New Zealand economic data released this morning showed an increase in consumer confidence for November while building permits decreased. With the holiday shopping season in its early days, consumer spending over the next four weeks will remain critical. The signing of a bill into law by US President Trump, supporting Hong Kong pro-democracy protesters, has complicated trade negotiations with China. The NZD/USD managed to maintain the breakout above its short-term support zone and is expected to ascend farther.

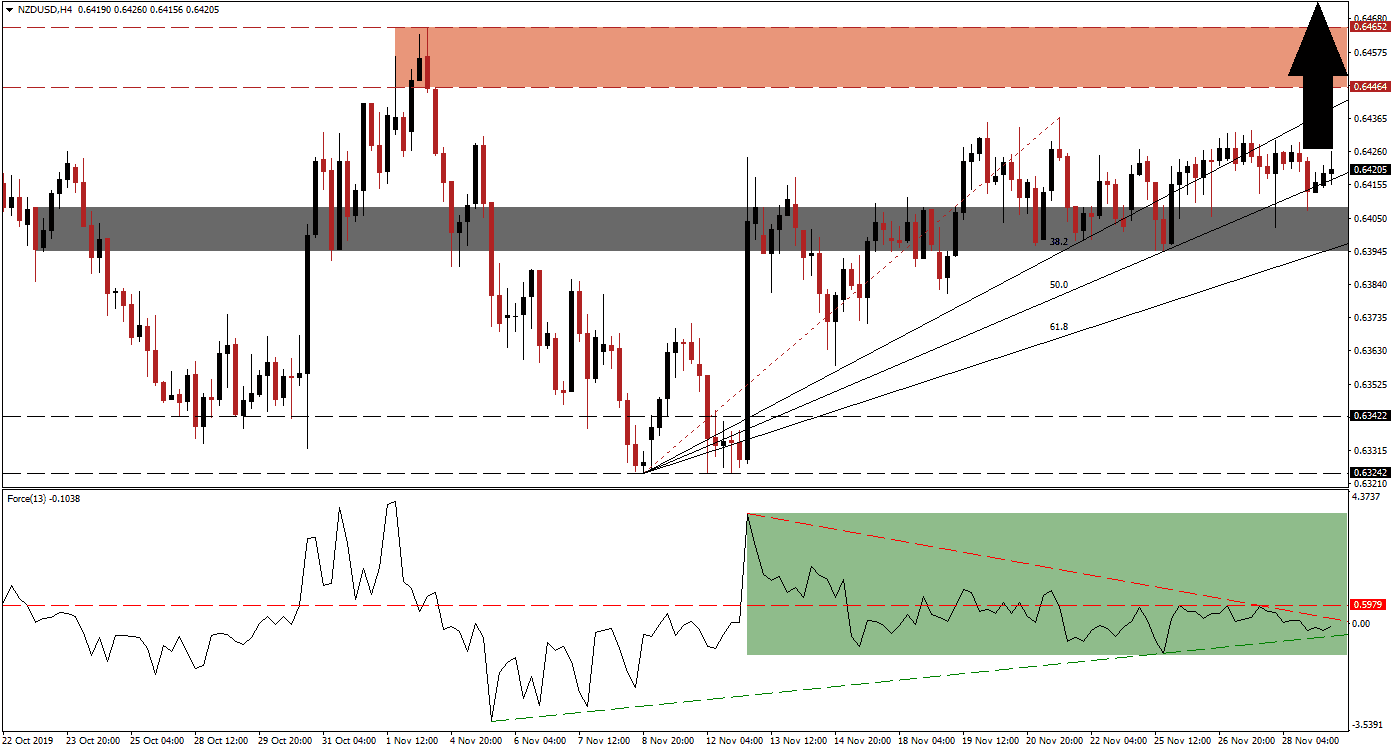

The Force Index, a next-generation technical indicator, peaked after this currency pair initially reached its short-term resistance zone which reversed price action. A second attempt, with support from the Fibonacci Retracement Fan sequence, led to a sustained breakout and conversion into a support zone. The Force Index gradually decreased and moved below its horizontal support level, turning it into resistance. This technical indicator is now trapped above its ascending support level and below its descending resistance level as marked by the green rectangle. The Force is anticipated to complete a double breakout and move back into positive territory, leading the NZD/USD to the upside.

Price action remains well supported by the Fibonacci Retracement Fan sequence that ended the reversal in this currency pair from its short-term resistance level and allowed for a breakout to develop. This breakout converted the short-term resistance zone into support, located between 0.63945 and 0.64085 as marked by the grey rectangle. The ascending 50.0 Fibonacci Retracement Fan Support Level is expected to guide the NZD/USD into its next long-term resistance zone and forex traders are advised to monitor the Force Index, a move into positive conditions is anticipated to attract fresh net buy orders.

One key level to watch remains the intra-day high of 0.64369, the current peak of the breakout in the NZD/USD above its short-term support zone and the end-point of the re-drawn Fibonacci Retracement Fan sequence. A move above this level is likely to accelerate price action to the upside. Given the proximity to its resistance zone, located between 0.64464 and 0.64652 as marked by the red rectangle, a breakout may follow. The next resistance zone awaits this currency pair between 0.65666 and 0.66155. You can learn more about a resistance zone here.

NZD/USD Technical Trading Set-Up - Breakout Extension Scenario

⦁ Long Entry @ 0.64200

⦁ Take Profit @ 0.65850

⦁ Stop Loss @ 0.63750

⦁ Upside Potential: 165 pips

⦁ Downside Risk: 45 pips

⦁ Risk/Reward Ratio: 3.67

In the event of a sustained breakdown in the Force Index below its ascending support level, the NZD/USD may attempt to reverse and push below its short-term support zone. The long-term fundamental outlook for this currency pair remains bullish and any short-term breakdown should be considered as a solid buying opportunity. The downside potential remains limited to the next long-term support zone located between 0.63242 and 0.63422.

NZD/USD Technical Trading Set-Up - Limited Breakdown Scenario

⦁ Short Entry @ 0.63550

⦁ Take Profit @ 0.63250

⦁ Stop Loss @ 0.63700

⦁ Downside Potential: 30 pips

⦁ Upside Risk: 15 pips

⦁ Risk/Reward Ratio: 2.00