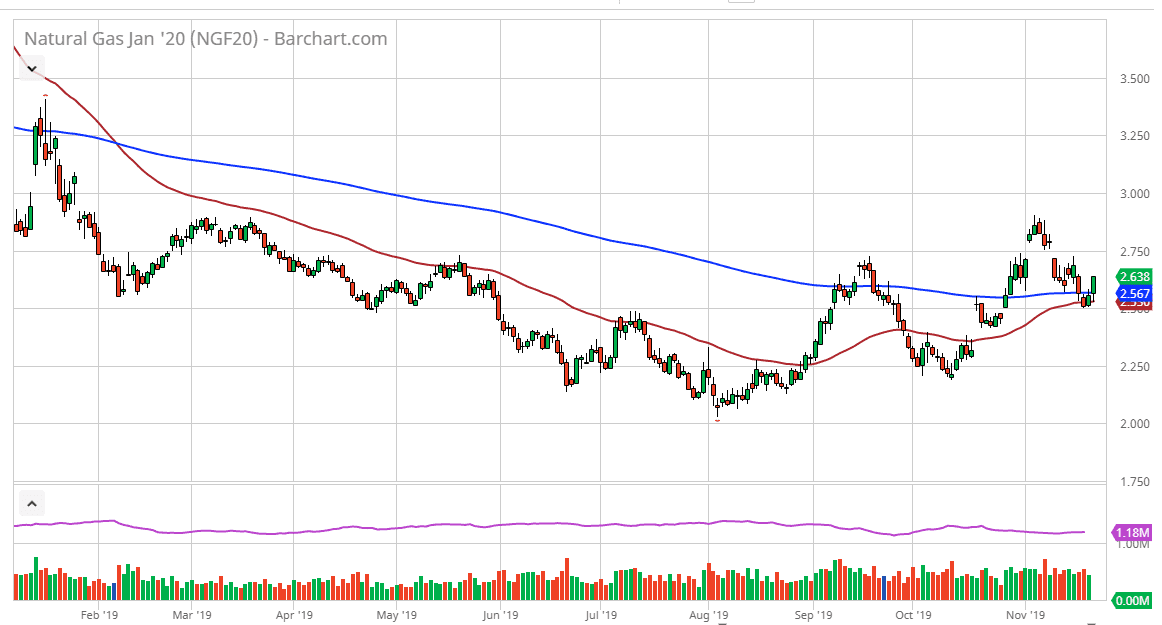

The natural gas markets have initially pulled back during the trading session on Thursday but found enough support at the 50 day EMA. The $2.50 level also is a large, round, psychologically significant figure, and as a result it will attract a lot of attention. The 50 day EMA and that large figure are enough to think that there should be a certain amount of technical support underneath current pricing, and we have of course taken off to the upside.

Looking at this chart, it’s obvious that Thursday was a very bullish sign, as we gained a little over 1% for the day. At this point, the market has broken above the $2.60 level, and it now looks as if it is ready to go looking towards the $2.75 level above, which is the scene of a gap that will attract a lot of attention. At this point, the market should continue to grind higher based upon not only the fact that we have been forming a bit of a rising channel, but also inventory figures came out during the trading session on Thursday that were much more bullish than anticipated.

As temperatures drop in the United States, demand for natural gas will continue to pick up. At this point, the market looks as if it is starting to recognize the fact that we are entering the busy season for natural gas, therefore I think it’s only a matter of time before we break out to the upside and go much higher. That doesn’t mean that it’s going to happen overnight, and clearly, we have a lot of concerns when it comes to oversupply of natural gas as we have drilled 14% more than last year. However, we are also getting colder temperatures a little earlier than usual, and that suggests that the market is going to continue to be bullish but noisy.

I believe that the $2.50 level will continue to be support, just as the $2.40 level will be as it is a gap. I think eventually we go looking towards the $3.00 level above, and then possibly even further as the market has a lot of momentum swinging back around. We have been choppy and back and forth, but one thing that would noticing is that the lows continue to rise, just as the highs do. It looks as if we have turned the corner for the cold weather rally.