Gold prices fell to $1450, the lowest level in two weeks during Tuesday's trading session and then rebounded to $1460 at the time of writing, and before the announcement of a package of important US economic data affecting the trends of the US dollar, which contributed to the pressure on gold prices recently. Investors' risk appetite, which is negative for gold, has increased amid optimism that the US-China trade deal is near. Markets lack the exact date for the formal signing of the first phase agreement between the two largest economies in the world.

In the same context. The two sides discussed "resolving issues related to each other's core concerns, reached consensus on properly resolving related issues and agreed to maintain communication on the remaining issues in consultations on the first phase agreement," Xinhua news agency said, but this was not confirmed immediately by the American side. This came after US stocks on Wall Street hit new record highs after Beijing announced new guidelines for patent and copyright protection. As is well known, intellectual property rights are one of the most important reasons that contributed to the global trade war.

Yesterday, China's Ministry of Commerce announced that senior trade negotiators from China and the United States had agreed to hold talks on a preliminary agreement to resolve the tariff war between the world's two largest economies.

At the economic level. US consumer confidence fell for the fourth consecutive month, but with limited percentage, and overall confidence remains at record highs despite the trade war with China. The US housing market remains strong and has not been much affected by the conflict. US new home sales fell slightly in October compared to September, but remained well above last year's levels, as mortgage rates fell, helping to boost buying.

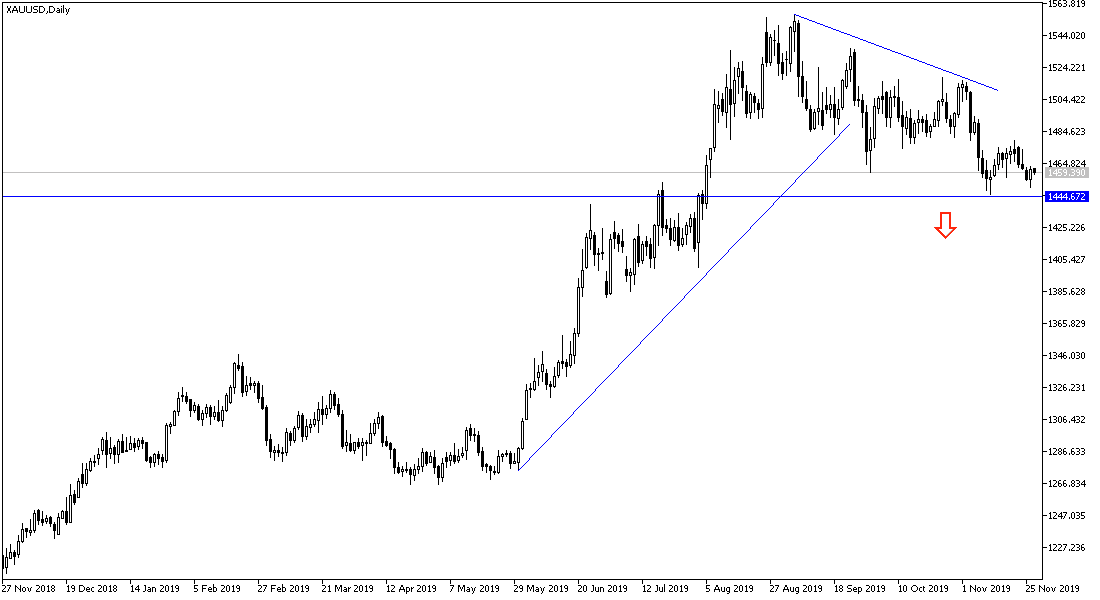

According to the technical analysis of gold: Gold prices are still under downward pressure as long as the dollar is strong, and investors risk appetite is high. The downward correction is facing the support level from the breakout forces, which will support further selling, and thus test stronger support levels. We wait for the support to break $1445 an ounce. If geopolitical and economic concerns around the world renewed, gold may jump, as a first stage, to the resistance levels at 1467, 1480 and 1495 respectively. We still prefer to buy gold from every bearish level.

As for the economic calendar data today: The biggest attention will be on the US session data, where durable goods orders, GDP growth rate, jobless claims, Chicago PMI, and the Federal Reserve's preferred inflation gauge, the CPI, will be announced. Then the average income and expenditure for the American citizen. Finally, pending home sales and US oil inventories data will be released.