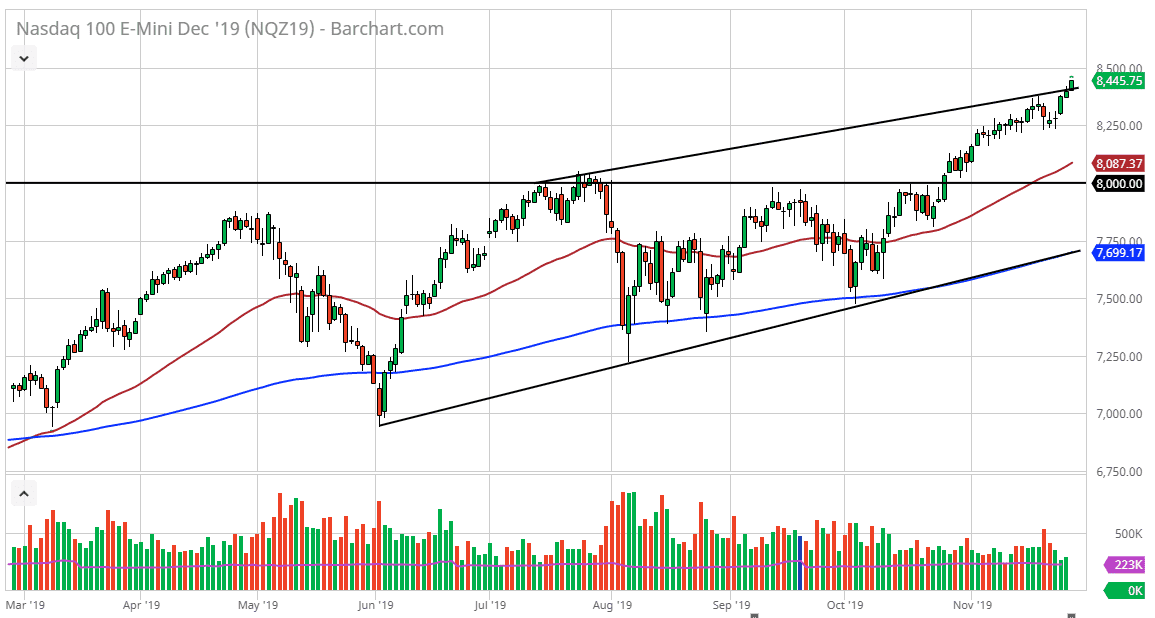

The NASDAQ 100 is taken off during the trading session on Wednesday, breaking above the top of the channel that we had been in. Because of this, it looks as if we are about to get a bit of an impulsive move, something that isn’t exactly that rare this time of year as there is even a name for it: “Santa Claus rally.”

At this point it’s very likely that the market will continue to go much higher in short-term pullbacks will continue to be thought of as buying opportunities. After all, this is a market that has plenty of momentum underneath that and has had plenty of reasons to pullback but yet has failed to. The 8250 level should be massive support, extending to at least the 8200 level. If we were to break down below there, then it’s likely that the 50 day EMA which is pictured in red on the chart should come into play in order to support the market.

The next target will be the 8500 level, and then possibly even the 8800 level which is the measured move based upon the ascending triangle that had formed previously when we broke out of the 8000 handle. Quite frankly, this is a market that looks like it is ready to go right along with everything else in more of a “risk on” attitude, as money managers and CTAs are looking to make better returns to report to their clients at the end of the year. With that being the case, I believe that every time we pull back you should be looking for buying opportunities on signs of support. A bounce is to be bought, just as a breakout to the upside in the top of the range for the Wednesday session will be. Keep in mind that the Thursday session will be Thanksgiving Day, and even though there will be electronic trading for the futures market, the underlying index will be closed. The Friday session will only be half a session, so that of course will be pretty thin when it comes the volume as well. With that being the case, it’s very likely that we will see Monday as a very important session, which could determine whether or not we really take off to the upside if we have to pull back in order to build up the necessary momentum.