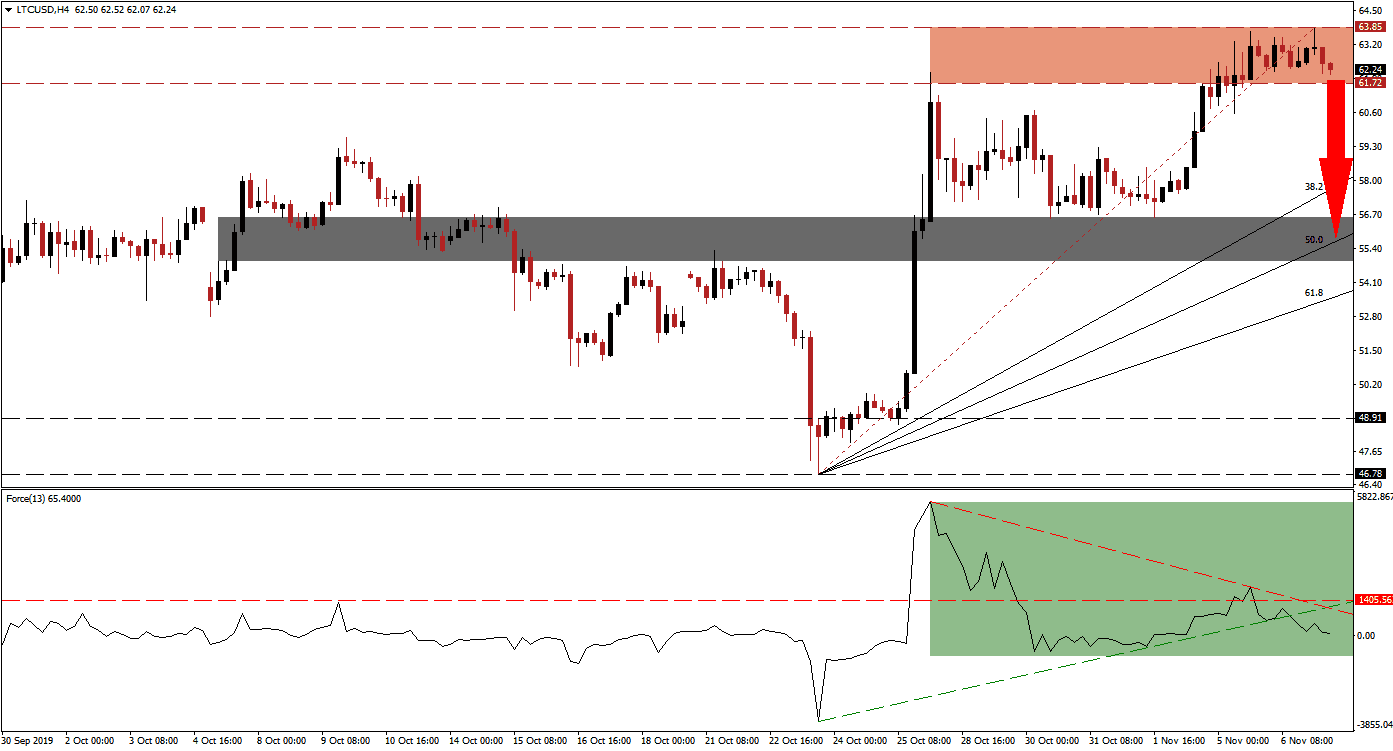

After Bitcoin struggled to maintain its uptrend, Litecoin kept pushing higher which took this cryptocurrency into its resistance zone from where bearish forces prevailed and halted the advance. LTC/USD rallied over over 35% from its intra-day low and a pause following such a move is normal. A fundamental catalyst, the listing of LTC/BNB on the Binance DEX, kept the advance in LTC/USD going longer than most of its peers and the second advance off of its short-term support zone led to a gap between price action and its Fibonacci Retracement Fan. A short-term corrective phase is expected to close the gap from where more upside is possible. You can read more about the Fibonacci Retracement Fan here.

The Force Index, a next generation technical indicator, indicates the collapse in bullish momentum as price action has pushed to a higher; a negative divergence formed as a result which suggests that a correction should be expected. The Force Index completed a breakdown below its horizontal support level, turned it into resistance and was then reversed by its ascending support level. Upside was limited to its descending resistance level and this technical indicator has now moved below its ascending support level as marked by the green rectangle. This represents another bearish development and more downside is expected in the Force Index, a move into negative territory will place bears in charge of the LTC/USD.

Bearish momentum is expanding inside the resistance zone which is located between 61.72 and 63.85 as marked by the red rectangle; a breakdown is expected to initiate a corrective phase partially fueled by a profit-taking sell-off. Forex traders should monitor the intra-day low of 60.57 which marks the low of the previous move below its resistance zone which was reversed to a higher high. Adding to breakdown pressures is the move in the LTC/USD below its Fibonacci Retracement Fan trendline and the next corrective phase in this cryptocurrency pair will determine if another breakdown will materialize or of the long-term uptrend will remain intact. You can learn more about a breakdown here.

Long-term fundamental factors favor an increase in the LTC/USD, but short-term conditions point towards a short-term reversal. Following the initial push into its resistance zone, price action reversed into its short-term support zone, converted from a resistance zone as a result of the strong rally, before accelerating to a higher high. This conformed the dominance of an uptrend, the short-term support zone is located between 54.92 and 56.61 as marked by the grey rectangle. Enforcing this zone is the 50.0 Fibonacci Retracement Fan Support Level which is passing through it.

LTC/USD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 62.25

⦁ Take Profit @ 55.50

⦁ Stop Loss @ 64.00

⦁ Downside Potential: 675 pips

⦁ Upside Risk: 175 pips

⦁ Risk/Reward Ratio: 3.86

A triple breakout in the Force Index, above its descending resistance level, its ascending support level and its horizontal resistance level, is likely to result in a breakout in the LTC/USD above its resistance zone. The next resistance zone awaits price action between 72.65 and 75.91; this would also close a previous price gap to the downside. This cryptocurrency pair may also challenge its intra-day high of 79.79 if bullish momentum is strong enough.

LTC/USD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 66.25

⦁ Take Profit @ 72.75

⦁ Stop Loss @ 64.00

⦁ Upside Potential: 650 pips

⦁ Downside Risk: 225 pips

⦁ Risk/Reward Ratio: 2.88