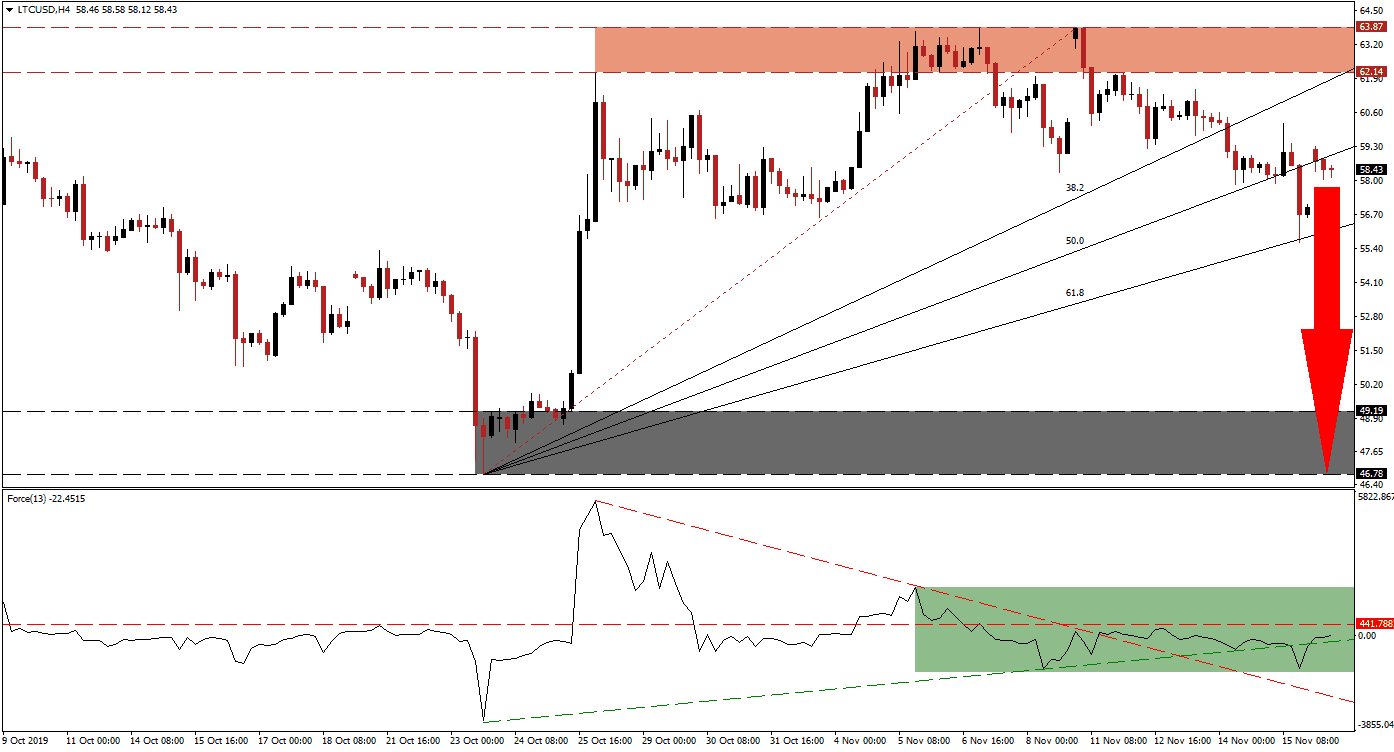

Over the weekend, the cryptocurrency market was faced with record low volume for 2019, led once again by Bitcoin which continues to pressure the entire sector to the downside. Litecoin remained a holdout and was able to keep its bullish bias, but eventually crippled under downside pressure. The LTC/USD completed a breakdown below its resistance zone, but the sell-off paused after price action reached its 61.8 Fibonacci Retracement Fan Support Level which led to a price gap to the upside. Bearish pressures are once again mounting and this cryptocurrency pair is likely to be pressured into a breakdown below its 61.8 Fibonacci Retracement Fan Support Level.

The Force Index, a next-generation technical indicator, has entered a sideways trend after an advance was rejected by its descending resistance level. This led to a breakdown below the horizontal support level and turned it into resistance and the Force Index moved into negative territory, suggesting bears are in charge of price action. The sideways trend allowed this technical indicator to move above its descending resistance level and following a brief drop it also eclipsed its ascending support level as marked by the green rectangle. A move to the downside is expected to follow and lead LTC/USD to a new breakdown. You can learn more about the Force Index here.

An early warning sign that a corrective phase is forming emerged after the LTC/USD completed its first breakdown below its resistance zone, which was reversed with a price gap to the upside. This was followed by a second breakdown below its resistance zone, located between 62.14 and 63.87 as marked by the red rectangle, which was accompanied by a rise in bearish momentum. The loss in volume has now increased the risk of more volatility and breakdown pressures increased further as the 38.2 Fibonacci Retracement Fan Resistance Level crossed into its resistance zone.

Traders should now monitor the Force Index together with the intra-day low of 56.61, this level represents the last instance when the LTC/USD reversed higher off of its Fibonacci Retracement Fan trendline. A move below this level may additionally lead to a profit-taking sell-off which will take price action below its 61.8 Fibonacci Retracement Fan Support Level and clear the path to the downside. The next support zone awaits this cryptocurrency pair between 46.78 and 49.19 as marked by the grey rectangle. You can learn more about a support zone here.

LTC/USD Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 58.50

⦁ Take Profit @ 46.80

⦁ Stop Loss @ 62.00

⦁ Downside Potential: 1,170 pips

⦁ Upside Risk: 350 pips

⦁ Risk/Reward Ratio: 3.34

A sustained breakout in the Force Index above its horizontal resistance level, assisted by its ascending support level, could pressure the LTC/USD back into its resistance zone. A breakout above this zone would require a fresh fundamental catalyst as the current scenario suggests more downside. The next resistance zone is located between 68.70 and 70.73 which includes another price gap.

LTC/USD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 64.00

⦁ Take Profit @ 70.00

⦁ Stop Loss @ 61.50

⦁ Upside Potential: 600 pips

⦁ Downside Risk: 250 pips

⦁ Risk/Reward Ratio: 2.40