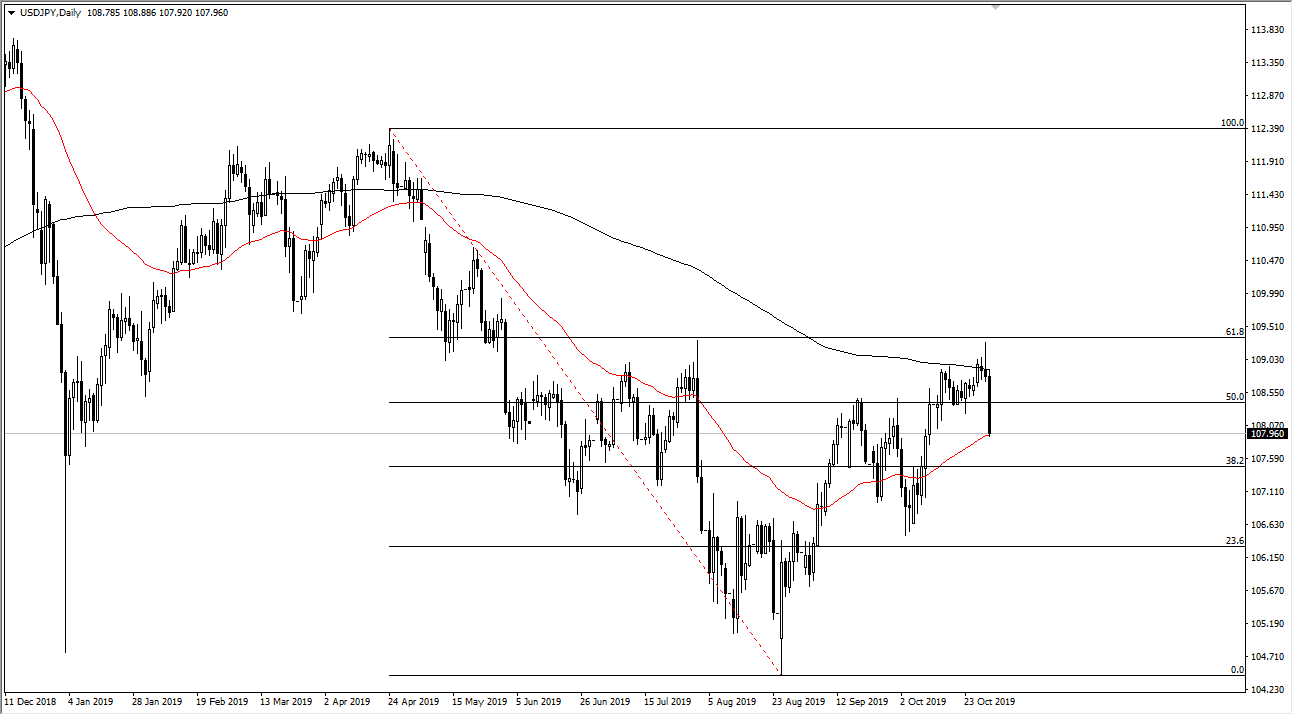

The US dollar has pulled back rather significantly during the training session on Thursday, reaching down towards the ¥108 level. That is crucial because it is also where the 50 day EMA is, and at this point it’s likely that the markets will find some type of buying pressure in this general vicinity. What makes this so interesting is that the jobs number comes out on Friday, and that of course will cause a significant amount of volatility in this pair as it is a risk barometer.

At this point, the market is likely to find support somewhere between current pricing and therefore the market could go down to the ¥107 level, as we have seen a lot of buying pressure in that area. That being said, we have pulled back from the 61.8% Fibonacci retracement level and the 200 day EMA, it’s likely that the market will continue to offer quite a bit resistance. At this point on, I think we will probably continue to see a lot of the same back-and-forth type of action that has been a mainstay of this market as of late. Having said that though, the jobs never could throw things in absolute disarray so make sure to keep that in mind.

As the job never comes out, it’s likely to see the market get very noisy, and perhaps try to find some type of directionality after this. The market has tried to reach towards the ¥109.50 level, and that is essentially the “ceiling” based upon the moving average and the Fibonacci retracement level mentioned previously. To the downside though, the ¥107 region should be massive support. If we were to break down below there, then the market is likely to go down to the ¥107 level. If we break down below there, then it opens up the door down to the ¥105 level which of course is a large, round, psychologically significant figure. One thing I think you can count on though is that we are going to see a lot of choppy behavior, and erratic behavior because not only is this a risk related type of situation, it is also highly sensitive to the US/China trade situation as well, which is a completely different type of moving target. As a general rule, it’s best to leave this pair alone until after the initial move from the jobs figure, seeing whether or not that support does in fact hold.