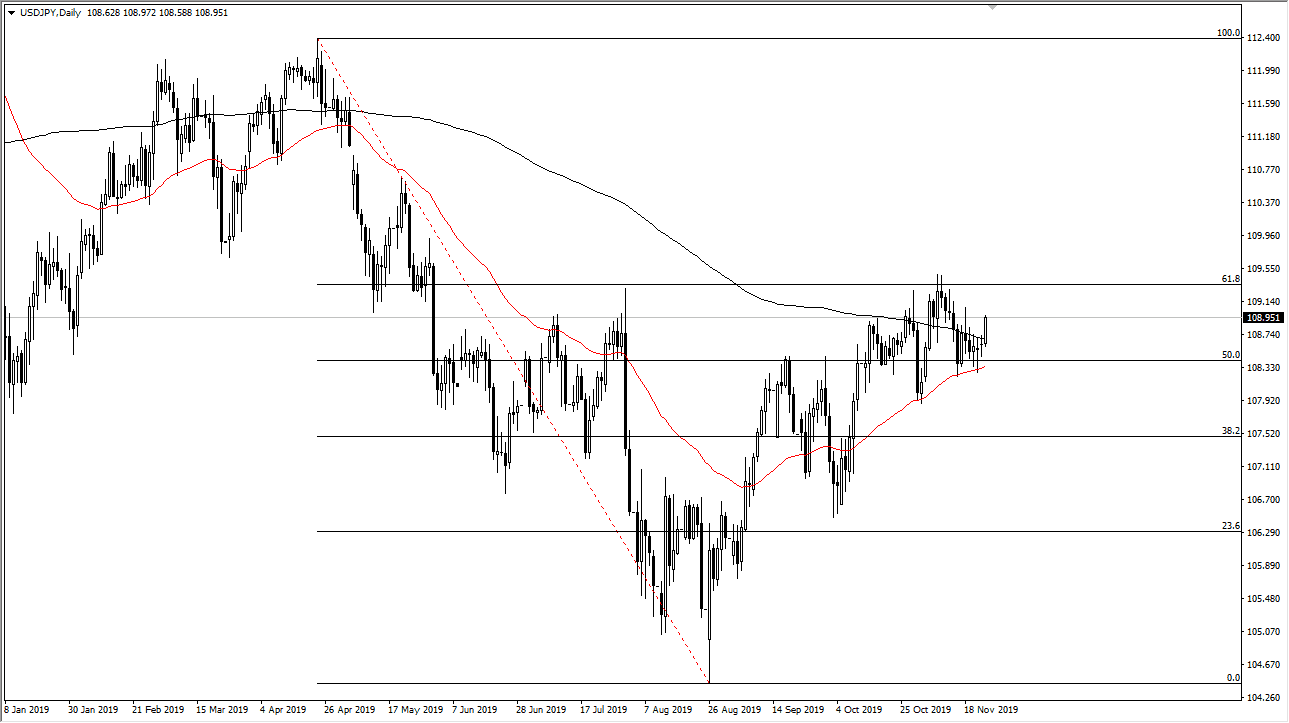

The US dollar has rallied a bit during the trading session on Monday, breaking clearly above the 200 day EMA. At this point, the market looks as if it is ready to go towards the 61.8% Fibonacci retracement level. The ¥109.50 level extends to the ¥110 level, as that resistance as well. If we were to break above that level, it could send this market much higher. That being said, we have struggled at this area before, and it now looks as if the market is going to press up against that level sometime in the next couple of sessions.

Looking at this chart, the market should have plenty of support near the ¥108 level, mainly because the 50 day EMA has offered so much in the way of support in that general vicinity. If we were to break down below that level, then it’s likely that the market should then go down to the ¥107 level. However, it seems very unlikely that we are going to have that happen, but it is one thing to pay attention to in case we break down.

Keep in mind that this market is highly sensitive to the overall risk appetite of traders, so if other markets such as the S&P 500 rallied significantly, it’s likely that the market would continue to go higher. If the risk appetite dwindles from here, the market will more than likely find reasons to start buying the Japanese yen, sending this pair lower as well. At this point, it looks as if we have an easier path higher, at least in the short term. That being the case though, we should also keep in mind that traders will be very quickly to take profit near that resistance.

If the 50 day EMA crosses above the 200 day EMA, then it becomes a “golden cross”, which of course is a bullish sign in general, as longer-term traders will start to try and “buy-and-hold” at this market. Ultimately, this is a market that continues to be very noisy, but overall if we were to break out to the upside this could be an explosive move as there is a lot of resistance built into this region. If we were to break down, it’s probably time to start looking to short this market, but until there some type of major negative headline out there, it looks as if we are going to continue to chip away at this resistance.