After the Reserve Bank of New Zealand surprised markets two days ago by keeping its interest rate unchanged at 1.00%, the New Zealand Dollar enjoyed a surge in bullish momentum. While uncertainty over the US-China phase one trade truce has deflated the initial price spike in the NZD/USD, a renewed push to the upside should be expected. Chinese economic data came in mixed, further adding uncertainty about the health of the global economy, but New Zealand is set to benefit from the 2020 RCEP which will create the world’s largest free-trade bloc. US data has been mixed with a bearish bias and a breakout sequence in this currency pair may materialize.

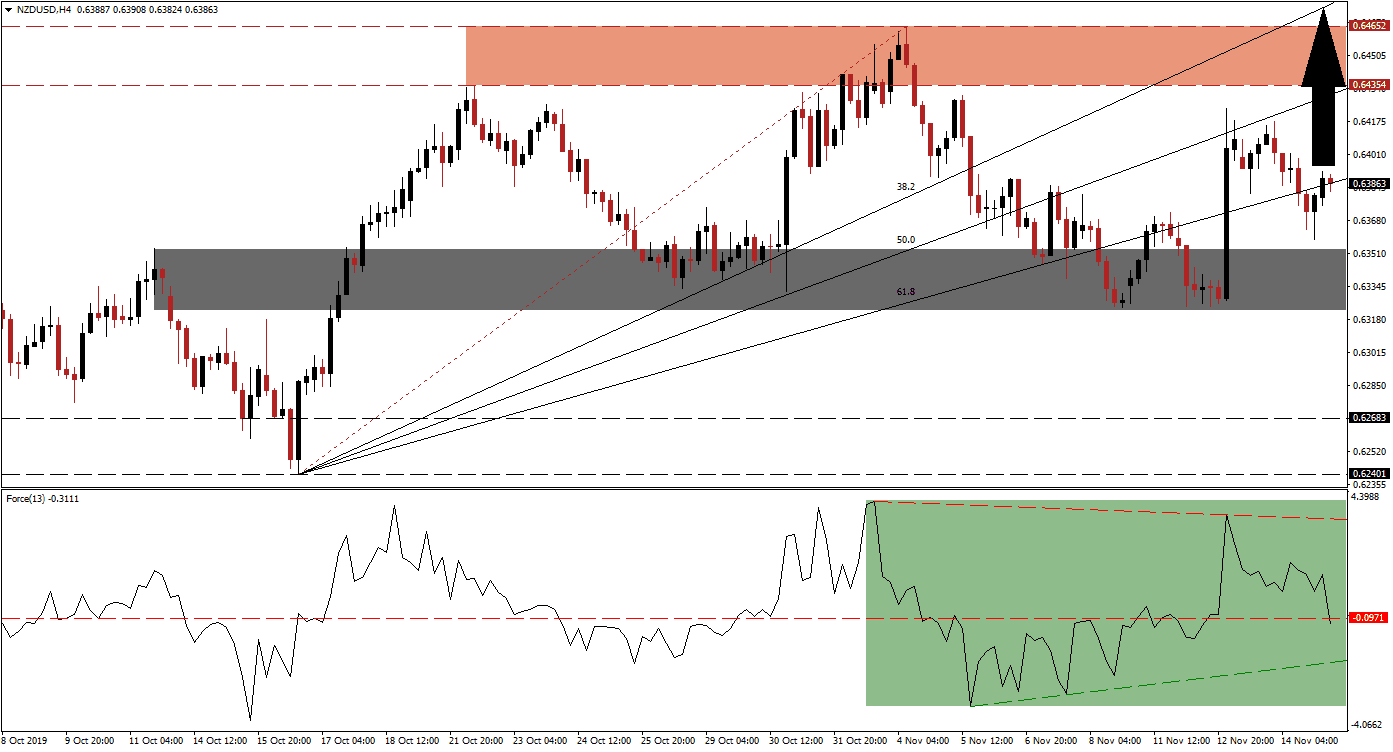

The Force Index, a next-generation technical indicator, spiked together with price action but has since retreated and is now pushing below its horizontal support level which is turning it into resistance; this is marked by the green rectangle in the chart. As long as the NZD/USD remains above its short-term support zone and this technical indicator above its ascending support level, more upside is possible. This currency pair is caught in a cross-current of fundamental news flow and an increase in volatility should be expected. A reversal in the Force Index in positive conditions may spark the next advance. You can learn more about the Force Index here.

Before the RBNZ surprise, the NZD/USD was in the midst of a corrective phase that took it from its resistance zone through its entire Fibonacci Retracement Fan sequence into its short-term support zone. This support zone, located between 0.63242 and 0.63536 as marked by the grey rectangle, has previously pushed price action higher and is now expected to do the same. The breakdown sequence in this currency pair has turned the Fibonacci Retracement Fan from support into resistance and the post RBNZ price spike briefly took this currency pair above the 50.0 Fibonacci Retracement Fan Resistance Level.

A reversal followed, which is normal after a strong move in price action, which took the NZD/USD close to the top range of its short-term support zone. Another recovery emerged and the NZD/USD is now trading above-and-below its ascending 61.8 Fibonacci Retracement Fan Resistance Level. A breakout sequence is expected to take this currency pair back into its resistance zone which is located between 0.64354 and 0.64652 as marked by the red rectangle. Depending on the magnitude of the advance, a breakout above its resistance zone cannot be ruled out. You can learn more about a resistance zone here.

NZD/USD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 0.63850

⦁ Take Profit @ 0.64650

⦁ Stop Loss @ 0.63600

⦁ Upside Potential: 80 pips

⦁ Downside Risk: 25 pips

⦁ Risk/Reward Ratio: 3.20

In the event of a breakdown in the Force Index below its ascending support level, the NZD/USD may challenge the strength of its short-term support zone. While a sustained breakdown would require a fresh fundamental catalyst, the long-term fundamental scenario favors more upside in this currency pair. The next long-term support zone awaits price action between 0.62401 and 0.62683 which should be viewed as an excellent buying opportunity.

NZD/USD Technical Trading Set-Up - Limited Breakdown Scenario

⦁ Short Entry @ 0.63100

⦁ Take Profit @ 0.62660

⦁ Stop Loss @ 0.63300

⦁ Downside Potential: 50 pips

⦁ Upside Risk: 20 pips

⦁ Risk/Reward Ratio: 2.50