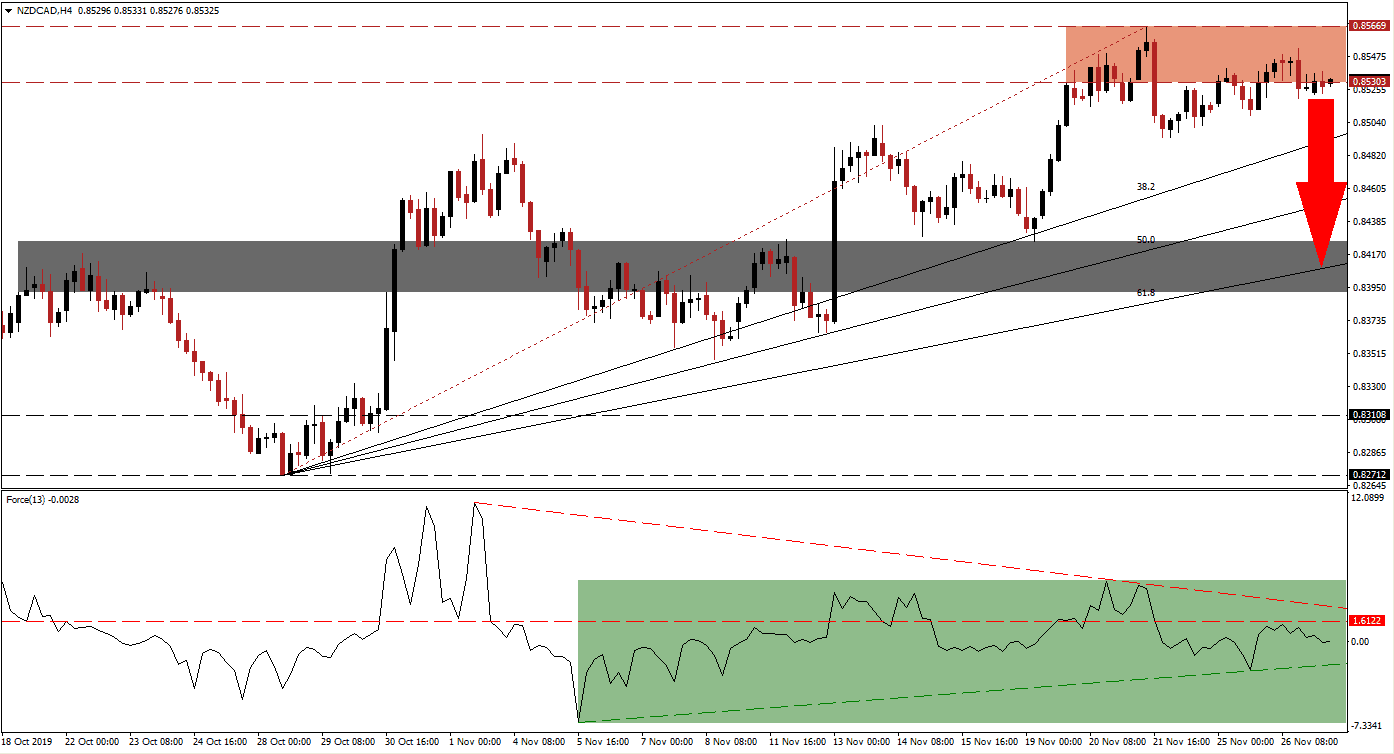

This morning’s New Zealand trade data showed an increase in exports for October over September, but the trade deficit widened slightly more than expected on the back of higher imports. The New Zealand Dollar came under mild selling pressure and together with the worst contraction in Chinese corporate profits on record in October, a contraction of 9.9% annualized, the upside momentum in the NZD/CAD is exhausted. The 38.2 Fibonacci Retracement Fan Support Level is closing in on the bottom range of its resistance zone with price action trapped in between. This has increased the potential for a breakdown. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, started to descend as the NZD/CAD entered its resistance zone and served as an early warning signal that the upside momentum is breaking down. A breakdown in price action below its resistance zone was confirmed by a breakdown in the Force Index below its horizontal support level, turning it into resistance. This technical indicator has remained below its horizontal resistance level and above its ascending support level ever since, as marked by the green rectangle. Following this morning’s economic data, the Force Index slipped into negative conditions and placed bears in charge of this currency pair.

Following the initial breakdown in the NZD/CAD below its resistance zone, a reversal led to a lower high in another bearish development. Give the current fundamental picture, supported by short-term technical developments, a breakout in this currency pair above its resistance zone remains unlikely. The exhausted upside momentum together with the approaching 38.2 Fibonacci Retracement Fan Support Level suggests a profit-taking sell-off is forming. This is expected to push price action away from its resistance zone, located between 0.85303 and 0.85669 as marked by the red rectangle, and lead to a breakdown sequence. You can learn more about a breakdown here.

One critical level to monitor is the intra-day low of 0.84939 which marks the low of the initial breakdown in this currency pair below its resistance zone. A push lower will take the NZD/CAD below its 38.2 Fibonacci Retracement Fan Support Level from where more net sell positions are expected. A move into its next short-term support zone, located between 0.83917 and 0.84255 as marked by the grey rectangle, is expected; the 61.8 Fibonacci Retracement Fan Support Level is passing through this zone. The long-term bullish chart formation would be violated if a sell-off extends into the 61.8 Fibonacci Retracement Fan Support Level and the next long-term support zone awaits price action between 0.82712 and 0.83108.

NZD/CAD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 0.85350

⦁ Take Profit @ 0.84150

⦁ Stop Loss @ 0.85700

⦁ Downside Potential: 120 pips

⦁ Upside Risk: 35 pips

⦁ Risk/Reward Ratio: 3.43

A breakout in the Force Index above its descending resistance level may inspire the NZD/CAD to reignite its advance and push for a breakout above its resistance zone. The New Zealand and Canadian Dollars are both commodity currencies, but the size of the Canadian economy allows it to weather the impact of the global economic slowdown more effectively. From a long-term perspective, more downside in this currency pair is expected. The next resistance zone is located between 0.87007 and 0.87389 and should be viewed as a solid short selling opportunity.

NZD/CAD Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 0.86100

⦁ Take Profit @ 0.87100

⦁ Stop Loss @ 0.85700

⦁ Upside Potential: 100 pips

⦁ Downside Risk: 40 pips

⦁ Risk/Reward Ratio: 2.50