The decline of the US dollar and weaker investor risk appetite pushed the price of gold to return to gains at the $1464 resistance after trying to drop at the beginning of this week's trading session to the $1456 support. US President Trump tweeted on Monday that his meeting with Fed Governor Powell was "very good and friendly." He added that they discussed "interest rates, negative interest rates, low inflation, easing, the strength of the dollar and its impact on manufacturing, trade with China, and other important issues. The Fed said Treasury Secretary Stephen Mnuchin also attended the meeting.

The U.S. president is trying to pressure the Federal Reserve led by Jerome Powell to further cut US interest rates like other global central banks, which eased monetary policy throughout 2019 to counter the aftermath of the trade war between the world's two largest economies that threatens to slow global economic growth.

Trump has often complained that negative interest rates, set by the European Central Bank and the Japanese central bank, have left the United States, with higher interest rates, and in a competitive disadvantage. The US interest rate now ranges from 1.5% to 1.75%, a very low level by historical standards, especially as the US unemployment rate is approaching a 50-year low at 3.6%.

For economic news. The NAHB index fell to a reading of 70 in November after rising to 71 in October. Economists had expected the index to remain unchanged. The modest decline came after the housing market index rose for four consecutive months to its highest level since a similar reading in February 2018.

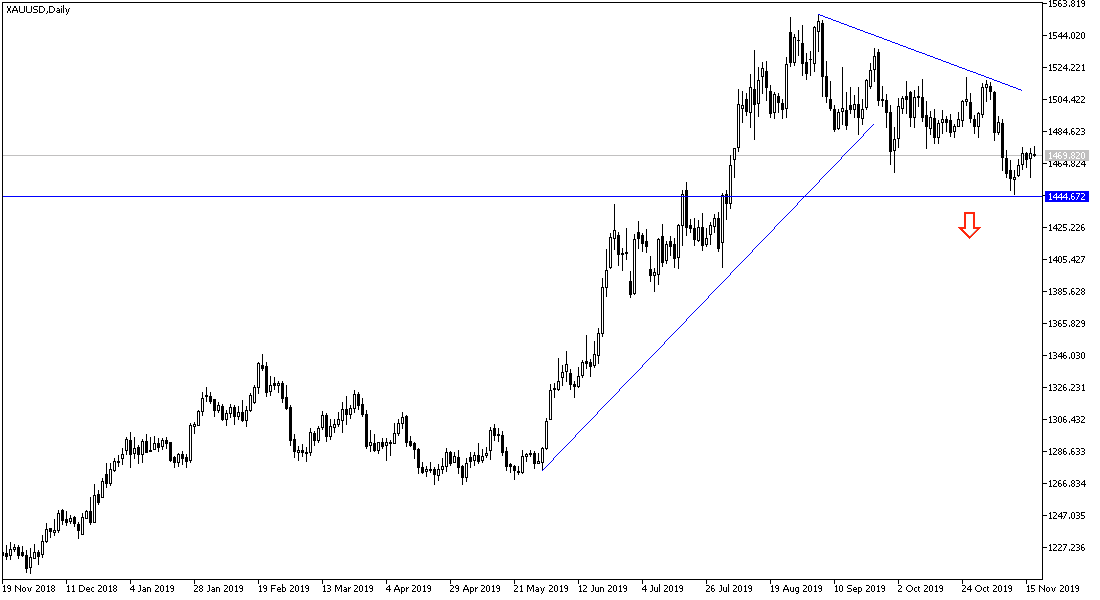

According to the technical analysis of gold: We are still waiting a move towards the $1500 psychological resistance to confirm the return of the uptrend strength of gold again. This may happen as global trade and geopolitical tensions re-emerge. On the downside, the price of gold remains stable around the correction levels, according to the performance on the daily chart below. The ideal support levels from where to buy gold currently would be 1452 and 1440 respectively.

Gold will react to the US dollar level after the release of US housing data.