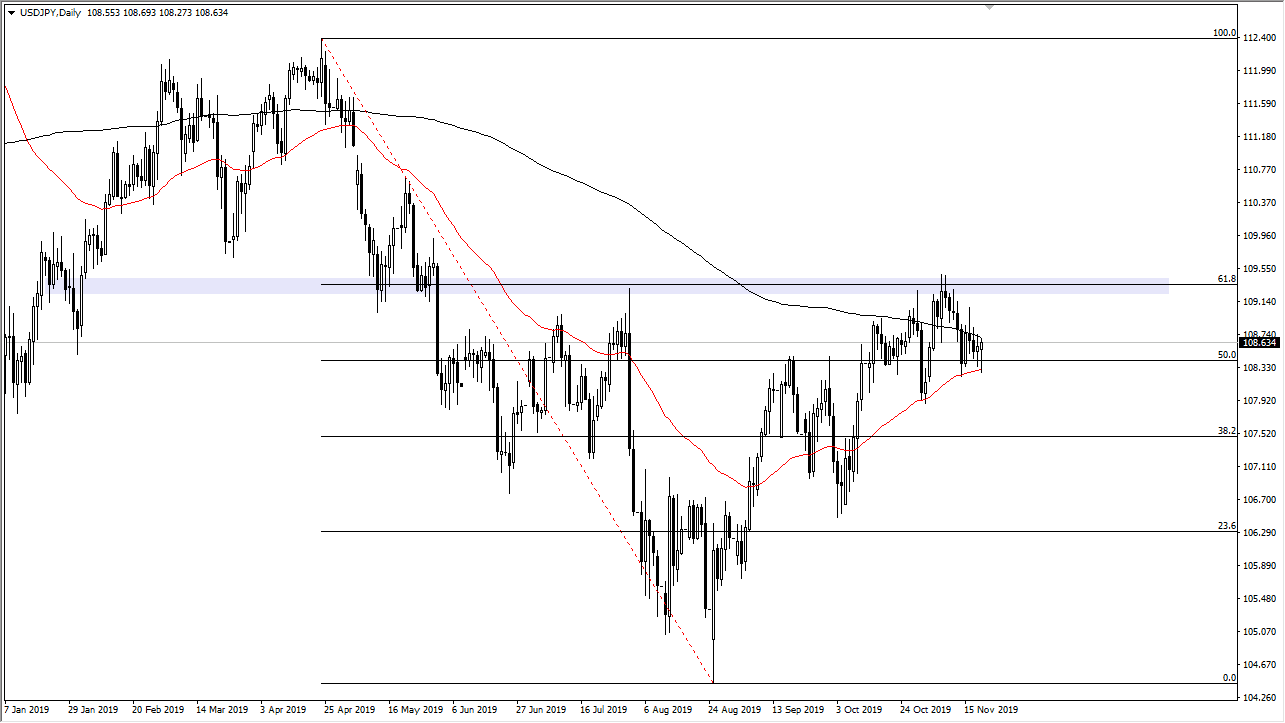

The US dollar fell a bit during the trading session on Thursday, reaching down to the 50 day EMA before turning around completely. The recovery was quite impressive, but at this point it looks as if the market is currently stuck between two major moving averages in the form of the 50 day EMA and the 200 day EMA. Because of this, there isn’t a lot to do unless you are willing to scout back and forth as this market really is an offering much in the way of momentum. That being said, it shouldn’t be ignored as the longer this goes on, the more likely it is to be explosive.

The 61.8% Fibonacci retracement level above continues to offer a lot of resistance, extending from the ¥109.50 level to the ¥110 level. If we were to break above the ¥110 level, that would be an extraordinarily bullish sign, sending this market towards the gap above at the ¥111 level, and then possibly the ¥112.50 level as it is the 100% Fibonacci retracement level from the entire move. It will take up significant good set of circumstances to make this market go higher like that, so I think at this point it would probably have something to do with the US/China trade situation. If it does not get resolved or at least the so-called “Phase 1 deal” signed, this pair will probably pull back rather drastically, and that would bring up the negative scenario.

The negative scenario would see this market breaking down below the 50 day EMA initially, but it’s not until we break down below the ¥108 level that I would become a bit more concerned. Even at this time I don’t necessarily expect some type of collapse, what I expect is a drive down to the ¥107 level which has been support in the past as well, and then another attempt to reassess the entire situation in that region. I think it’s very likely that the market would have to have some type of seriously negative headline come out to drive it down there, and it’s probably something that would become quite obvious at that point. All things being equal though, I do believe that the buyers are standing the ground, simply waiting for an opportunity to break through that resistance above and go to the upside. Until then, this is going to be choppy and tight.