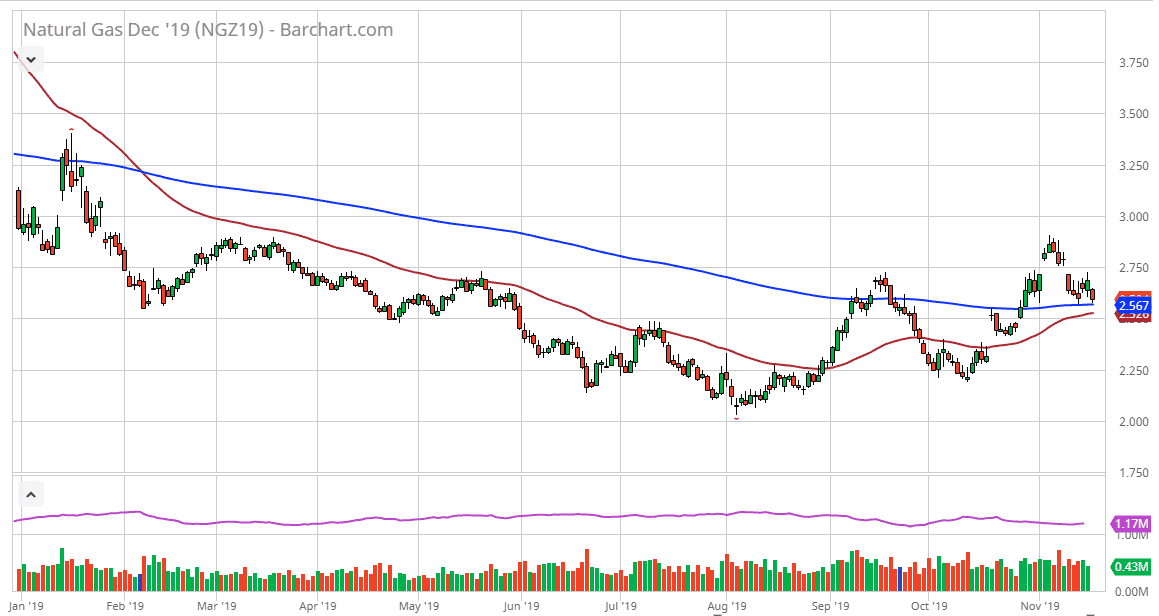

Natural gas markets fell a bit during the trading session on Monday to kick off the week, testing the 200 day EMA. We continue to grind sideways back and forth in this market, which makes quite a bit of sense. After all, the market has a lot to think about at this time of year. The initial thought is that the demand for natural gas to heat homes will continue to go forward and increase, but at the same time we also have issues with oversupply. Regardless though, temperatures in the United States have been colder than usual, and that should begin to help the idea of the winter rush that we get every year.

Looking at the chart, we are sitting on top of the 200 day EMA with the 50 day EMA starting to slide towards it. If the 50 day EMA were to cross above the 200 day EMA, it’s very likely that we could continue to go higher, with an eye on the $2.75 level above as there is a gap there. With that being the case, I would anticipate that there will be a lot of noise in that area, and perhaps a lot of resistance. However, if we were to break above there, the market should then go much higher, perhaps kicking off the longer-term move for the winter.

At this point, it’s very likely that the market will continue to see a big fight here, but eventually the market could take out to the upside as we would reach towards the previous high, and that of course the psychologically important $3.00 level. At this point, the market is going to find a lot of options barriers as well but given enough time I think we even break above there. Granted, this is going to be a very noisy marketplace, and the situation isn’t exactly completely clear like it would be this time year as we had massive increases in drilling earlier this year, so it’s going to take a bit of time to break through the supply barrier to drive demand pricing higher. At this point though, I have no interest in shorting this market and I believe that it’s only a matter of time before we take off to the upside, at least until the middle of January. Once we clear that gap above, momentum should start to pick up.