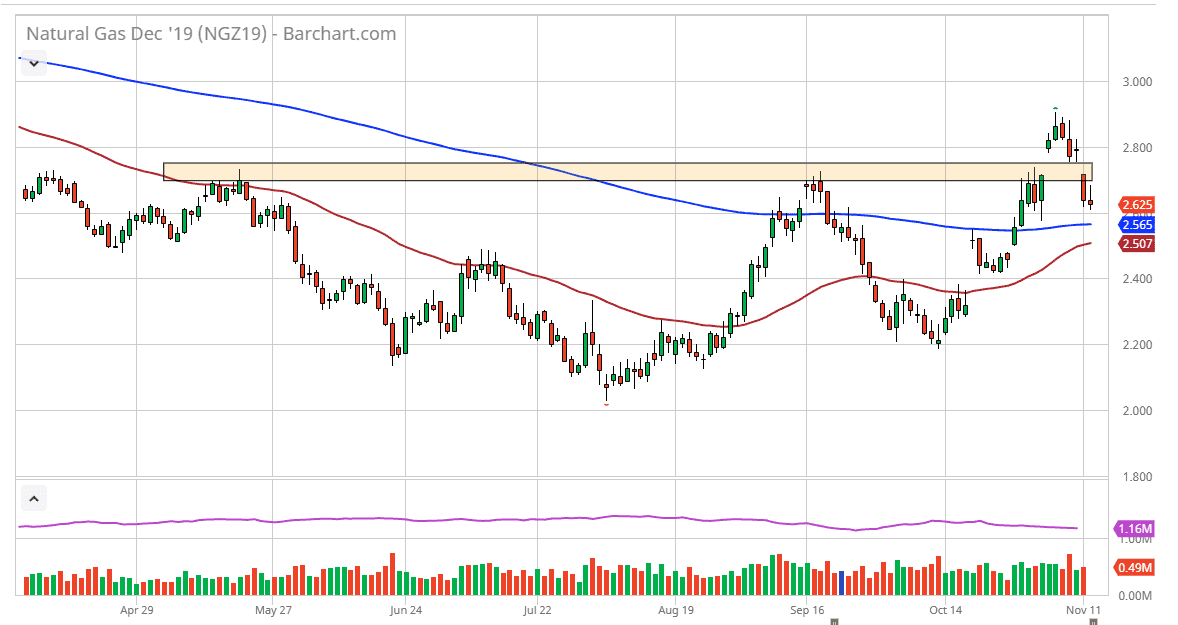

The natural gas markets initially tried to rally during the day on Tuesday but found enough resistance near the gap just above, and that shows that there could be a significant amount of selling pressure just above. At this point, the market is very likely to find sellers in that general vicinity, but I think it’s only a matter of time before we break out to the upside. This is the right time a year to see significant bullish pressure to the upside, but it takes a while to see this market break out above the gap just above. Once we do get that though it’s very likely that the market will reach towards the $2.90 level, and then possibly the $3.00 level.

The 200 day EMA underneath will continue to offer support at the $2.56 level. At this point, the market looks likely to see a lot of support underneath based upon not only that but the 50 day EMA that is trying to reach to the upside. All things being equal, if we can break above the 200 day with the 50 day EMA that is the so-called “golden cross” which is a longer-term “buy-and-hold” scenario. All things being equal though, it’s very likely that the market will continue to find plenty of buyers based on the fact that there is a lot of demand this time a year.

Looking at this chart, one thing that should be kept in mind is that the United States is currently going through a major cold snap, and that of course will cause a lot of demand for natural gas in order to heat homes in the northeastern part of the United States, especially around Boston, New York City, and Philadelphia which are all dealing with a very cold temperatures. I think at this point, it’s very unlikely that this market breaks down rather significantly and we have made a “higher high”, although it certainly looks as if the short-term charts could be a bit bearish. Longer-term, I would anticipate a move towards the $3.50 level given enough time, as this market tends to be bullish between now and the middle of January in general. Otherwise, short-term buying is the best way to go going forward, as there should be plenty of support going forward. I have no interest in trying to short this market, quite frankly this is the wrong time of year to see that.