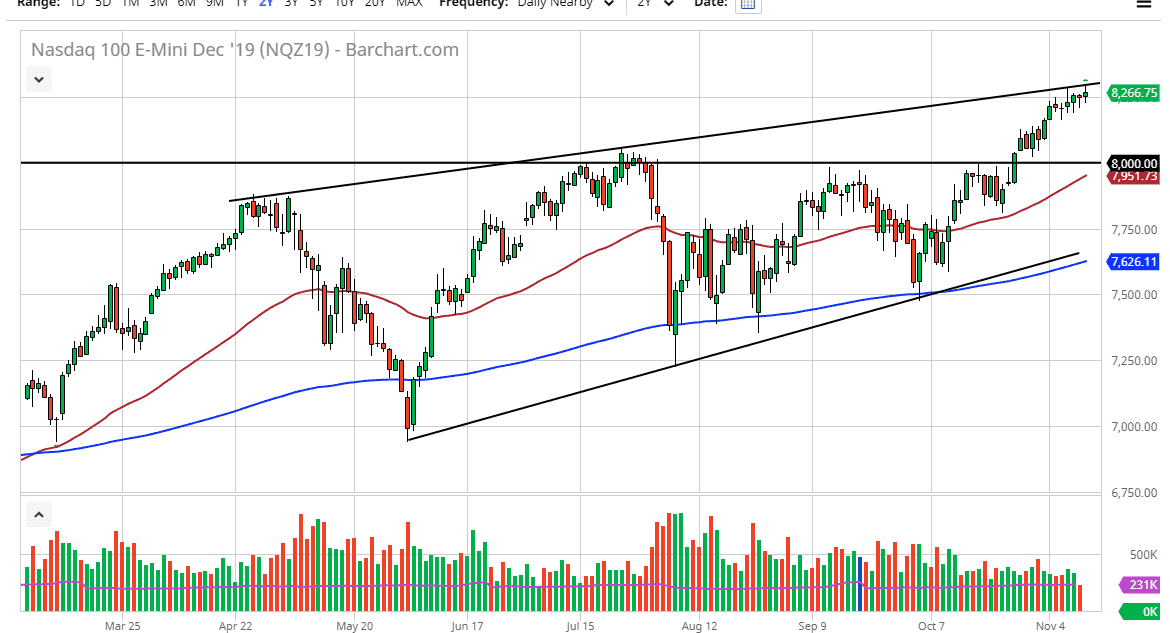

The NASDAQ 100 went back and forth during the trading session on Tuesday, showing signs of volatility yet again. Initially, we ended up breaking towards the top of the overall channel but gave back quite a bit of the gains as we have turned around to show signs of exhaustion. At this point, the market looks likely to continue going to the upside, but I think in the meantime we need to find some type of catalyst to continue to go higher. At this point, I think it’s very likely that the market will pull back to try to find a bit of value in the meantime in order to pick up a bit of momentum.

Looking at this chart, I believe that the absolute “floor” is closer to the 8000 handle. Beyond that, the 50 day EMA sits just below there and is starting to turn higher. I think it’s only a matter of time before the market finds that area as value that it needs to take advantage of, if we can even get down to that area. We are in an uptrend regardless, so I have no interest in shorting this market, even though the session was a bit lackluster due to Donald Trump suggesting that he is more than willing to continue adding tariffs to the Chinese if we don’t see some type of deal struck.

Looking at this chart, I like picking up value going forward, but I also recognize that if we break above the high from the trading session on Tuesday, then the market could continue to go higher. All things being equal, the market should continue to reach towards the 8500 level, possibly even the 8800 level after that. Based upon the ascending triangle underneath, the market was looking very likely to go to the 8800 level, and quite frankly there’s nothing on this chart to suggest that it wasn’t going to happen. I have no interest in shorting, I simply look at selloffs as an opportunity to pick up the market and take advantage of value. The market has gotten a little bit ahead of itself, so a pullback makes plenty of sense. In the environment that we are in, it makes sense that we may see some type of drift lower, but I will be looking to pick it up, not try to get cute and short it.