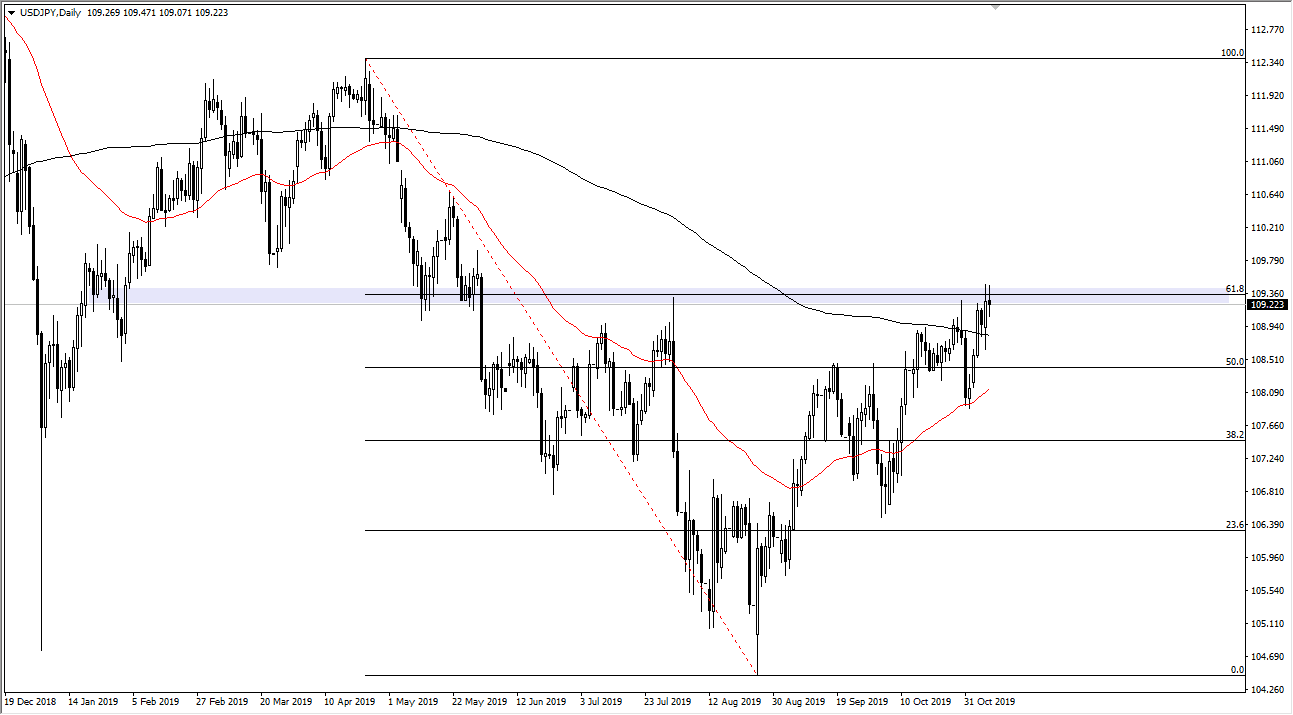

The US dollar has gone back and forth during the trading session on Friday as we approach the significant 61.8% Fibonacci retracement level. The ¥109.50 level of course is an area where we have seen a lot of selling at previously. Beyond that, we have seen the area between the ¥109.50 level and the ¥110 level. That’s an area that will be very difficult to overcome but if the market can do that it’s very likely that it will continue to go much higher, initially filling the gap above at the ¥111 level. After that, the market then very likely could go towards the 100% Fibonacci retracement level which allows this market to go to the ¥112.25 level.

The 200 day EMA sits below price now, and it is offering support based upon the last couple of trading sessions. That being said though, the market did pull back a bit on Friday as there is a lot of uncertainty when it comes to the US/China trade war. As that is the case, the market will be able to break out until we get some type of stability. While the market celebrated that the Americans could possibly rollback tariffs and preparation and in congruence with the signing of “Phase 1” of the deal, it was short-lived as Donald Trump suggested that he had not made that decision yet. At this point, going into the weekend with uncertainty was always going to be too much to keep this market going to the upside. A bit of caution into the week it makes quite a bit of sense, so the fact that it failed at this level again should not be much of a surprise.

In the short term, I suspect that the market will probably pull back again but should see support again at the 200 day EMA colored in black on the chart. The 50 day EMA is starting to curl higher, and recently has offered support so it looks as if we may soon get the “golden cross” that longer-term traders tend to pay attention to in order to go long. If that happens, it will be yet another reason to think that this market is probably going to break out. To the downside, if the market was to break down below the 50 day EMA it could open up the door to the ¥107 level.