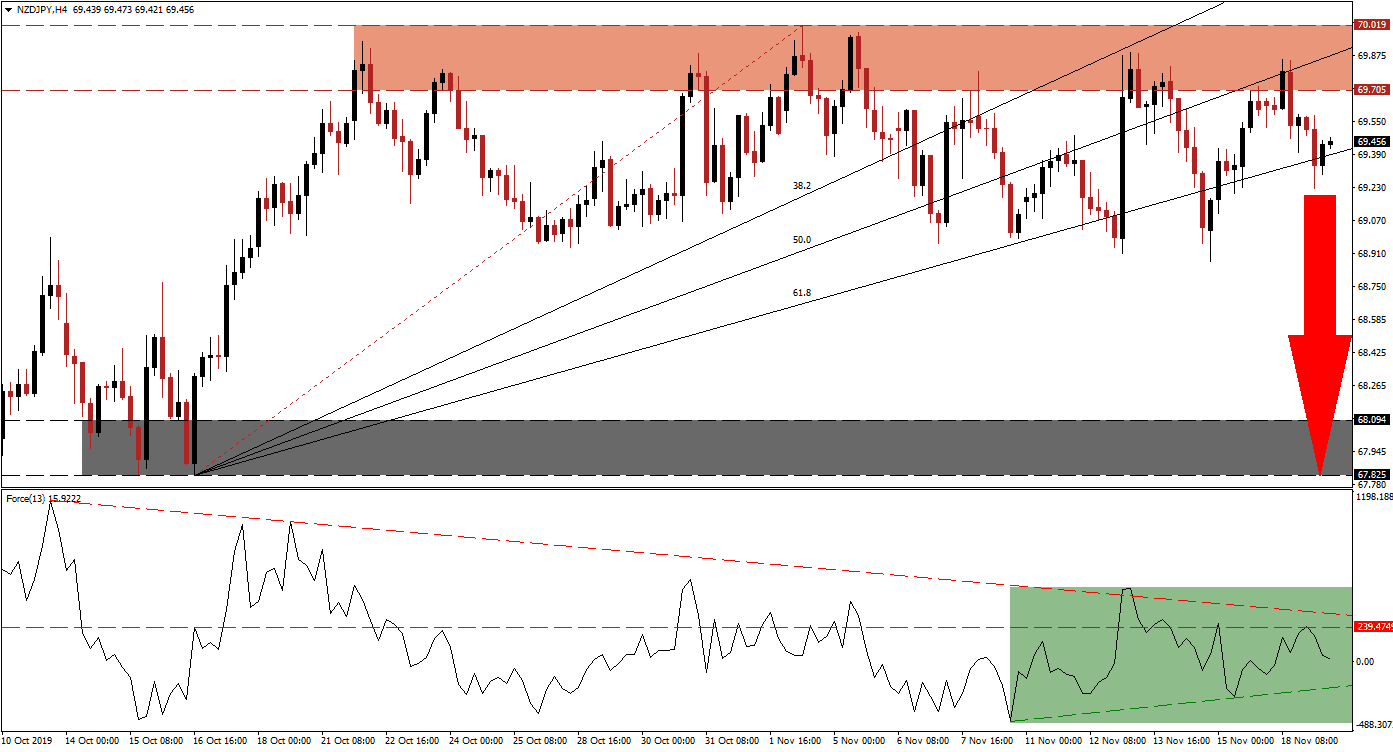

Produce prices for the third-quarter out of New Zealand came in higher than expected, but remain at low levels; fourth-quarter inflation data will play a greater role to gauge if a trend is developing. The Reserve Bank of New Zealand opted to keep interest rates unchanged at 1.00%, surprising markets, but the positive has faded. Global trade concerns have grabbed headlines again and the NZD/JPY just completed the ninth breakdown below its resistance zone while the 50.0 Fibonacci Retracement Fan Resistance Level has entered this zone, adding more downside pressure on this currency pair. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, shows the rise in bearish momentum as price action has gyrated across the Fibonacci Retracement Fan. The current breakdown in price action below its resistance zone was followed by a rejection in the Force Index by its horizontal resistance level as marked by the green rectangle. Its descending resistance level is exercising additional downside pressures and a push into negative conditions is expected to follow; this should lead the NZD/JPY into a sustained breakdown below its 61.8 Fibonacci Retracement Fan Support Level and clear the path to the downside.

Given the rise in uncertainty over the US-China phase one trade truce and the global economy in general, the Japanese Yen is likely to attract more demand due to its safe-haven status. The strength of the resistance zone, located between 69.705 and 70.019 as marked by the red rectangle, remains too strong for the NZD/JPY to push through in the current fundamental scenario. Forex traders are now advised to monitor the Force Index for a move into negative conditions as well as price action as it approaches the ascending 61.8 Fibonacci Retracement Fan Support Level; a breakdown may spark a profit-taking sell-off.

Following a breakdown below the 61.8 Fibonacci Retracement Fan Support Level, which will turn it into resistance, the next key level to watch out for is the intra-day low of 68.871; this represents the low of the nine breakdowns below its resistance zone. A move in the NZD/JPY below this level should take it into its next support zone which awaits between 67.825 and 68.094 as marked by the grey rectangle. A further breakdown would require a fresh fundamental catalyst, you can learn more about a breakdown here.

NZD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 69.450

⦁ Take Profit @ 67.850

⦁ Stop Loss @ 69.900

⦁ Downside Potential: 160 pips

⦁ Upside Risk: 45 pips

⦁ Risk/Reward Ratio: 3.56

In case of a reversal in the Force Index, assisted by its ascending support level, which will lead to a breakout above its horizontal resistance level, the NZD/JPY may attempt a tenth breakout attempt above its resistance zone. The current fundamental picture, supported by technical aspects, suggests a bigger sell-off is looming on the horizon. Any breakout is likely to remain a short-term event and should be considered a good short-selling opportunity. The next resistance zone is located between 71.150 and 71.500.

NZD/JPY Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 70.200

⦁ Take Profit @ 71.350

⦁ Stop Loss @ 69.800

⦁ Upside Potential: 115 pips

⦁ Downside Risk: 40 pips

⦁ Risk/Reward Ratio: 2.88