The US dollar has rallied during the trading session on Friday due to comments coming out of the mouth of Larry Kudlow suggesting that the Americans and the Chinese were getting closer to a deal again. I think it comes down to a lot of algorithmic trading, and therefore people have no choice but to follow right along. Such is the compromise of trading automated strategies.

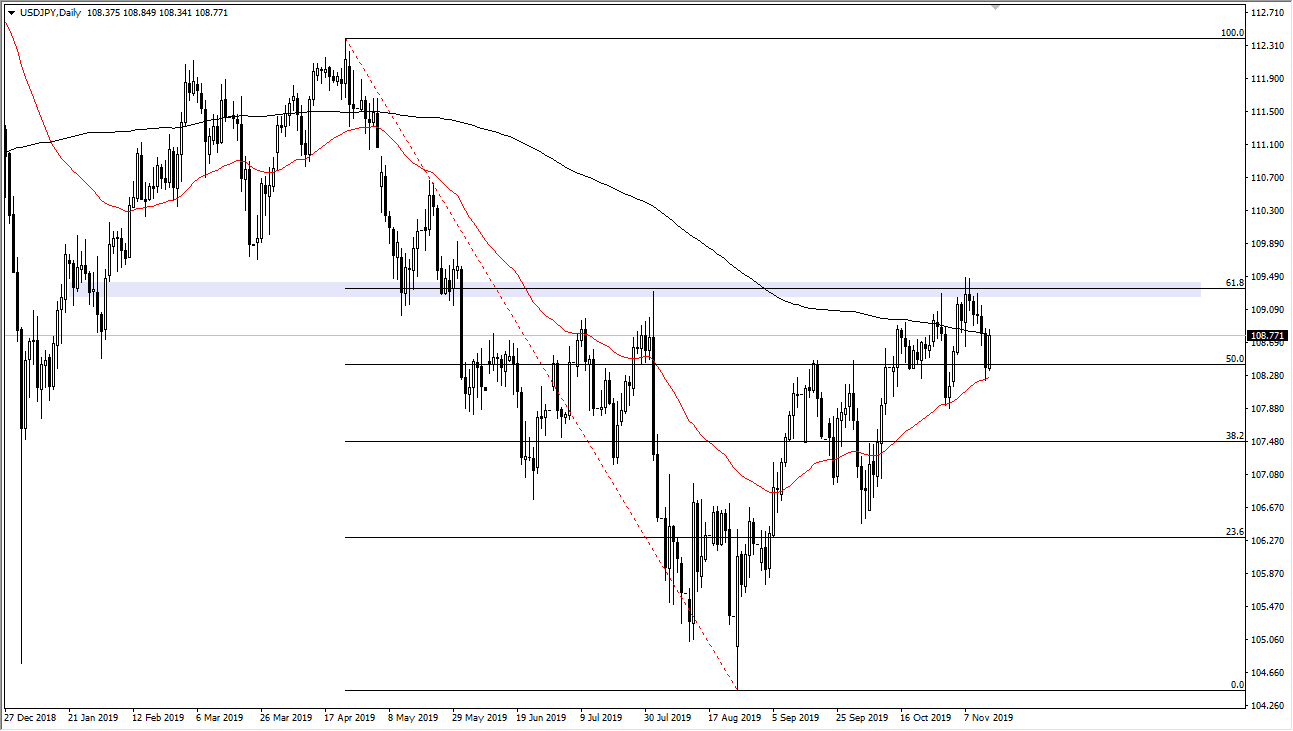

Looking at the chart, the 50 day EMA has offered support as painted in the red color on the chart, just as we are stopping at the 200 day EMA, which is painted in black. I think we will break above the 200 day EMA, and therefore it’s likely that we could go to the 61.8% Fibonacci retracement level. That is at the ¥109.50 level, which extends all the way to the ¥110 level. This is an area that is going to be very difficult to break above, and if we can then the market is likely to go much higher. Beyond that, the market could rally towards the ¥111 level. That is an area where we have seen a gap, and that of course will attract a certain amount of attention. Once we break above the 61.8% Fibonacci retracement level, I have found that typically we will eventually go to the 100% Fibonacci retracement level. In this move, that means that we could go as high as the ¥112.50 level.

To the downside, if we were to break down below the most recent low at the ¥108 level, then we could probably drop down to the ¥107 level. All things being equal, this is a market that will continue to be choppy and noisy, based upon the risk appetite of traders at any given moment. While that’s normally true, it seems to be especially true at this point. For example, during the trading session on Friday, the pair rallied somewhat significantly, just as the S&P 500 broke the 3100 level. Because of this, I will quite often use the S&P 500 as a tertiary indicator as to which direction this market should go. It’s not a perfect correlation but it does give you an idea as to where risk appetite is around the world, and therefore what happens with the Japanese yen.