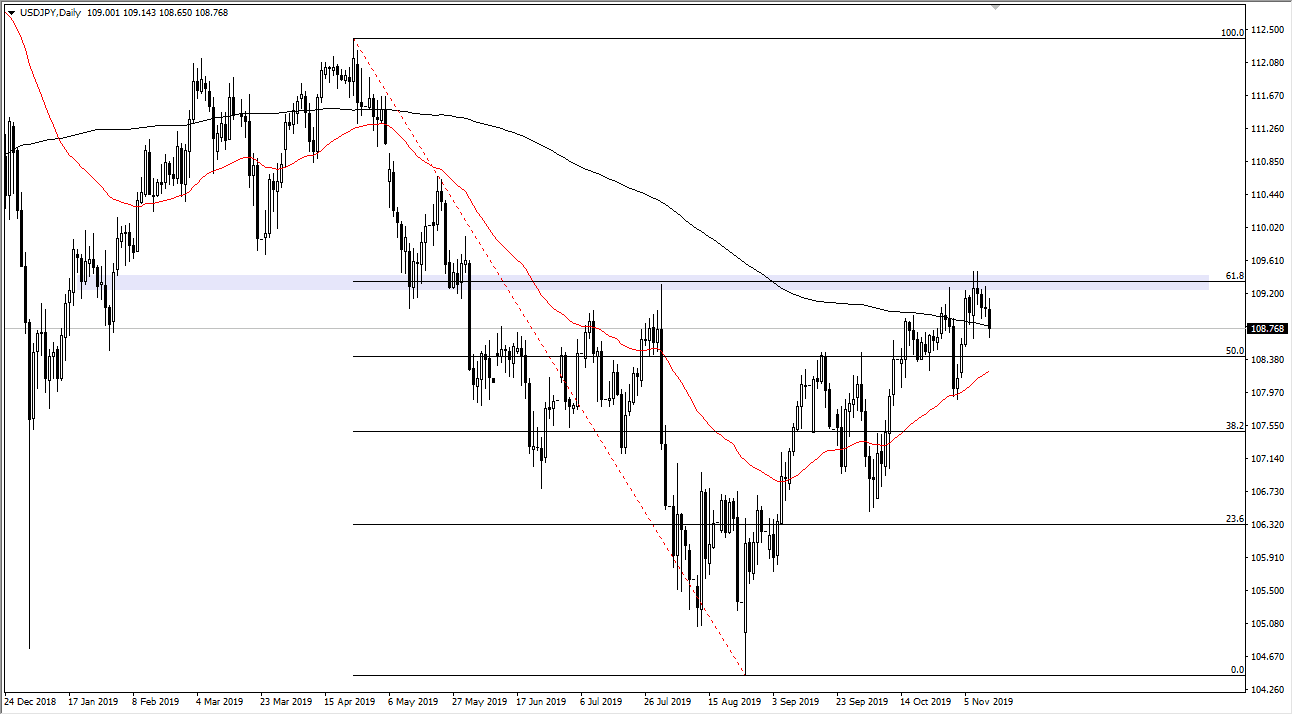

The US dollar has initially tried to rally during the trading session on Wednesday, but then broke down a bit during the trading session on Wednesday as we continue to struggle with significant resistance just above. However, there is significant support just below, in the form of the 200 day EMA and rapidly approaching 50 day EMA. Quite frankly, this is a very difficult market to trade right now but that should not be much of a surprise considering that most of the market is difficult to trade right now. With that being the case, it’s very likely that we will continue to see a lot of back and forth, as this is a very sensitive market when it comes to risk appetite.

As a general rule, this pair will rise with the risk appetite as the Japanese yen is considered to be the safest currency overall. At this point, it looks as if any time we pull back it’s likely going to be a buying opportunity also, considering we are getting close to a couple of major technically supportive areas. The first thing of course is the 200 day EMA that we have pierced, and then underneath there we have the 50 day EMA which sits right at the ¥108 level. There was also a recent low at that area, and we have technically made a “higher high” as of late. This market certainly needs to make a decision sooner rather than later, but it would need to clear the ¥110 level to truly take off to the upside and blow through the resistance. If it does, the market then will go looking towards the ¥111 level, and then eventually the ¥112.50 level.

To the downside, the market could continue to see a lot of support that will cause volatility on the way back down. If we were to break down below the ¥108 level though, that could change a lot of things and perhaps even open up the door to the ¥106 level. All things being equal, I favor the upside but it’s obvious that we need to make a move rather soon as we have been killing far too much time in this potential rising wedge, which is a bearish pattern. We need some type of good news out there to send the markets higher in general. That will probably have to do with the US/China trade situation if we can get things moving.