For the first time since working here at Daily Forex, I am covering the US dollar against the Chinese Yuan because it is such an important currency pair that unfortunately far too many retail traders ignore. For quite some time now, it has been known that the USD/JPY pair tends to move back and forth due to risk appetite, but that pales in comparison to the USD/CNH pair, especially in the geopolitical climate that we find ourselves and between the Americans and the Chinese.

The US dollar has drifted lower against the Chinese Yuan during the month of October, which is typically thought of as a bullish sign for risk assets. This may be partly due to the fact that the so-called “Phase 1” deal between the Americans and the Chinese looks likely to finally be a reality sometime during the month, or at least shortly afterwards. At the very least, it looks as if the two sides are starting to become a little bit more conciliatory. In general, this means that people will have more demand for the Chinese Yuan, mainly because they won’t have as much demand for the US dollar. However, it’s not quite that simple at this point from both a technical analysis standpoint and of course fundamental, depending on what metrics you pay attention to.

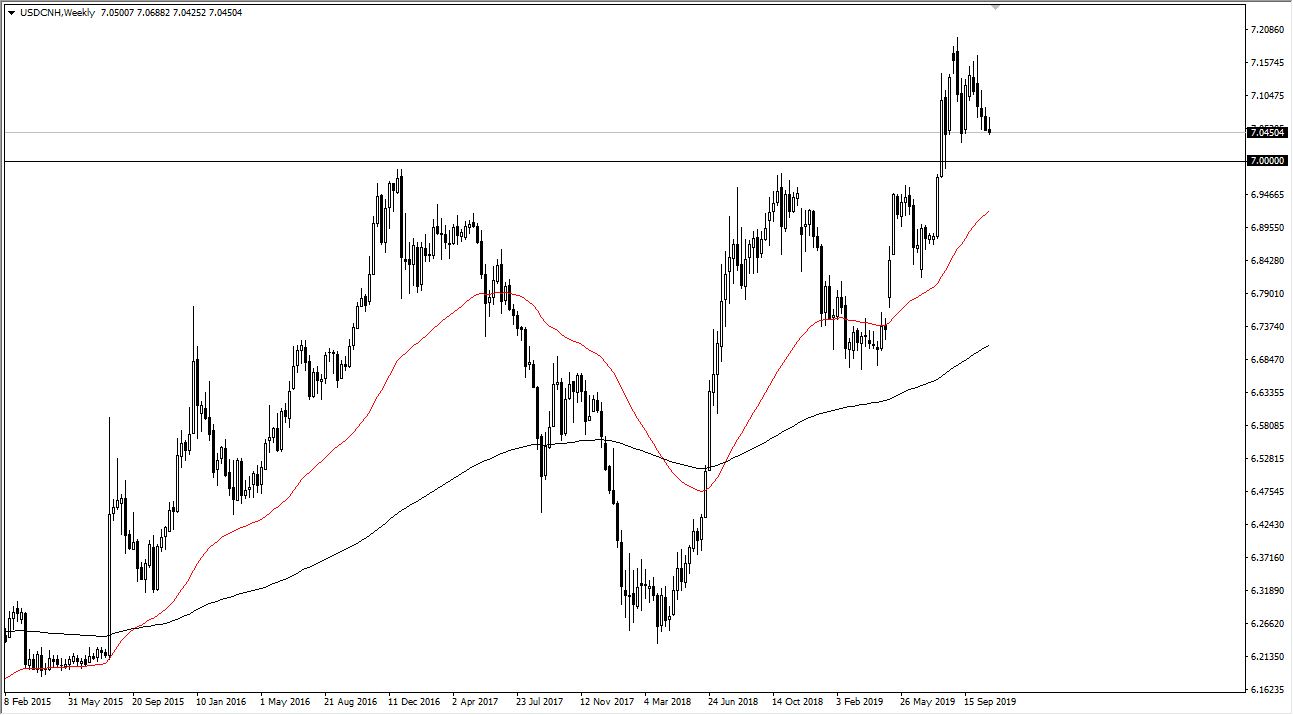

One of the most important technical levels on this chart is going to be the 7.00 CNH level. There was a lot of fanfare once the market broke above there, as it is a large, round, psychologically significant figure. At this point, the 50 week EMA looks likely to continue granting towards that area, and it does in fact offer a bit of psychological and dynamic support. A drift lower from here will attract a lot of attention, and therefore it will be interesting to see if we can find some type of bounce from there. In fact, that’s the trade I prefer this month. I like buying dips, especially if we get some type of bounce between 6.95 and 7.00. Beyond that, the 7.05 level also could offer a bit of support. Unless there is some major breakthrough with the overall trade situation between the Americans and the Chinese, I anticipate that this market will continue to grind higher. Regardless of which you may read or hear via Twitter, China does not want the US dollar to appreciate too quickly, because most of China’s debt is denominated in US dollars and could wreak absolute havoc on the mainland’s economy. Because of this, I would expect rallies to be more of a grind than a shot higher.