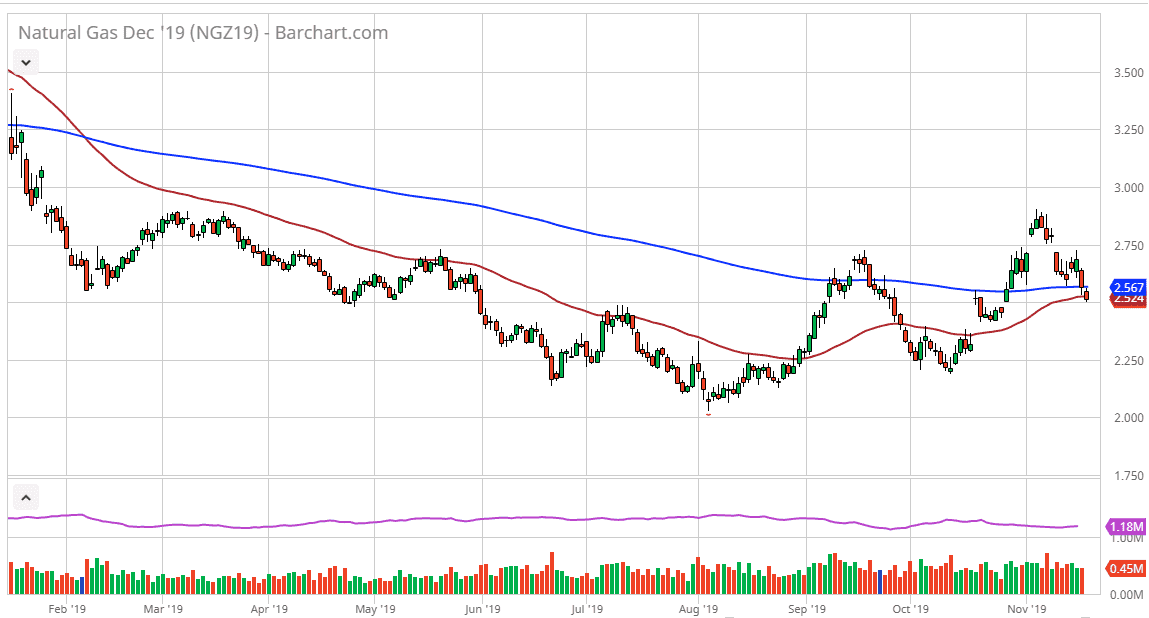

The natural gas markets fell slightly during the trading session on Tuesday, as we continue to dance around the crucial $2.50 level. We are also near the 50 day EMA, which of course makes quite a bit of sense as it creates a lot of attention by technical traders out there. At this point, there is a gap underneath at the $2.40 level, so I think that somewhere in that area is the absolute bottom of the market, so if we were to break down below there it would be a huge surprise. After all, this is the time of year where we see a lot of demand for natural gas to heat homes in the northeastern part of the United States, and it is most certainly cold enough there now to get people interested in the market.

To the upside there is also a gap at the $2.75 level, so it makes quite a bit of sense that we will continue to pound around this area overall. Ultimately, if we can break above there then it would kick off the surge higher that we should continue to get. That being said, this is a market that tends to be very erratic and move on the latest weather report more than anything else, so it’s obviously a market that is going to remain volatile as whether is also volatile.

At this point, the market is witnessing the 50 day EMA coming very close to crossing above the 200 day EMA, which of course is the “golden cross” that people pay attention to him from a technical analysis standpoint. That should send this market into a longer-term uptrend, but that doesn’t mean that we go straight up in the air. Pullback should continue to offer buying opportunities, but you will need to be trading small enough to handle the nasty volatility that this pair tends to have. However, once we do break above the $2.75 level, we could accelerate to the upside which would signify just how much bullish pressure there is. Ultimately, this is a market that will continue to be very noisy but typically will run until the middle of January or so when the futures traders start to focus on spring contracts. Between now and then, every time we get nasty cold weather in the north recent per the United States, this market should continue to go higher.