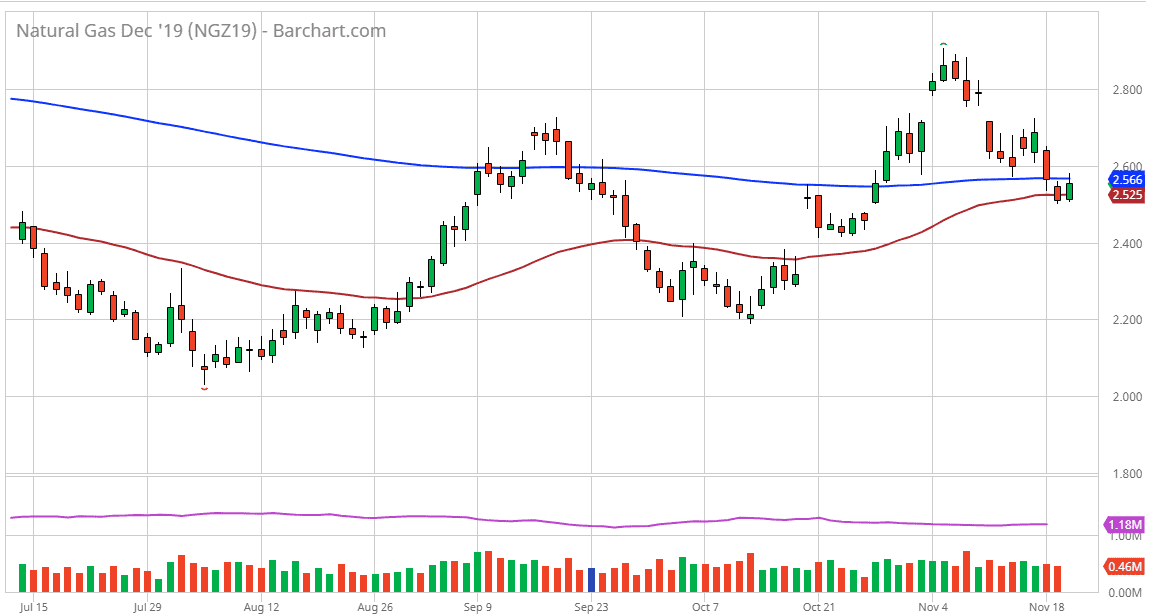

Natural gas markets rallied during the trading session on Wednesday, breaking above the 200 day EMA during the session. However, the market was relatively quiet once we got there, and it now looks as if the market is going to be awaiting the inventory figures. Obviously, inventory continues to be a longer-term issue for natural gas as the United States has been extraordinarily oversupplied, so it’s going to take a certain amount of cold temperatures out there to get this market rallying significantly for a larger move. That being said, this is the time of year when it happens, so it is more than likely only a matter of time.

Unfortunately, there has been a roughly 13% increase in drilling over the year, but colder temperatures have arrived a little earlier than usual, so that could help drive down the supply as well. This comes down to supply and demand, and this time of year it typically means more demand than anything else. Because of this, I believe that the market is one that you should be buying and not selling, but that doesn’t necessarily mean you should be buying it every chance you get.

To the downside, the $2.40 level underneath is a major gap and I think at that level we have the absolute “floor” in the market down in that region. I don’t even know that we get there, but if we do, I’d be all over any buying opportunities. Alternately, if we can break above the $2.60 level then I believe that the market will start to target the $2.75 level above which of course features a gap as well. That gap being broken to the upside opens up the door to the $3.00 level, which I do think happens given enough time. This time of year, we normally have some type of spike, and if we suddenly get massive amounts of cold weather in the United States, that is what’s going to kick this off. Either way, I have no interest in shorting natural gas at this time year, and especially at these extraordinarily low prices. Don’t be wrong, I am generally bearish on natural gas for longer-term trading, but this time a year and the fact that we are so low suggests that we are more likely to go higher than lower, as the demand obviously is much more stringent in November, December, January and February that it is during the hot summer months.