Comments out of the Swiss National Bank that an interest rate cut remains on the table has pressured the Swiss Franc to the downside, despite its safe-haven appeal. Switzerland is already home to the deepest negative interest rates globally, together with Denmark, at -0.75%. This represents the latest sign that negative interest rates don’t have the desired impact and going farther down the same road is expected to result in long-term damages to the economy. The NZD/CHF was able to push into its resistance zone, but bullish momentum started to deflate and forex traders may be faced with a short-term price action reversal.

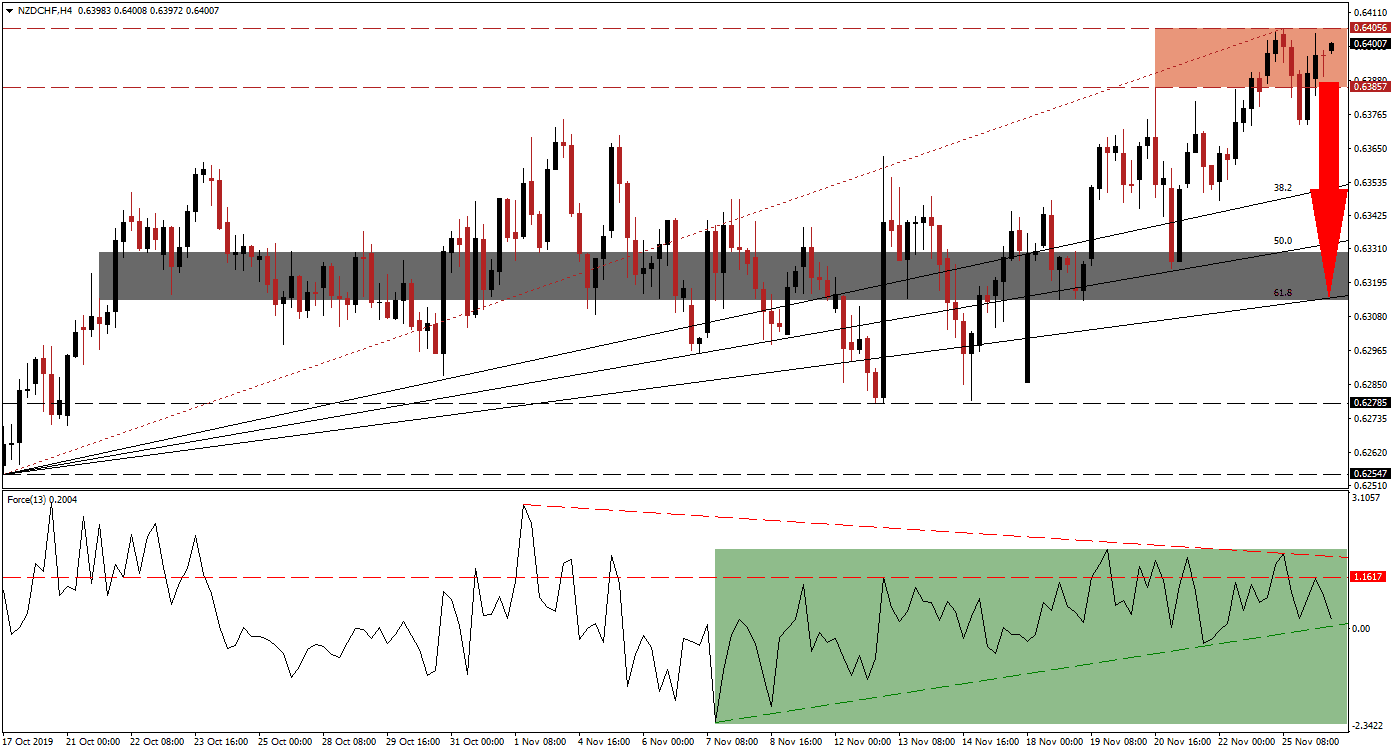

The Force Index, a next-generation technical indicator, was unable to maintain its advance together with price action and its descending resistance level is applying downside pressure. As the NZD/CHF is testing the strength of its resistance zone, the Force Index completed a breakdown below its horizontal support level and turned it into resistance as marked by the green rectangle. The rise in bearish pressures is now likely to force this technical indicator below its ascending support level and into negative territory placing bears in charge of this currency pair. You can learn more about the Force Index here.

Price action recorded a higher high that formed the top range of its resistance zone located between 0.63857 and 0.64056 as marked by the red rectangle, but the short-term technical scenario suggests a reversal expected to violate the fragile bullish formation. A breakdown in the NZD/CHF below its resistance zone is additionally expected to result in a profit-taking sell-off and provide more volume to the downside. This currency pair is already trading below its Fibonacci Retracement Fan trendline and a move into its ascending 38.2 Fibonacci Retracement Fan Support Level will close the gap between price action and the Fibonacci Retracement Fan sequence.

Forex traders are advised to monitor the intra-day low of 0.63731 which marks the low of a failed breakdown attempt below its resistance zone; a move lower is expected to result in the addition of new net short positions in the NZD/CHF. The next short-term support zone awaits price action between 0.63137 and 0.63297 as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level has just entered this zone and may mark the end of the anticipated reversal. A breakdown into its long-term support zone, located between 0.62547 and 0.62785 would require a fresh fundamental catalyst.

NZD/CHF Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 0.64000

⦁ Take Profit @ 0.63200

⦁ Stop Loss @ 0.64250

⦁ Downside Potential: 80 pips

⦁ Upside Risk: 25 pips

⦁ Risk/Reward Ratio: 3.20

A sustained breakout in the Force Index above its descending resistance level could result in the NZD/CHF attempting a breakout. Given the long-term fundamental, upside is expected to remain confined to its next resistance zone located between 0.64931 and 0.65246; this should be viewed as a solid short-selling opportunity in this currency pair. The short-term technical scenario suggests that a breakdown case remains dominant.

NZD/CHF Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 0.64450

⦁ Take Profit @ 0.65000

⦁ Stop Loss @ 0.64200

⦁ Upside Potential: 55 pips

⦁ Downside Risk: 25 pips

⦁ Risk/Reward Ratio: 2.20