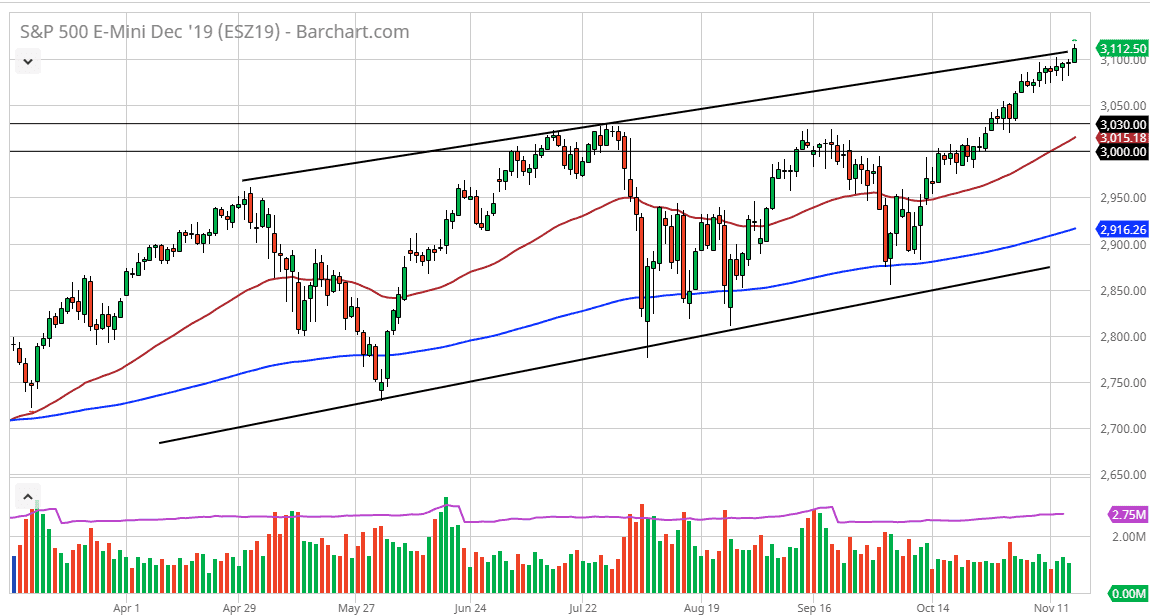

The S&P 500 has rallied significantly during the trading session on Friday, breaking cleanly above the 3100 level. By doing so, the market looks very likely to continue to go higher and based upon the previous ascending triangle there is a target of 3200 out there. Quite frankly though, I do think that we need to pull back a bit in order to find some value, but you can’t argue with a break above the highs from the trading session on Friday.

Below I think there is plenty of support at the 3050 level, the 3030 level, and of course the 50 day EMA which is just broken above the psychologically important 3000 handle. I would even be willing to buy all the way down to the 3000 handle, because it would be a retest of the break of the ascending triangle, and as a result I think it’s only a matter of time before he rallies for the longer-term move anyway. Ironically, it was Larry Kudlow yet again suggesting that the US and China were getting ready to sign the deal, or at least getting closer, that sent the stock markets much higher.

The candlestick for the session does of course look very bullish, but at this point I think that the market although bullish has quite a bit of work ahead of itself. In the short term, day traders will probably continue to see the 3100 level offer support as well as we have several wicks underneath the hammer shape candles that had been forming before the breakout. All things being equal I think it’s only a matter of time before the buyers overwhelm the market yet again, because quite frankly with the Federal Reserve sitting on the sidelines it’s unlikely that stock markets will get hammered from that concern, and with other central banks around the world looking to be very loose with her monetary policy it’s more than likely going to continue fueling the stock market to the upside as has been the case for over a decade.

I have no scenario in which I would be a seller of the S&P 500, at least not until we were to break down below the 200 day EMA, which at this point seems very unlikely to happen. If it did happen, that would be an extraordinarily negative sign but obviously would have to have some type of major catalyst to push it lower like that.