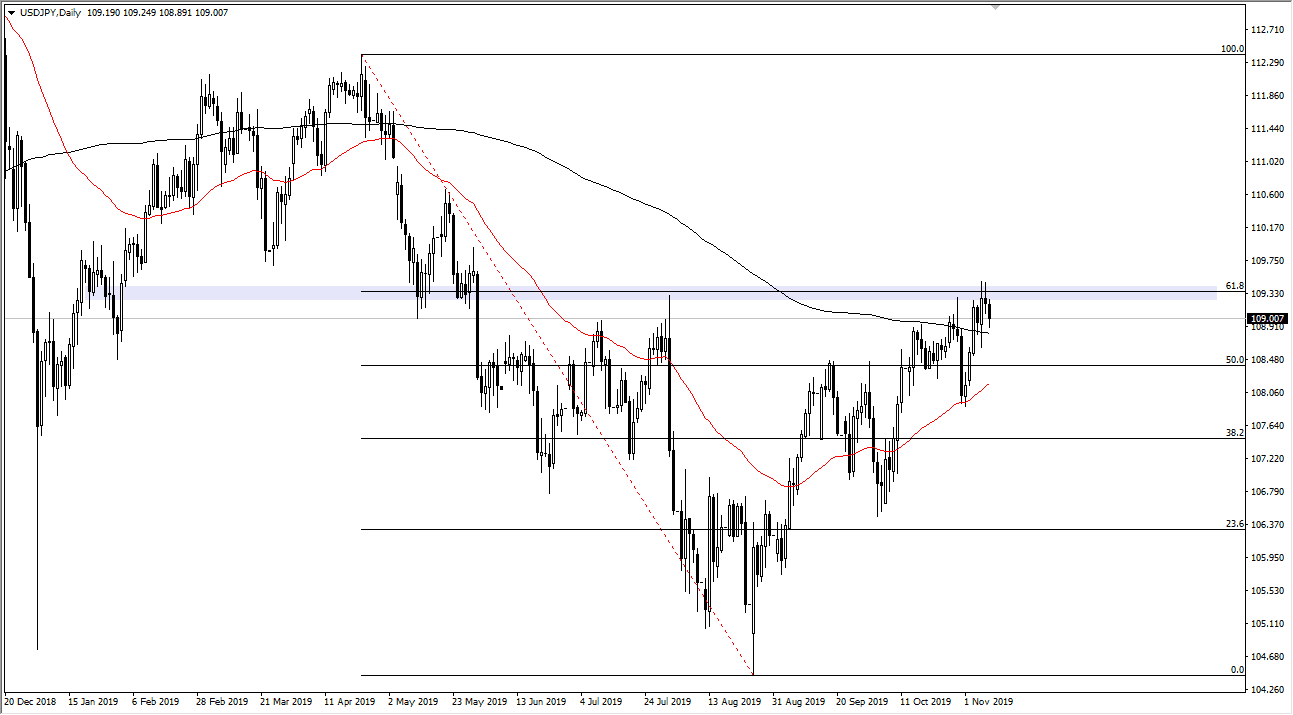

The US dollar will continue to struggle against the Japanese yen going into the next several days, as the 61.8% Fibonacci retracement level has obviously been very resistive. The ¥109.50 level should cause issues, as it lines up nicely with that 61.8% Fibonacci retracement level, but beyond that we also see the ¥110 level above as resistance, so I look at this is more or less a “resistance zone.”

Looking at the 200 day just below, it should continue to offer support, and it looks to me like the market is going to continue to struggle to break out but it certainly looks as if it is going to make a lot of attempts to get above there, and obviously there seems to be a lot of buying pressure underneath. At this point, short-term pullbacks continue to offer buying opportunities and I anticipate that probably will be the case going forward as well.

It should also be noted that the 50 day EMA is starting to rise near the ¥108 level, and racing its way towards the 200 day EMA, possibly setting up a “golden cross.” This is a longer-term signal for buyers, so I believe that we really are starting to build up the necessary momentum to finally break out above the resistance that it has been finding. Think of this as a beach ball underwater, as it’s been held it’s building up inertia and then eventually once it breaks the water level, it will pop up in the air. I think that’s what we are about to see what we need some type of catalyst for more of a “risk on” type of move overall.

Remember, the Japanese yen is considered to be a safety currency, so if we can get some type of really positive economic news, be it the Brexit being sorted out, obviously the US/China trade situation working itself out, or quite frankly just the stock markets rallying for whatever reason, that could send this market much higher. The alternate scenario as if we get some type of horribly negative news, that could send this market down to the 50 day EMA and if it breaks down below there, it’s likely that we will go much lower. All things being equal though, I like the idea of buying short-term pullbacks, because they have worked out over the last several weeks, although you should not be looking for major move until we get some type of news catalyst.