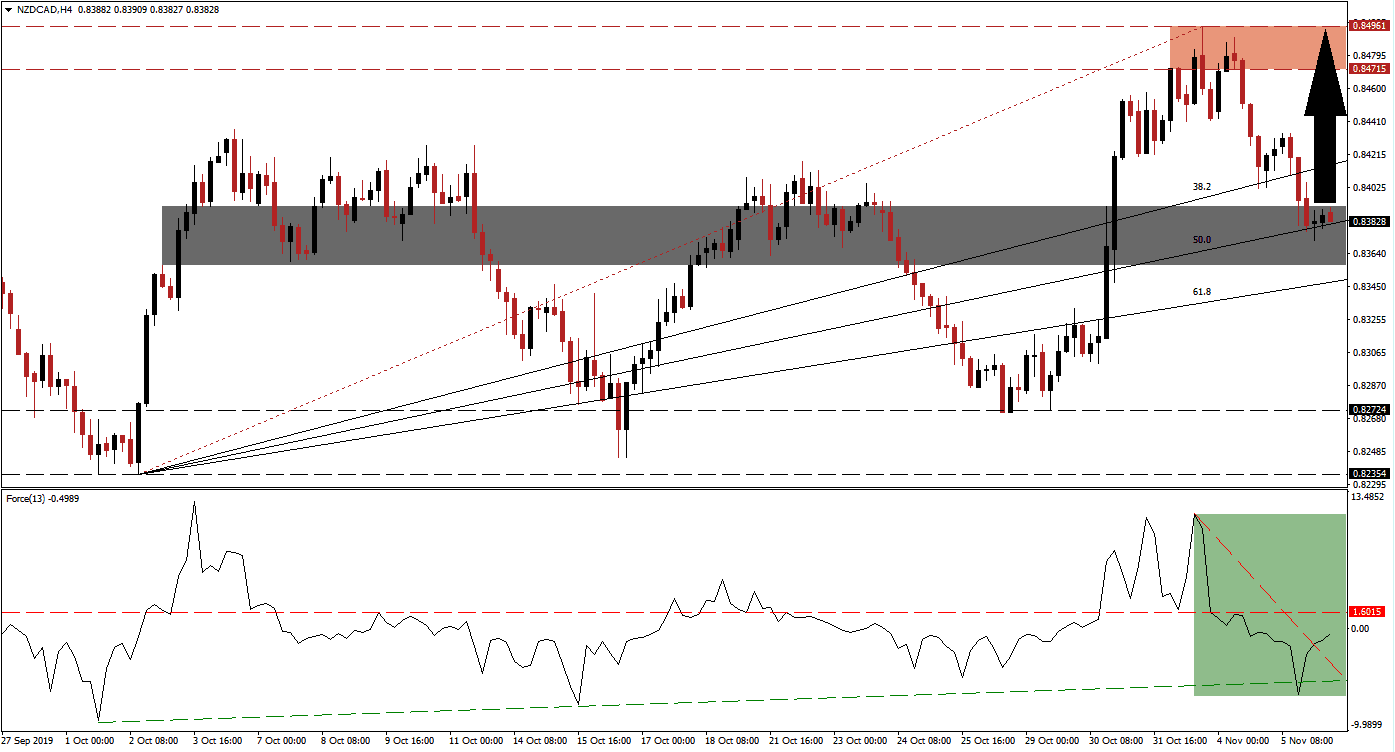

Volatility in the Canadian Dollar increase after the Bank of Canada opened the door to a possible interest rate cut, but bond markets in the US suggests that pressure on interest rates may be to the upside. Optimism about the phase one trade deal between the US and China has boosted economic optimism, but it is too early to dismiss the risks to the global economy which remains in a recession path. The NZD/CAD has formed a long-term uptrend with a series of higher highs and higher lows and price action is well supported by its Fibonacci Retracement Fan.

The Force Index, a next generation technical indicator, confirmed the volatility spike in this currency pair and has gyrated from a higher high to a higher low. The most recent corrective phase took the NZD/CAD from its resistance zone into its short-term support zone, where price action stabilized; the Force Index completed a breakdown below its horizontal support level and turned it into resistance. Following a brief plunge below its ascending support level, this technical indicator now pushed above its descending resistance level in a bullish development as marked by the green rectangle; a push into positive conditions and a breakout above its horizontal resistance level are expected to follow.

Price action halted its correction after it reached its 50.0 Fibonacci Retracement Fan Support Level, nestled inside its short-term support zone located between 0.83571 and 0.83916 as marked by the grey rectangle, from where bullish momentum started to increase. An advance from current levels will keep the long-term uptrend intact and a short-covering rally may provide the necessary catalyst for the NZD/CAD to retrace its correction, with the Force Index leading to a breakout in this currency pair. You can learn more about a breakout here.

With the New Zealand Dollar and the Canadian Dollar being commodity currencies, both are exposed to additional volatility. While the Canadian economy is the bigger commodity exporter, the 15 nation RCEP trade pact which is expected to be signed in 2020 will give New Zealand a tremendous long-term advantage. A breakout in price action should lead the NZD/CAD back into its resistance zone which is located between 0.84715 and 0.84961 as marked by the red rectangle; another breakout is possible which will extend the long-term uptrend. You can learn more about a resistance zone here.

NZD/CAD Technical Trading Set-Up - Price Action Reversal Scenario

⦁ Long Entry @ 0.83850

⦁ Take Profit @ 0.84950

⦁ Stop Loss @ 0.83550

⦁ Upside Potential: 110 pips

⦁ Downside Risk: 30 pips

⦁ Risk/Reward Ratio: 3.67

Should the Force Index fail to push above its horizontal resistance level and follow its descending resistance level, which currently functions as a descending support level, to the downside, the NZD/CAD may attempt a breakdown. The next long-term support level is located between 0.82354 and 0.82724 and any correction into this zone should be considered as an excellent long-term buying opportunity.

NZD/CAD Technical Trading Set-Up - Limited Breakdown Scenario

⦁ Short Entry @ 0.83400

⦁ Take Profit @ 0.82750

⦁ Stop Loss @ 0.83700

⦁ Downside Potential: 65 pips

⦁ Upside Risk: 30 pips

⦁ Risk/Reward Ratio: 2.17