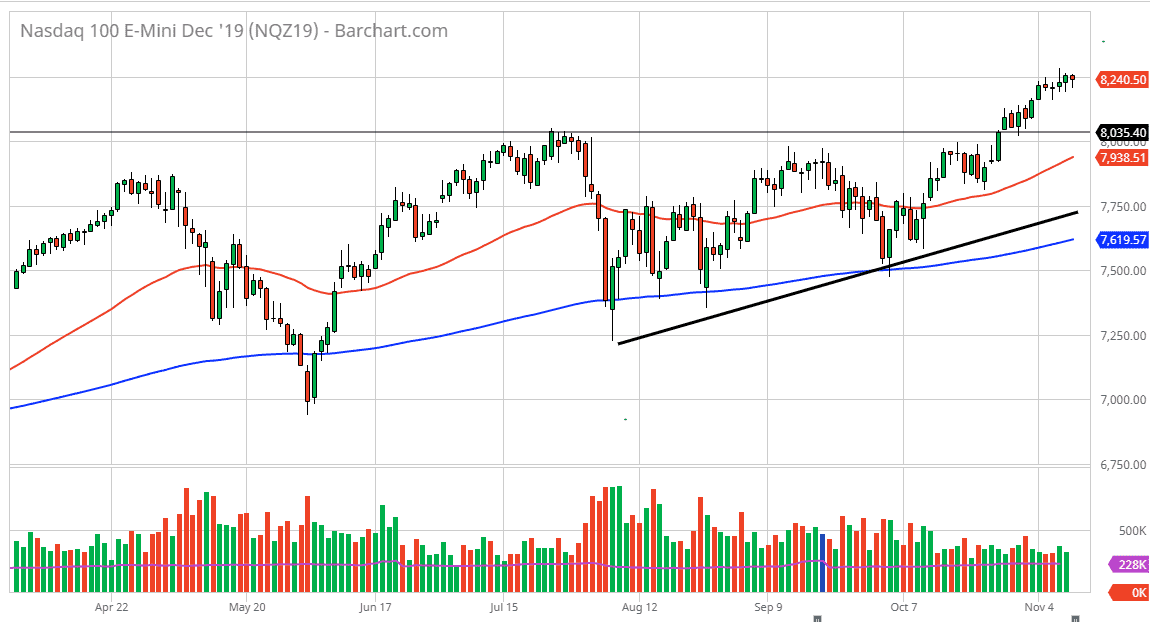

The NASDAQ 100 has pulled back a bit during the trading session on Monday but found enough support underneath the turn around and broke higher. The 8250 level is an area that has caused a bit of psychological resistance, and we have recently seen a significant amount of bullish pressure in general, and as we have pulled back a little bit occasionally, only to find buyers looking for value. Ultimately, this is a market that continues to grind higher based upon the fact that a lot of traders are simply coming to the conclusion that “there is no alternative” as the bond markets or not offering much in the way of yield.

This is a market that’s going to be highly sensitive to the US/China trade situation to keep that in mind. The 8035 level underneath was the previous resistance that now offers a bit of a “floor” in the market, so it’s likely that the buyers will show up in that general vicinity in order to support the market. Beyond that, the 50 day EMA is starting to reach towards that area, so that will be yet another reason to think that the buyers will show up somewhere in that general vicinity.

To the upside, if we were to break above 8250 level, then the market is very likely to go looking towards the 8300 level rather quickly. When you look at the chart, you can see that the ascending triangle that got broken out of is rather large, suggesting that we could go as high as roughly 8800 over the longer term. That doesn’t mean that we are going to see it in the short term or anytime soon, but the reality is that the market will have the occasional pullback between now and then. Those should be thought of as buying opportunities, as this market has been extraordinarily bullish, but obviously very volatile as the NASDAQ 100 has a high sensitivity to the US/China trade situation. The market will continue to go up and down based upon trade war expectations, which are all over the place. In general, this is a market that should continue to see value hunters come back in, perhaps due to the fact that the Federal Reserve is seen as being on the sidelines but willing to step in if things get out of control. The trend is up, so at this point there’s no reason to argue with it.