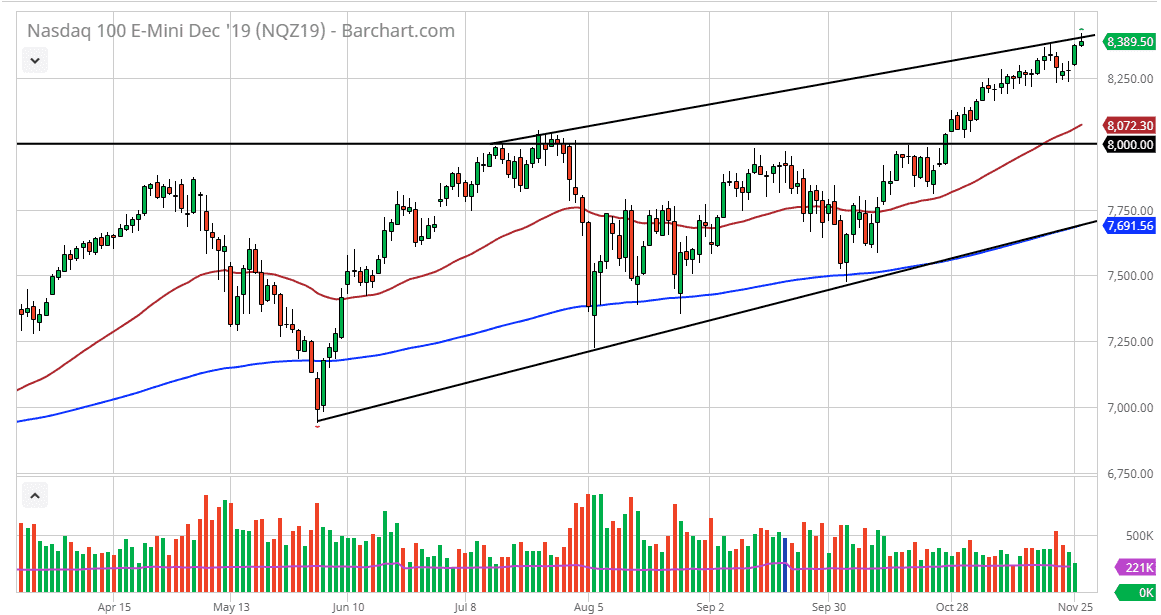

The NASDAQ 100 has rallied a bit during the trading session on Tuesday, piercing the top of the overall uptrend and channel. At this point, the market has pulled back a bit during the trading session as it may have gotten a bit ahead of itself. At this point, I think that the market probably comes down to reach towards the 8250 handle, an area that has been rather supportive. Beyond that, there was a gap higher at the open on Monday, so I think at the very least we need to go down and fill that.

Keep in mind that the Thanksgiving holiday is on Thursday, so as we get further into the week, it’s very likely that we will see a little bit of weakening of stock markets in the United States is volume dries up. At this point, I think that pullback is very constructive, because quite frankly we are far too overextended to continue going higher like this, and therefore it’s likely that what we see next is a bit of value hunting at lower levels. That is your signal to start buying, and it’s very likely that it won’t be able to happen until next week. This is one volume will come back and we could start to get into the “Santa Claus rally” that is quite common.

The 50 day EMA underneath would be a nice place to start buying, and that of course 8000 level. At this point, the market is in an uptrend, and you should keep that in mind. However, momentum is a funny thing, as in it can’t go on forever. At this point it’s likely that we will see plenty of buyers when we drop from here as the central bank in the United States is more than willing to step in and loosen monetary policy to keep asset prices rising. In fact, they have signaled several times recently that the central bank is on hold, and that gives the stock market the wherewithal to continue going higher. Beyond that, we have been in an uptrend for some time, and it’s likely that the buyers will continue to look at this as opportunities to pick up the market “on the cheap” every time it dips. That being said, don’t expect a lot of buying between now and holiday and of course Friday is only a half day, so volume won’t be strong then either.