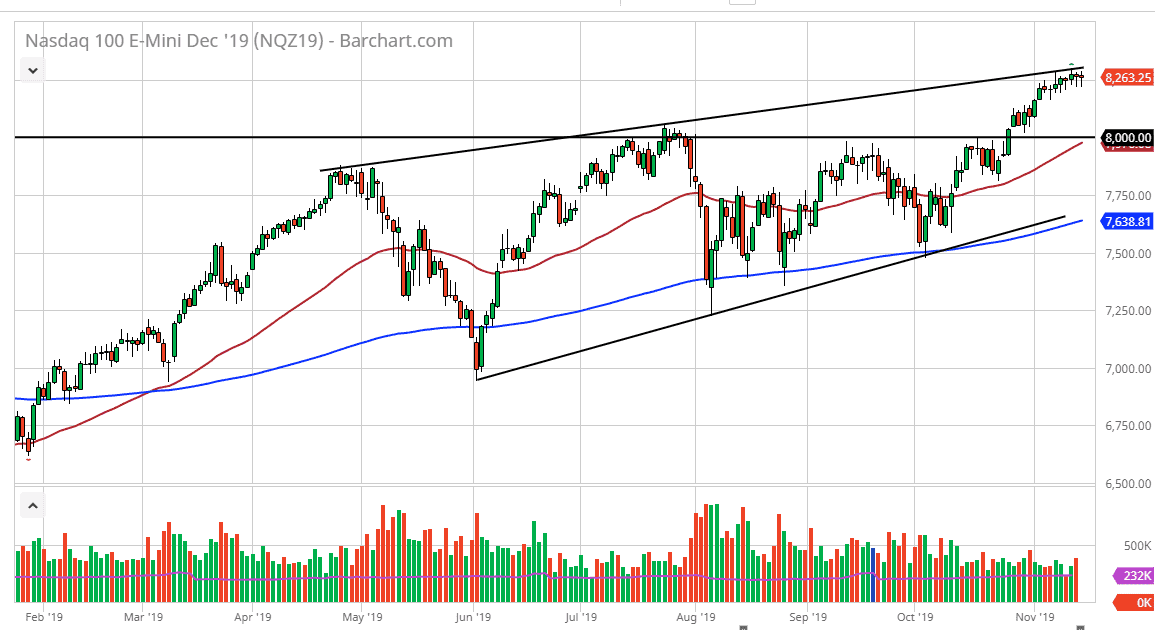

The NASDAQ 100 has continued to go back and forth during the trading session on Thursday again, as we simply kill time just below the recent highs. At this point in time it’s likely that the market will continue to go sideways until it finds some type of reason to move, and right now this is a market that is struggling to break above the 8300 level. We are at the top of a larger channel, so a pullback from here makes quite a bit of sense and quite frankly would probably be a welcome break. After all, the market has rallied so much lately that at the very least it will need to grind sideways, but quite frankly a pullback will offer a lot of value in a market that is very strong.

The 8000 level underneath should be supportive, because it is a large, round, psychologically significant figure and it is also the top of an ascending triangle that we had recently broken out of. That area should offer support as it was once resistance, so therefore I like the idea of buying closer that level if we can get down to it. Overall, I like the idea of bouncing from there and adding to a core position or jumping in initially based upon a larger move.

The 50 day EMA sits just below the crucial 8000 level as it suggests at least a couple of different reasons to find buyers in that area. All things being equal, it looks as if we are running out of momentum, and by running out of momentum we normally will get some type of pullback as the market simply doesn’t have the force to continue. Ultimately, the market was the breakout above the highs from the week, we could then take off towards the 8400 level, perhaps even the 8500 level above. Looking at the ascending triangle that had previously been broken, the target is likely to be the 8800 level. That doesn’t mean we get there tomorrow but given enough time we will probably continue to rally and try to go to that level eventually. With the Federal Reserve on the sidelines, there will be concerns about monetary policy tightening to weigh upon stocks. Nonetheless, a bit of value hunting on a pullback would make quite a bit of sense and that’s by far my favorite way to play this type of market.