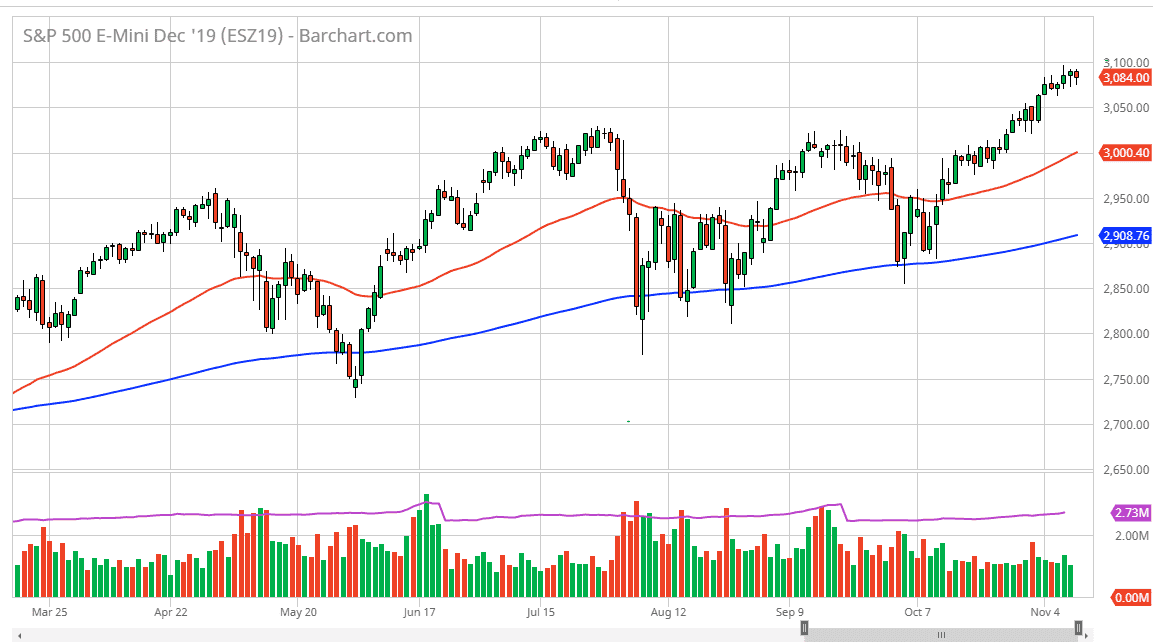

The S&P 500 continues to struggle at the 3100 level, as it is a large, round, psychologically significant figure that has been defended by those in the options market, as they will often go into the futures market to manipulate prices away from barriers that they are trying to defend. Beyond that, the market has been a bit overextended, so don’t be surprised at all to see some type of pullback. However, that pullback should be a nice buying opportunity as it has been so bullish as of late.

The 50 day EMA is currently hanging around the 3000 level, and therefore it makes the 3000 level significant not only based upon the recent action, but the round figure itself in the psychology that is found around it. That being said, I also suspect that the 3050 level is also supported, so ultimately, it’s only a matter of time before buyers return on any pullback that we get at this point. Overall, this is a market that is bullish, so I have no interest in shorting it, although I do recognize that there are sellers out there just waiting.

Underneath, even if we were to break below the 3000 handle, I believe that there is plenty of support underneath, especially close to the 200 day EMA which is 100 points lower at the 2900 level. All things being equal, I think there are plenty of reasons to expect buyers are going to be waiting in that area, as it gives an opportunity for those who look at the longer-term bullish attitude of the market as offering value every time we drop towards the more congested areas underneath.

To the upside, if we were to break above the 3100 level, the market could continue to see this market reached towards the 3200 level based upon the ascending triangle underneath that measures for that move. We have broken out above significant resistance, so it looks as if we should continue to see more of a drive to the upside. The S&P 500 has ignored a lot of the concerns of traders over the longer term, so instead of arguing with the overall trend you are going to be better off looking for buying opportunities based upon value. In fact, at this point I don’t have a selling scenario, but I do recognize that looking for pullbacks it causes a bit of a bounce could be a nice opportunity.