Investor risk aversion has increased with the expected length of time for the signing of a trade agreement between the United States and China and the reaction on an important political debate between British Prime Minister Boris Johnson and the opposition parties. The return of safe haven buying has contributed to gold's gains to the $1476 level at the time of writing. More momentum could push the yellow metal towards the $1500 psychological resistance again.

It is reported that US President Trump summoned Federal Reserve Chairman Powell to the White House on Monday. The USD retreated after the meeting, as each side remained firm on their positions. It is clear that Trump wants a further rate cut, and in return the Fed sees tariff warfare and other global trade disputes as a strong reason for the recent weak economic performance. The US central bank relies on monitoring the results of US economic data to make the appropriate decision for its monetary policy. Jerome Powell strongly maintains the independence of the Bank's decisions without any pressure, which is welcomed by both Democrats and Republicans.

According to economic news. The US Commerce Department announced that housing starts reached a seasonally adjusted annual rate of 1.31 million. Housing starts for single-family homes rose by 2%, largely due to construction in the west and south. Residential building construction rose 6.8% from the previous month. Low mortgage rates and a strong labor market have helped the housing market in recent months, however, housing starts are still falling 0.6% year on year due to land shortages and high construction costs. Affordability is a problem for potential buyers because the increase in house prices has outpaced wage growth.

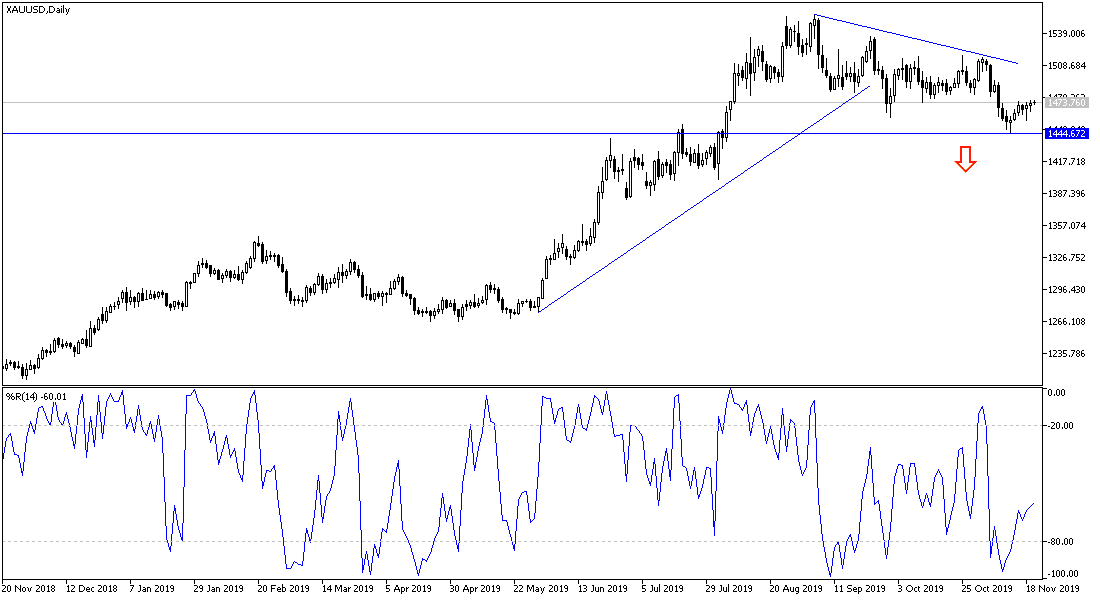

From the technical perspective of gold: Until now, gold is preparing for an upward correction, and at the same time, still need to move towards the $1485 resistance and the $1500 psychological resistance to make this attempt a success. Technical indicators are preparing for a change of direction after it was bearish before the middle of this month, which pushed the price towards the $1446 support, the lowest for more than three months. On the downside, the currently stronger support is located at $1460, and approaching it ends the current correction expectations. Renewed global trade and geopolitical tensions will continue to favor gold's gains.

As for the economic calendar data today: All focus will be on the content of the minutes of the last meeting of the US Federal Reserve.