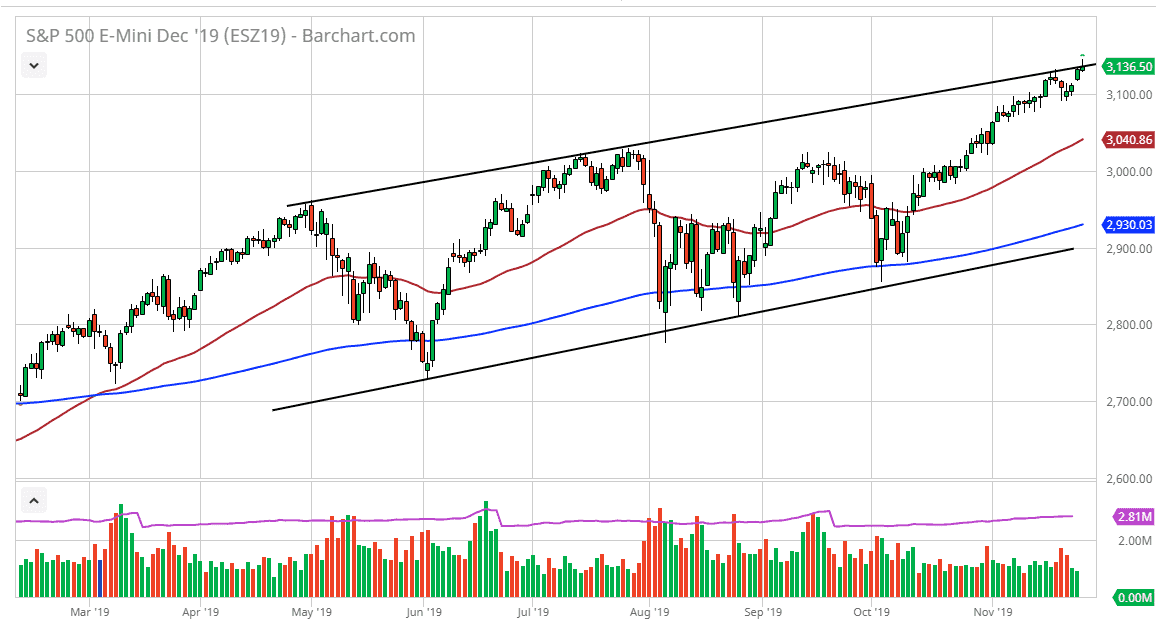

The S&P 500 initially tried to rally during the trading session on Tuesday, breaking above the top of the channel that we have clearly been in for some time. However, we have turned right back around to form a bit of a shooting star which of course is a negative sign but quite frankly I think it’s only a matter of time before we pullback due to the fact that we are a bit overextended, facing resistance, and of course still have a gap lower to be tested. The gap lower of course will have a big target placed upon it and I think it’s only a matter of time before it happens.

Looking at this chart, the market has gotten far ahead of itself, and we should keep in mind that this is Thanksgiving week in the United States. With that being the case it’s very likely that we will continue to see a lot of thin trading, and therefore it’s likely that we will continue to see unreliable moves on short-term charts. The gap underneath getting filled between now and the end of the week makes quite a bit of sense, because traders will want to come back on Monday with a “clean slate.”

Looking at this chart, if we were to fill that gap it should attract a certain amount of support due to the fact of the surge higher to the upside. Underneath, the 3100 level underneath would be a support level as well but having said that if we were to break down below that level then it’s likely that we go looking towards the 50 day EMA. The alternate scenario of course is that we break above the top of the shooting star for the trading session on Tuesday, it would lead the next leg higher and could have a bit of a “blow off top” feel to it.

To the downside, the markets also have formed an ascending triangle that got broken out of near the 3000 level, and therefore the measured move is one worth paying attention to. That suggest that we could go as high as the 3200 level, and that is my longer-term target. I think pullbacks continue to offer value until we get there, and I have no interest in shorting this market as there is so much in the way of bullish pressure and of course end of the year run towards profits.