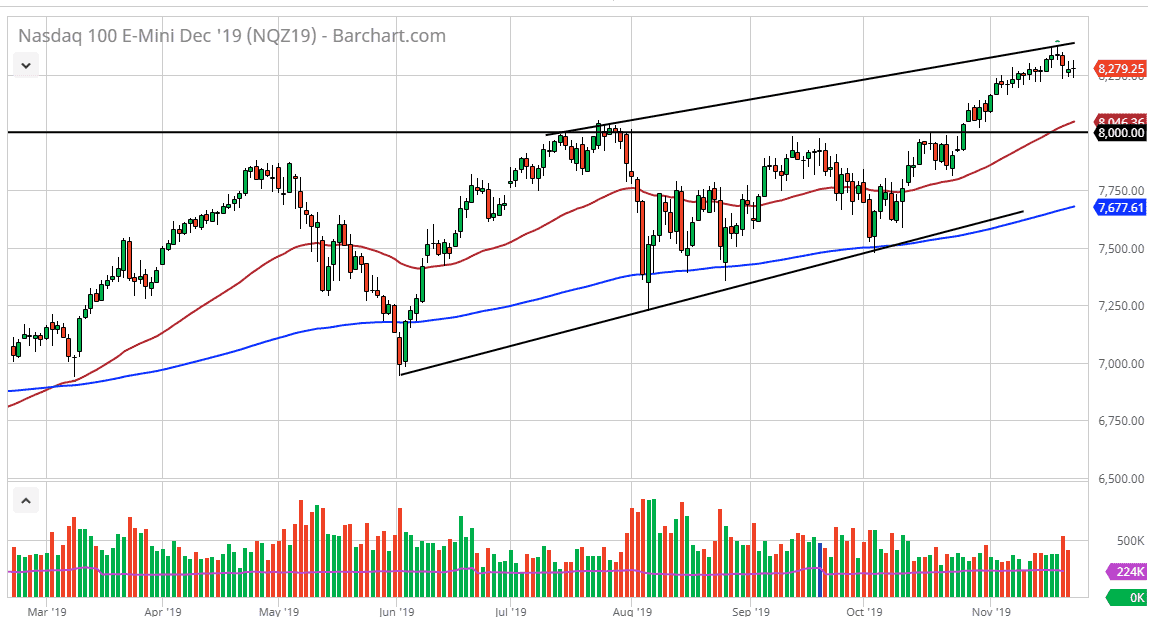

The NASDAQ 100 went back and forth during the course of the session on Friday, as we are trying to figure out where to go next. Ultimately, this is a market that is a bit overextended so it will do one of two things: it will either go sideways or kill time in order to build up enough momentum to go higher. Otherwise, if the market pulls back, that will also be a nice buying opportunity. The 50 day EMA underneath should continue to offer support, as it has broken above the 8000 handle, showing improved bullish pressure. The ascending triangle underneath should dictate that we go to the 8800 level, but that’s a longer-term call, not something that we need to do see in the next few days.

Looking at pullbacks, it’s very likely to attract a lot of attention and it’s very likely that people will be looking for value underneath, as the NASDAQ 100 is obviously very bullish. That being the case, the market is likely to have plenty of traders willing to jump in and take advantage of any signs of weakness that show up. I do think that eventually we go much higher, perhaps fulfilling that 8800 target, but it’s going to take serious time to get there. With that, it’s going to be very likely to be thrown around by earnings season and of course the US/China trade situation. That nonsense continues to be a major thorn in the side of traders, as politicians play games with each other via headlines.

That being said, the market should eventually break to the upside and I think that the 8000 level underneath is essentially the “floor” in the market. At this point, the market is likely to see a lot of buyers in that area as it would be an obvious value play, offering an opportunity to pick up bits of value in a cheap market. All things being equal, I don’t not expect this market to break down significantly, and now it’s only a matter of time before we get a continuation of the overall buying pressure. Remember that this market is highly sensitive to the US/China trade situation, as technology stocks and companies tend to deal with both economies. With that, it remains erratic but one thing that we have seen of the last decade is that stock markets in America only go up as long as the Federal Reserve is willing to get involved.