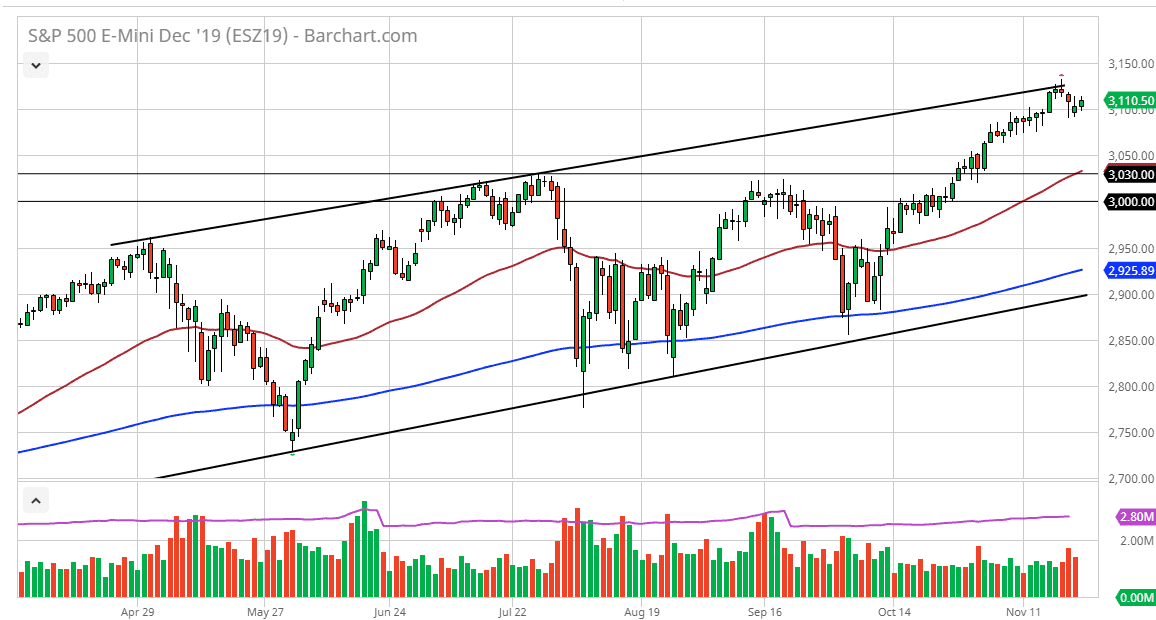

The S&P 500 has initially fallen during the trading session on Friday, but then turned around to show signs of life as the 3100 level has offered support. At this point it’s obvious that the market continues to go back and forth and chop around in order to kill time, as we are trying to figure out where to go next. The nonsense with the US/China trade situation continues to cause issues, so it’s difficult to imagine how the market moves next without some type of crystal ball when it comes to the next rumor or headline.

That being said, looking at the longer-term trend it’s obvious an uptrend is in fact, so I look at this through the prism of whether I can buy on a breakout or if I get the opportunity to pick up a bit of value “on the cheap” out the S&P 500 pulls back. I believe that there is a significant amount of support at the 3100 level extending down about 10 or 15 points, but then the bottom has even more support at the 3030 level. The 50 day EMA sits right around that area at the moment, and it should continue to be a massive support level. All things being equal I don’t have any interest in shorting, at least not until we break down below the bottom uptrend line of the overall uptrend and channel, which we are currently pressing. I think at this point we are very likely to see this market explode to the upside, which could send this into a bit of a “melt up” going forward.

The Federal Reserve has stepped to the sideline and basically told the market that it wasn’t going anywhere near loosening monetary policy or raising it without some type of massive change in the markets. We are in the midst of earnings season so that can have an effect as well, but quite frankly this is a market that should continue to be bought on dips, but we are essentially sitting in neutral as we are trying to figure out where to go next. I do think ultimately the buyers will win though, because the trend and the time of year both dictates that typically we will be more bullish than bearish because of the so-called “Santa Claus rally” that tends to happen every December as money managers try to get more gains for the year to report to their customers.