The strength of the US dollar, the return of risk appetite and the abandonment of safe havens put pressure on the price of gold, which fell to $1451 support before settling around $1457 at the time of writing. Optimism remains the dominant position on the future of the US-China trade agreement, despite mixed reports from several sources on the future of this. The price of gold shone when tension increased amid the trade war between the United States and China. In recent months, tensions between the United States and China have slowly subsided and the two sides have exchanged positive messages. However, no agreement has been reached between them so far. Investors are now waiting for a meeting next month between the two leaders to determine whether trade tension will continue to ease.

At the economic level. The German IFO survey for November increased expectations that the world's fourth largest economy is beginning to stabilize. Overall investor valuation rose to 95.0 from a revised 94.7 (from 94.6) in October. It has not dropped since August, and the expectations index rose to 92.1 from 91.6 (adjusted from 91.5). This was the second consecutive month of improvement, something we have not seen since 2017. However, the assessment of current conditions remains at rock bottom. It stands at 97.9, after hitting an August low of 97.4.

In contrast, Moody's lowered the expectations of German banks from stable to negative. They warned that profitability and overall creditworthiness are likely to weaken further in the next 12-18 months. These concerns were also shared by Moody's. The ECB has identified weak bank profitability as one of the biggest threats to EMU growth. Moody's realized that a weak business outlook had an indirect impact on many key industries, including automobiles and spare parts. On the same day, the Moody's report warned the German central bank, that credit risk was undervalued.

On the US side. President Trump has an important decision to make this week. Will he sign Hong Kong bills unanimously passed by Congress? Or not ?

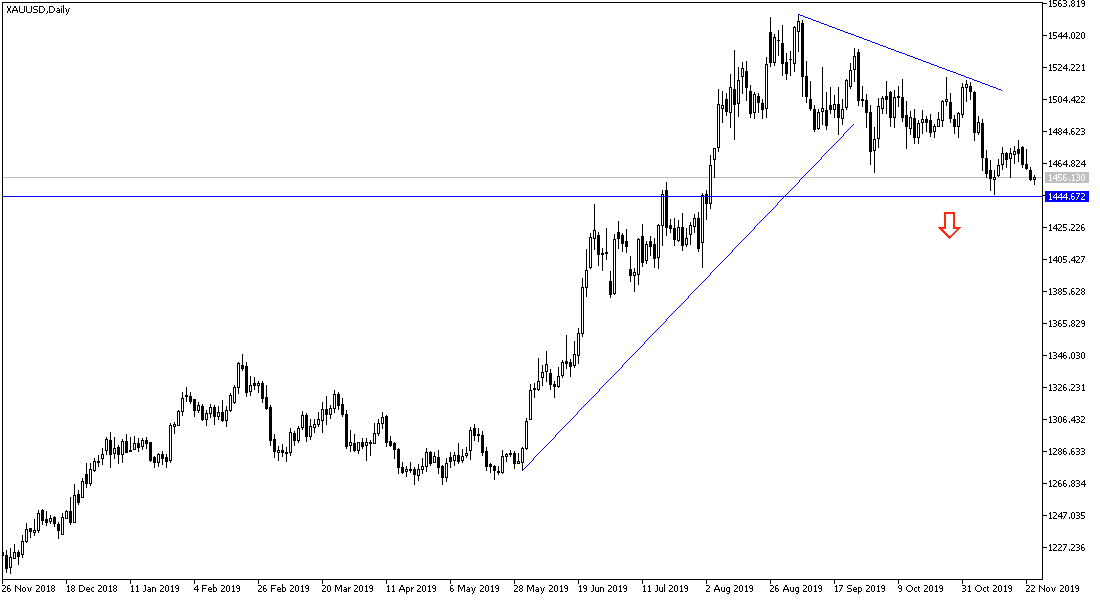

According to the technical analysis of gold: Undoubtedly the price of gold is heading towards the important 1445 support, the lowest level in three months, from the current price, and from this support, buying can be for the goals of a return to the vicinity of the 1475 and 1483 resistance, if the price went back there, the path will be clear towards the $1500 psychological resistance, will ill support the uptrend. A break of 1445 support means more selling. Renewed global trade and geopolitical tensions will be a catalyst for bulls to kick off the price of the yellow metal again, the ideal safe haven for investors in times of uncertainty.

As for the economic calendar today: From the Eurozone, the German GFK consumer climate will be announced. From the US, consumer confidence, new US home sales and commodity trade balance data will be released.