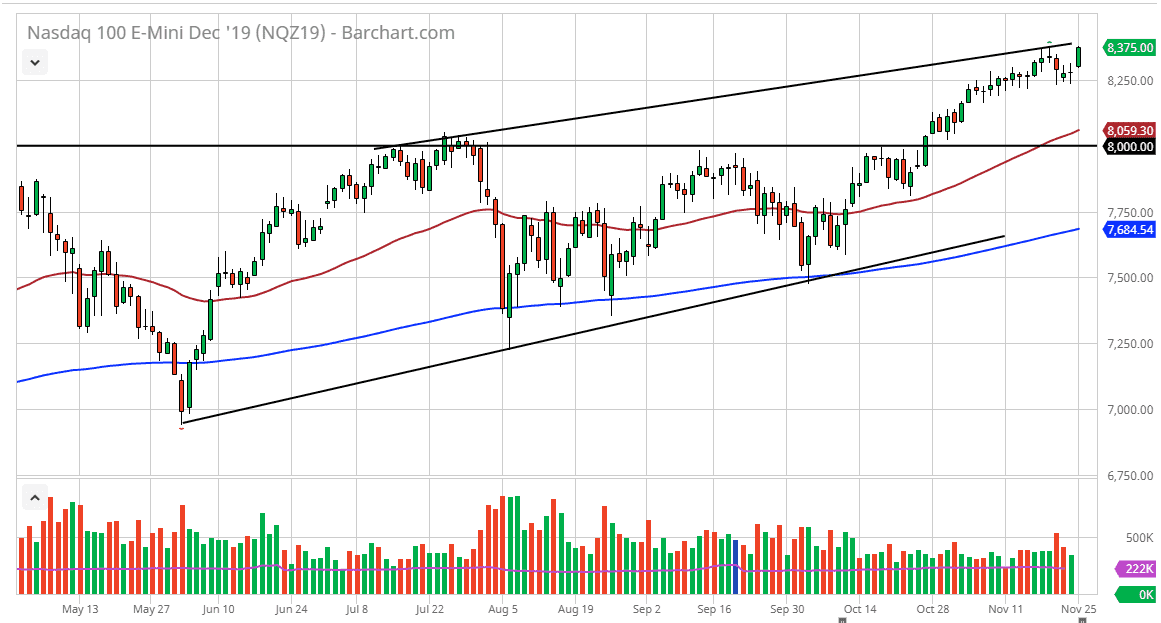

The NASDAQ 100 has gapped at the open on Monday, shooting towards the upside. At this point, the market looks as if it is going to face a little bit of trouble at the 8400 level, and more importantly at the top of the overall uptrend in channel. Because of this, if the market were to break above that level, then it’s likely that the market could continue to go looking toward to the perceived target above.

At this point, I believe that the target above is 8800, although we don’t necessarily need to go there overnight. Looking at the ascending triangle underneath, once we broke above the 8000 resistance barrier, it suggests that the market could go as high as 8800 given enough time, based upon the measurement of that triangle itself. That being said, it doesn’t mean that we have to get there right away, and it could be a longer-term target, something that takes weeks if not months to go to the upside.

Looking at the chart, I think that the 8250 level offer significant support, and if we were to break down below there it’s likely that the market could go down to the 8050 level. A reason I say that is that the 50 day EMA is trading in that general vicinity so I think it’s only a matter of time before people would pay attention to it. All things being equal, I do believe that the market will go higher, but it probably needs to reassert a little bit of momentum, and one of the best ways to do that is to pull back a bit.

This is also a holiday week in the United States so will have a great influence on what happens next, as Thursday is Thanksgiving Day. This means that the markets will probably only trade with any type of volume on Monday and Tuesday, and then things will drop off the face of the year this far as volume is concerned. The E-mini S&P 500 contract will be trading later in the week, but quite frankly this is a market that should probably be avoided later in the week. I do like the idea of buying pullbacks, and we may get one later this week as volume dries up. That being said, I don’t have any interest in shorting this market, so if it breaks down, I will simply wait for signs of a bounce or support in order to take advantage of value.