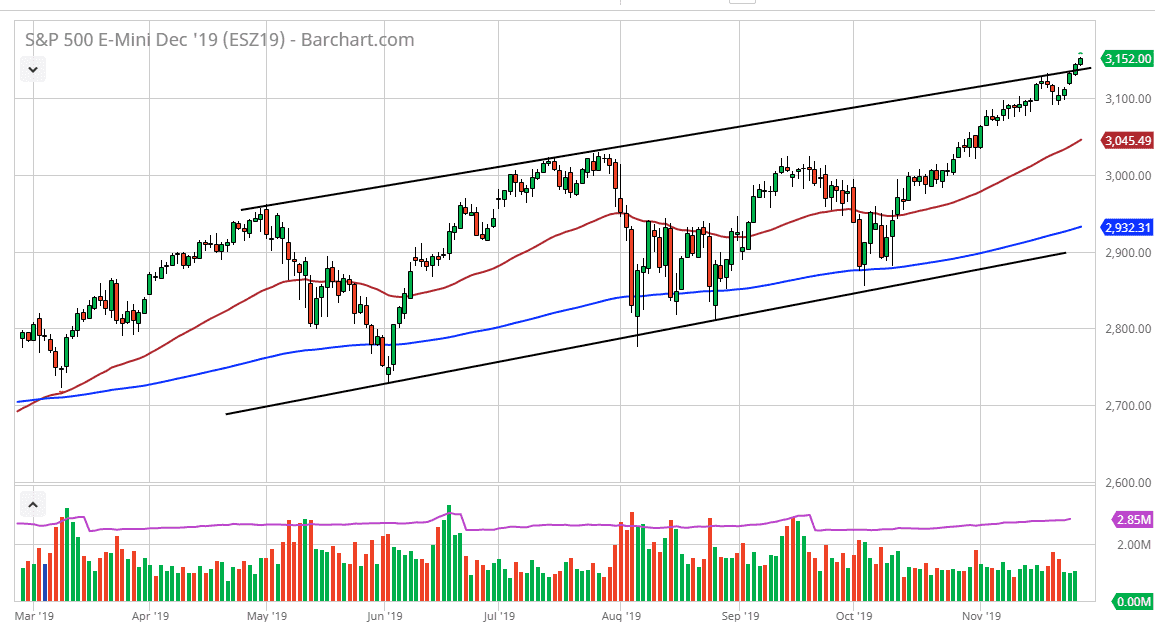

The S&P 500 as rallied significantly during the trading session on Wednesday to close out the majority of the week, as the Thursday session will be Thanksgiving. Because of this, the underlying index won’t be open, so any trading will be solely in the E-mini electronic markets. That being said, the market is very bullish, and we have broken above the top of the uptrend and channel, which of course is a very bullish and impulsive move. Pullbacks at this point aren’t to be trusted, and quite frankly I think they are nice buying opportunities as the market is obviously very bullish.

To the downside, I believe that the 3100 level underneath will continue to be supportive, just as the 50 day EMA will be. When you look at the ascending triangle underneath, once we broke out of the 3000 handle it gave us a target of 3200. It looks very likely that we are going to see that hit sometime between now and the end of the year, so retail we pullback is probably going to be buying opportunities as it represents a lot of value and being able to get involved in what is obviously a very bullish trend.

Quite frankly, I don’t have a situation in which I want to sell this market unless of course something truly has changed when it comes to the geopolitical situation or the economic picture. All things being equal, I believe that every time this market falls there will be plenty of money managers out there looking to take advantage of the “Santa Claus rally” that we get this time year most years, to pad the returns for investors. At this point, I have no interest in shorting and I think that we are about to fulfill that 3200 level rather quickly. In fact, it’s quite possible we even go as high as 3300. Unless we get some type of catastrophic economic news, it’s likely that there’s no way we can break down. Looking at this chart, it’s obviously very bullish in a bit overdone, but at this point in time it doesn’t seem to be an issue for most traders. Quite frankly, this has been a “one-way trade”, and I think that continues between now and the end of the year. That being said, things do change I will inform you here at Daily Forex as to what I plan on doing about it.