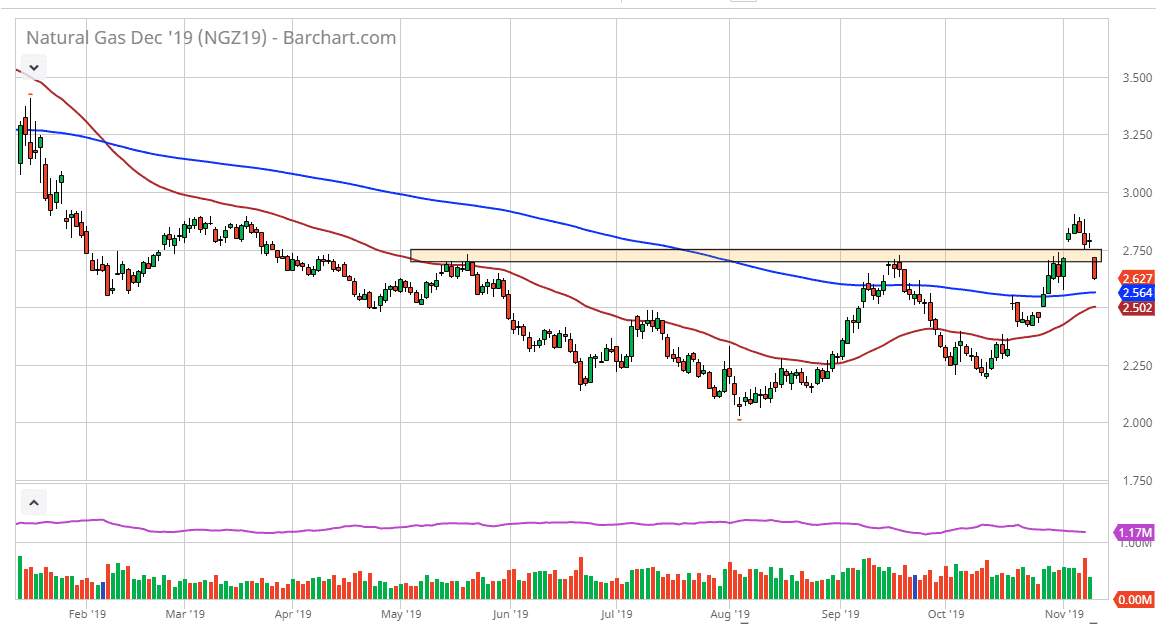

The natural gas markets have gapped lower to kick off the week on Monday and have even broken down below the $2.65 level. At this point, the market is likely to continue going lower because it has closed towards the bottom of the range for the session. This is a very negative sign, but when looked at through the prism of the larger time frames, it could be a buying opportunity given enough time.

When I look at the chart, I can see a potential “golden cross” as the 50 day EMA is breaking above the $2.50 level, and the 200 day EMA is closer to the $2.56 level. If we do get the idea of a golden cross been kicked off, that is a longer-term “buy-and-hold” situation, sending the market much higher due to larger timeframe based investors getting involved. That being said though, this is a cyclical trade that I do like and even though we’ve had this nice selloff, the reality is that there are plenty of places underneath that could cause significant buying opportunities.

The psychologically important $2.50 level has offered psychological and structural support and resistance in the past, so I would anticipate it to offer support going forward. At this point, I suspect that the Tuesday session will probably be more negativity, but by the time we were all around to the Wednesday session, there’s a good chance the buyers will start to step back into the market as we have made a “higher high” and now should start to make a “lower low.”

At this point in time it’s likely that the gap at the $2.75 level should continue to attract a lot of interest as we have gapped through that area a couple of times. At this point, the market is very likely to go looking towards that level again. If we can break above that gap, then more money will flow into the natural gas markets, which I do expect to see sooner or later as temperatures are dropping in the United States. At this point, the market will more than likely go looking towards the $3.00 level. To the downside, even if we do break down below the $2.50 level there is a gap at the $2.40 level that should come into play as support as well. Be patient but look for buying opportunities on pullbacks.