The US dollar returned to rise after better results from the US jobs report, and increased investor risk appetite with reassuring remarks from both sides of the global trade war that the deal was near. This helped the price of gold to fall to $1502 an ounce at the time of writing, and abandoned $1515 resistance, where it tried to stable above for three trading sessions in a row. Last week's data showing continued contraction in US manufacturing activity helped cap losses with support at $1500.

Unexpectedly strong US jobs data helped boost investor appetite for riskier assets, but was offset by weaker manufacturing activity in the US for the third consecutive month in October, supporting business sentiment remaining cautious. US manufacturers continue to suffer from weak demand and weak exports amid a continuing trade dispute with China. In addition, the German manufacturing sector remained stuck in the recession in October, although the final reading was slightly better than the preliminary estimate released last month.

After the US jobs report, market expectations that the Fed will accelerate the pace of US rate cuts in the future, weakened. This year, the bank cut interest rates three times by a quarter of a point at a time, and the rate now stands at 1.75 percent. At the same time, the bank is still facing sharp and persistent criticism from US President Trump, who wants a deeper rate cut and has sometimes called for negative interest rates, as other global central banks have recently done to counter the aftermath of the global trade war.

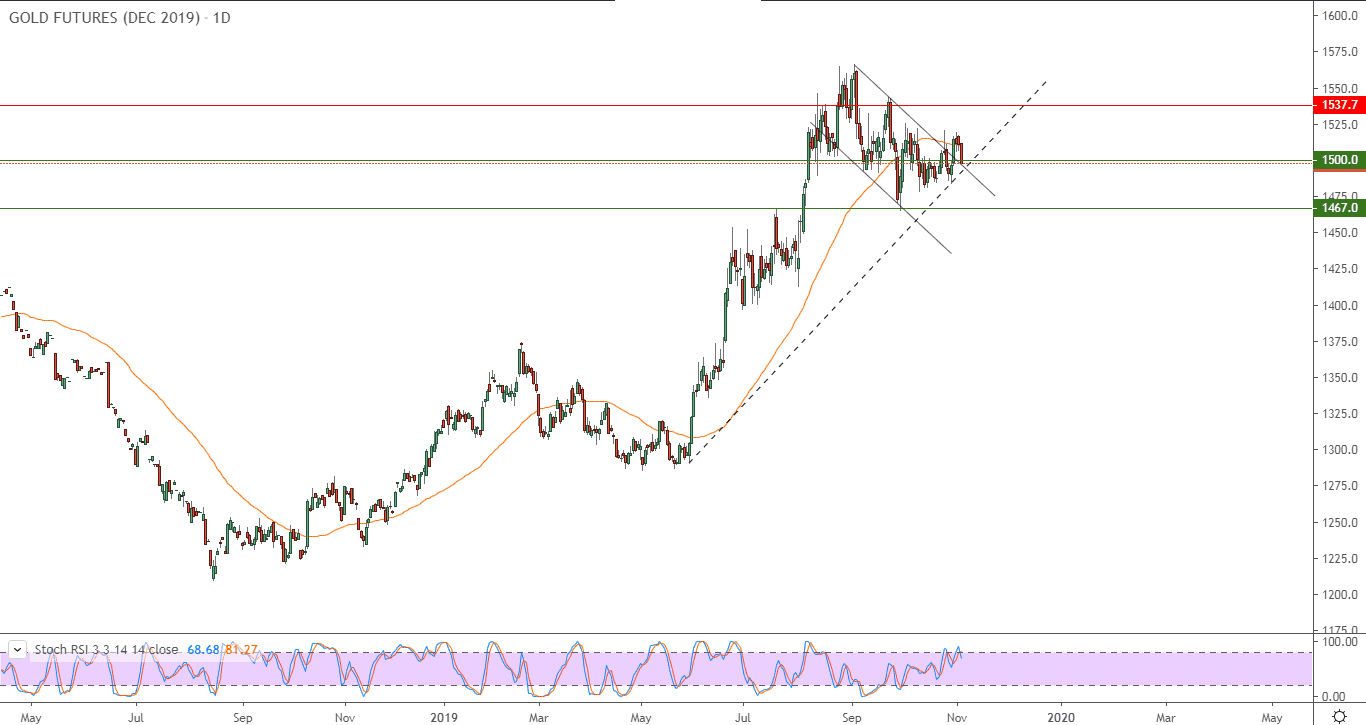

According to the technical analysis of gold: According to our previous expectations, the $1500 psychological resistance remains a catalyst for the uptrend strength, and the stability above it will support the move towards higher resistance levels at 1515, 1527 and 1540 respectively. Renewed global trade and geopolitical tensions, coupled with a weak US dollar, supports gold as one of the most important safe havens for investors in times of uncertainty. On the downside, the nearest gold support levels are currently at 1503, 1495 and 1480 respectively. The latter level is a strong threat to the current bullish outlook.

As for the economic calendar data today: Gold will react to the release of the Australian Interest Rate, the British Services PMI, the US Trade Balance, the ISM Non-Manufacturing PMI and JOLTS report data.