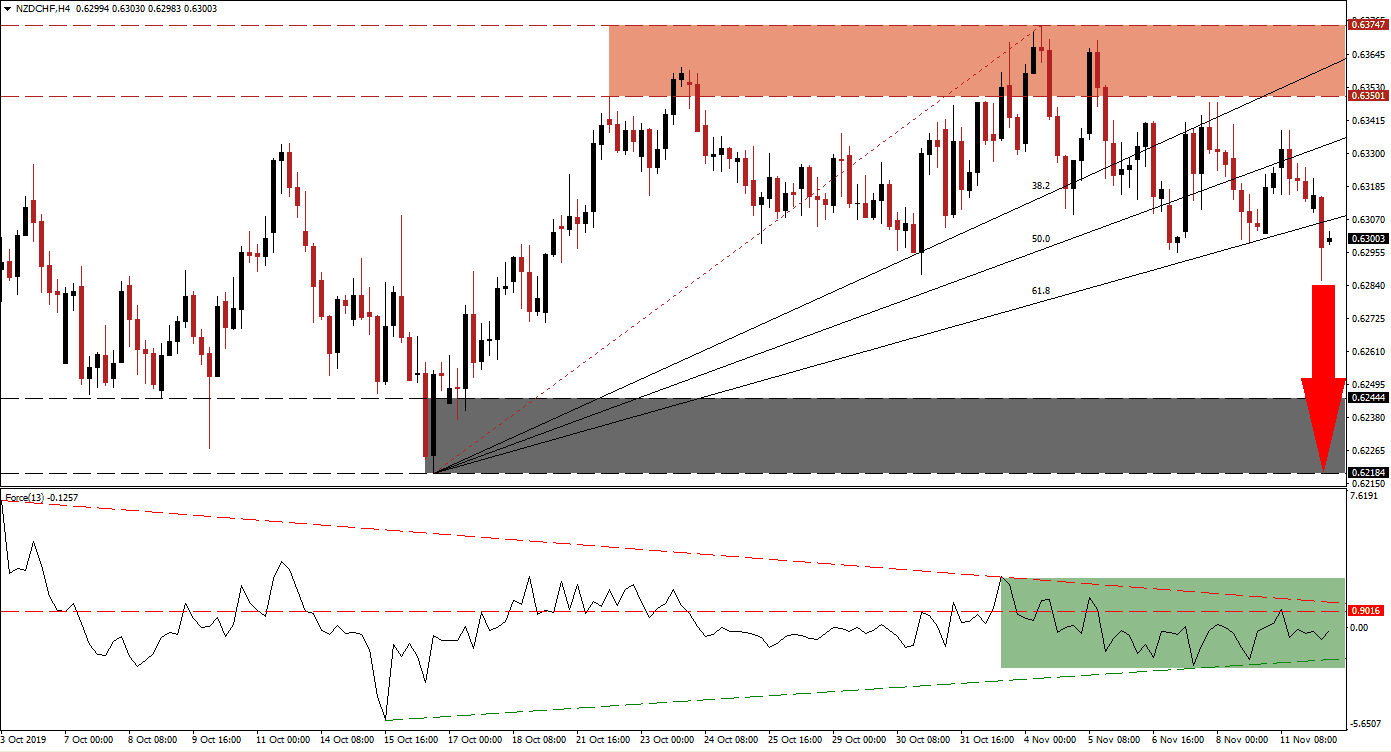

This week’s expected interest rate cut by the Reserve Bank of New Zealand is pressuring the New Zealand Dollar to the downside. Economists expected a 25 basis point cut to 0.75% and markets start to price it in. The renewed rise in global trade fears is boosting support for the Swiss Franc, a safe-haven currency, and this has resulted in a breakdown sequence in the NZD/CHF. This morning’s breakdown below the ascending 61.8 Fibonacci Retracement Fan Support Level, which turned it into resistance, has cleared the path to the downside for this currency pair. You can read more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, started to contract after price action initially moved into its resistance zone; this led to a breakdown below its horizontal support level and turned it into resistance. Since then, the Force Index has been confined to a narrow trading range below its converted horizontal resistance level and its ascending support level as marked by the green rectangle. This technical indicator is trading in negative conditions which place bears in charge of price action and its descending resistance level is applying additional downside pressure. A breakdown in the Force Index below its ascending support level is expected to lead the NZD/CHF to the downside.

After the resistance zone, located between 0.63501 and 0.63747 as marked by the red rectangle, rejected an extension of the advance, bearish pressure increased and a series of lower highs and lower lows emerged. This bearish chart pattern is supported by fundamental factors and the NZD/CHF is likely to extend its corrective phase until it can challenge its next support zone. Forex traders should monitor the intra-day low of 0.62856 which marks the low of the breakdown below its 61.8 Fibonacci Retracement Fan Support Level; a push below this level is expected to result in the addition of fresh net sell-orders in this currency pair.

Without another support level, until price action will reach its support zone which is located between 0.62184 and 0.62444 as marked by the grey rectangle, bearish momentum can build during the sell-off which may lead to another breakdown. Economic data out of New Zealand has been mixed this morning, but next year’s RCEP trade pact is providing a long-term boost to the fundamental outlook for the economy, especially if India decides to join. A potential breakdown is likely to remain limited to the support zone which awaits the NZD/CHF between 0.61589 and 0.61746. You can learn more about a breakdown here.

NZD/CHF Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 0.63000

⦁ Take Profit @ 0.62200

⦁ Stop Loss @ 0.63250

⦁ Downside Potential: 80 pips

⦁ Upside Risk: 25 pips

⦁ Risk/Reward Ratio: 3.20

A double breakout in the Force Index, above its horizontal resistance level and its descending resistance level, could lead the NZD/CHF back into its resistance zone. A breakout above it unexpected with the RBNZ interest rate cut looming, the short-term technical picture favors more downside while the long-term scenario suggests a stronger currency pair moving forward. The support zone should be considered as a solid long-term buying opportunity.

NZD/CHF Technical Trading Set-Up - Price Action Reversal Scenario

⦁ Long Entry @ 0.63350

⦁ Take Profit @ 0.63700

⦁ Stop Loss @ 0.63200

⦁ Upside Potential: 35 pips

⦁ Downside Risk: 15 pips

⦁ Risk/Reward Ratio: 2.33