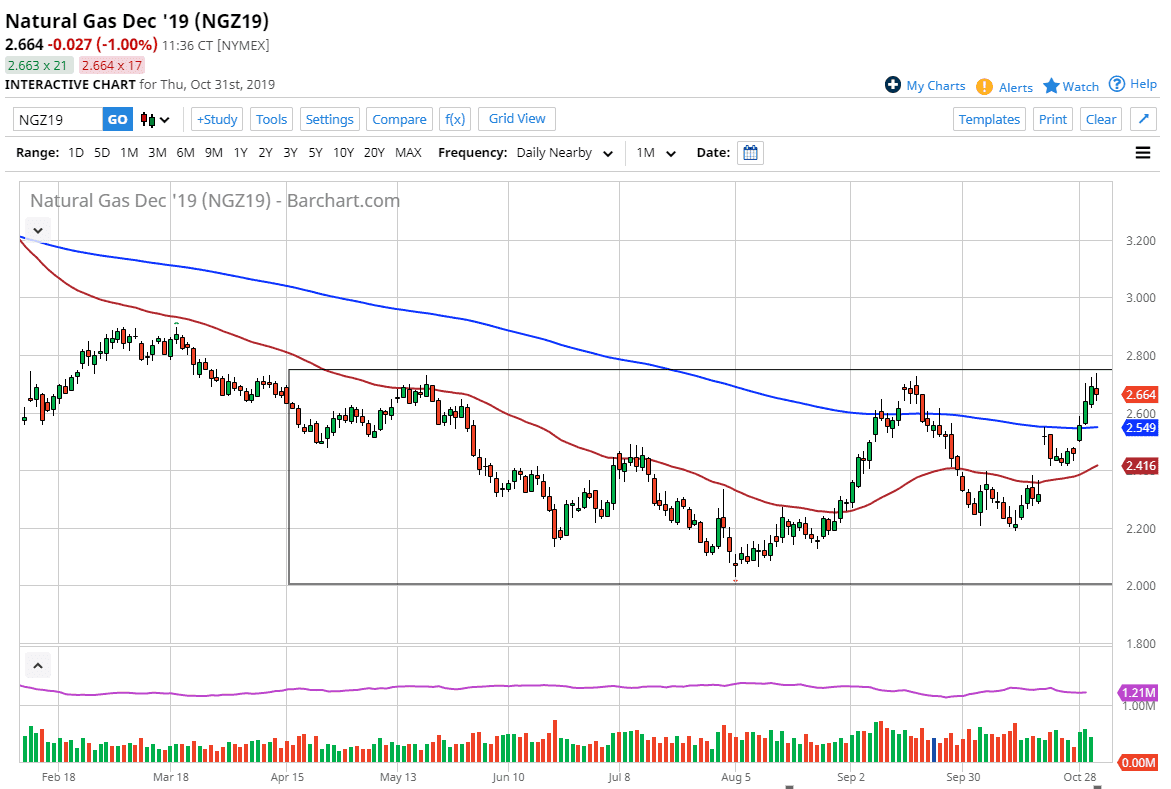

The natural gas markets initially tried to rally during the trading session on Thursday but failed to continue going higher as we then pulled back to form a bit of a shooting star. Ultimately, this is a good sign though, because we have pressed the top of the consolidation area, and even made a “higher high” over the last 24 hours. Ultimately, it shows that we are trying to break out and that makes quite a bit of sense considering the time of year we are in. The demand for natural gas will start to pick up in the United States as temperatures drop, and it looks very likely that colder temperatures are coming rather soon.

To the downside, if the market breaks down below the bottom of the candlestick it’s likely that we will go looking towards the 200 day EMA underneath which is currently trading at the $2.55 level. Underneath there, the $2.42 level should be supported, as it is the 50 day EMA and towards the top of the gap underneath it has not been filled yet. At this point, it’s not necessarily a matter of whether or not the buyers will return but when, and I will continue to look at this market as an opportunity to pick up value going forward.

Looking at the start, it’s likely that the 50 day EMA is going to try to cross the 200 day EMA to form a bit of a “golden cross” which of course is a very bullish sign overall. At this point on, it’s likely that the market should continue to see people looking for opportunities to pick up value on dips. This is a short-term pullback just waiting to send this market higher. The trade will probably run until the middle of January, which is when we will start focusing on spring contracts and warmer temperature in the United States. This is a cyclical trade that I use every year, and it looks as if it has just started to kick off yet again.

With all of that being said I like the idea of buying pullbacks to pick up value, or perhaps buying a breakout above the $2.75 level. I believe that the $3.00 level will be the initial target, followed by every $0.20 after that as the market should continue to see a lot of upward momentum.