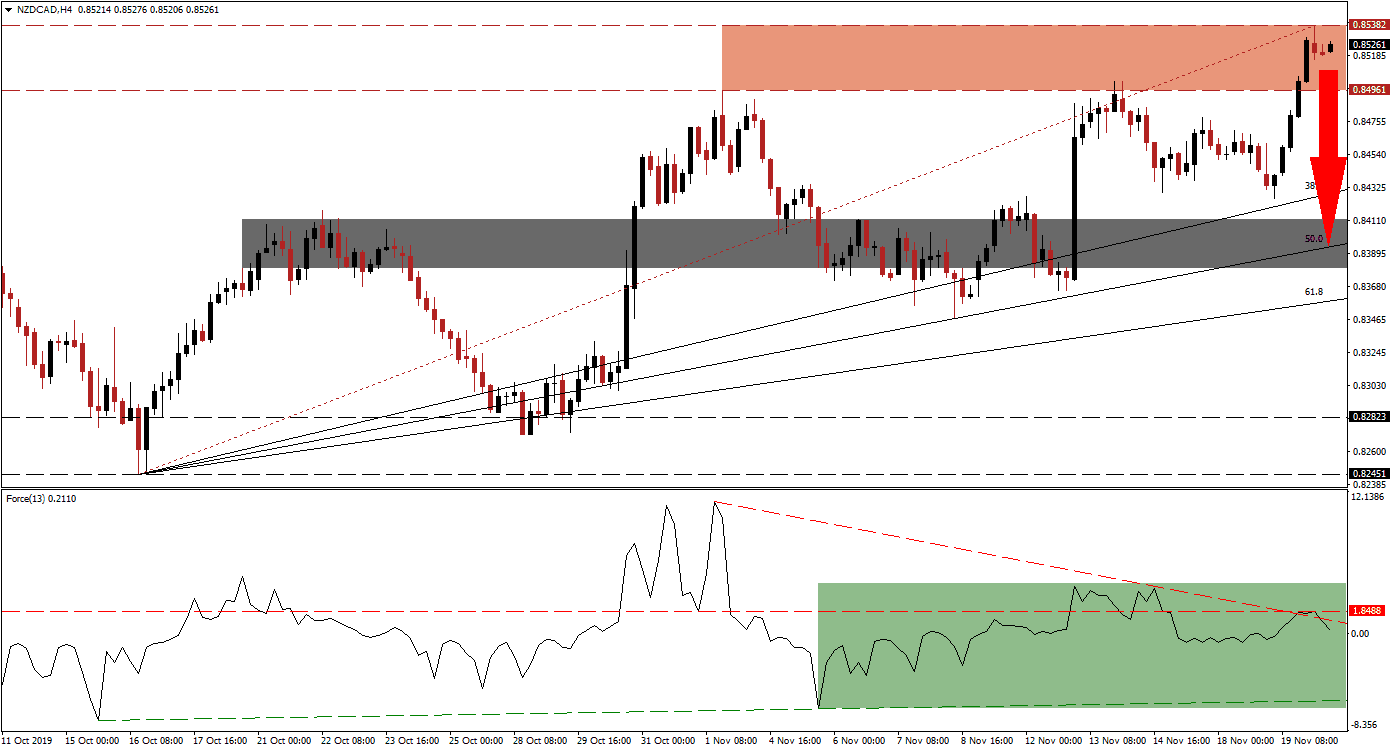

Following a strong advance in the NZD/CAD, the uptrend is exhausted and vulnerable to a corrective phase. Price action is already located below its Fibonacci Retracement Fan trendline, inside of its resistance zone, with a build-up in bearish momentum which is expected to lead to a breakdown. A profit-taking sell-off is likely to add selling pressure, but a contraction in this currency pair into its ascending 50.0 Fibonacci Retracement Fan Support Level will keep the long-term uptrend intact and ensure its longevity. You can read more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, is flashing a major sell signal with the formation of a negative divergence; this bearish development points towards the end of the existing trend. As the NZD/CAD pushed through its short-term resistance zone, which turned it into support, the Force Index gradually decreased and is now trading below its horizontal resistance level. Its descending resistance level is adding bearish pressures, as marked by the green rectangle, and has crossed below its horizontal resistance level in another bearish development. A move into negative territory by this technical indicator is expected to lead price action into a breakdown.

Long-term fundamental developments suggest more upside potential in this currency pair, but the technical picture favors a short-term correction. The Force Index is anticipated to descend further and the NZD/CAD is likely to follow with a breakdown below its resistance zone, located between 0.84961 and 0.85382 as marked by the red rectangle. Forex traders should monitor the intra-day high of 0.85017 which marks the previous peak before price action was reversed down into its 38.2 Fibonacci Retracement Fan Support Level; a move below this peak is likely to accelerate the pending breakdown to the downside. You can learn more about a breakdown here.

A breakdown in this currency pair below its resistance zone will clear the path for price action to correct into its short-term support zone, located between 0.83794 and 0.84118 as marked by the grey rectangle. The 50.0 Fibonacci Retracement Fan Support Level is nestled inside this zone while the 61.8 Fibonacci Retracement Fan Support Level is closing in on the bottom range. Should the NZD/CAD reverse from its 50.0 Fibonacci Retracement Fan Support Level, a higher low would be created and confirm the long-term uptrend remains healthy and alive.

NZD/CAD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 0.85250

⦁ Take Profit @ 0.83900

⦁ Stop Loss @ 0.85700

⦁ Downside Potential: 135 pips

⦁ Upside Risk: 45 pips

⦁ Risk/Reward Ratio: 3.00

While the Force Index is expected to move down into its ascending support level, a double breakout above its descending as well as horizontal resistance level, could inspire a breakout attempt in the NZD/CAD. Given the increase in bearish pressures and dominant uptrend exhaustion, this remains an unlikely scenario without a corrective phase. The next resistance zone is located between 0.86497 and 0.87007 from where a further breakout would require a fresh fundamental catalyst.

NZD/CAD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 0.85900

⦁ Take Profit @ 0.86650

⦁ Stop Loss @ 0.85550

⦁ Upside Potential: 75 pips

⦁ Downside Risk: 35 pips

⦁ Risk/Reward Ratio: 2.14