The yellow metal is still under downward pressure due to increased investors’ risk appetite and gains in global stock markets due to investors' optimism that a trade agreement between the United States and China will be signed soon. The gold prices suffered losses in early trading this week, falling to the $1448 support before settling around $1453 at the time of writing. Despite the uncertainty surrounding trade negotiations between China and the United States, traders continue to bet on stocks amid hopes that the world's two largest economies will soon reach an agreement.

The dollar also fell, but the yellow metal is still struggling to climb. The dollar index fell to 98.13. US President Donald Trump is due to speak at the Economic Club in New York on Tuesday and the testimony of Federal Reserve Chairman Jerome Powell before the Joint Economic Committee of Congress will be on Wednesday. Yesterday bond markets were closed to celebrate Veterans Day. Most investors expect the Fed to keep interest rates unchanged now after cutting them three times since the summer.

Later this week, the US Department of Labor will also provide updates on consumer and wholesale inflation. On Friday, economists expect a government report to show that retail sales returned to growth in October. This may indicate that strong consumer spending helps offset weak manufacturing due to the global trade war.

The earnings season is near completion, with nearly 90% of S&P500 companies reporting earnings for the July-September quarter, with the results partially weak due to the global economic slowdown.

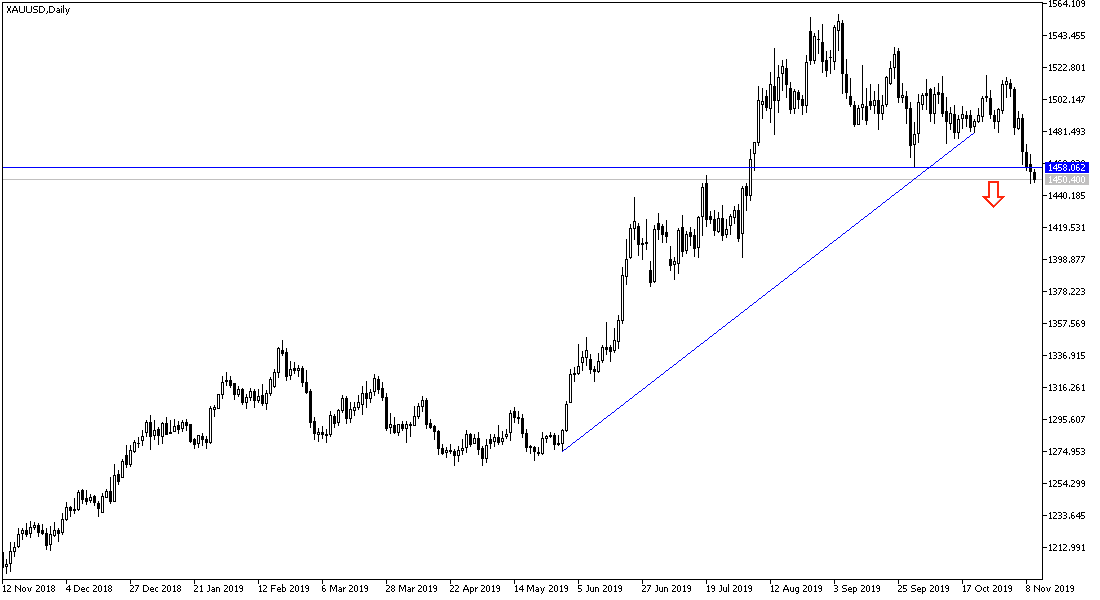

According to the technical analysis of gold: As long as gold prices are below the $1500 psychological resistance and above the $1480 support, it will remain under downward pressure and the price may move down towards the $1440 support or slightly higher before starting to rebound higher. If the two sides of the World Trade War announce the date and details of their agreement in the coming hours, we may see a stronger fall in prices to $1425. In contrast, the idea of abandoning the deal, which is currently excluded by the markets, means a new momentum for the price of gold to go up.

As for the economic calendar data today: From Britain, the average wage, employment change and unemployment rate data will be announced. From the euro zone, ZEW German economic sentiment index data will be released. There are no significant US data for the second consecutive day.