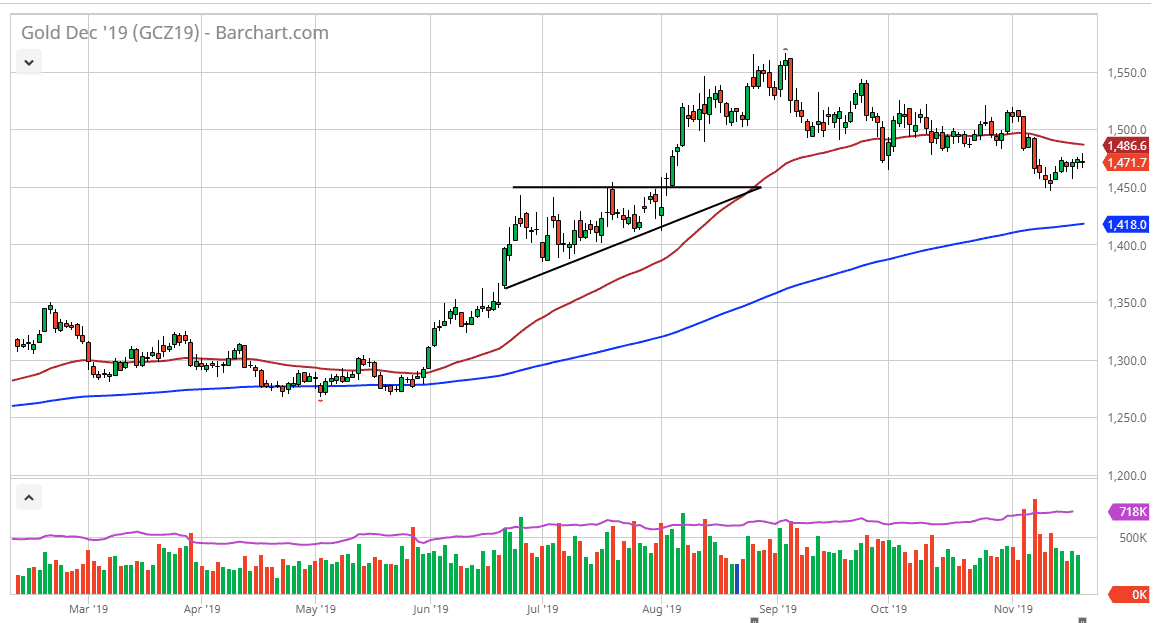

Gold markets went back and forth during trading on Wednesday as we continue to see a lot of confusion in the markets. At this point, it looks as if the $1450 level continues offer massive support as we have bounced from there, and at this point the market looks likely to continue respecting the level as it was the previous resistance barrier from the ascending triangle that formed several months ago, and of course it offers an area where the buyers would be interested in going long, based upon market dynamics.

Keep in mind that the market is going to continue to react to headlines in general, as this market is quite often use as a safety play, and as a result it makes sense that gold should continue to have a bit of momentum going forward, but it should also be noted that there is a significant amount of technical resistance just above, at the 50 day EMA and of course the $1500 level. If we can break above the $1500 level it’s likely that we will continue to go higher, perhaps reaching towards the $1550 level.

That being said, if the $1450 level underneath gets broken, then it’s likely that the $1418 level would be tested as it is the scene of the 200 day EMA. Overall, this is a market that is going back and forth and trying to build up enough momentum, but there are so many moving pieces right now the trader simply don’t know what to do. With that being the case, I like the idea of buying gold rather than selling it, but I need to see some type of forward momentum in order to get long. That being said, algorithmic traders have been thrown all over the market during the last couple of days, as we keep getting conflicting comments coming out of both the United States and China as far as the path forward.

At this point, I believe that the market will continue to go higher, but it isn’t necessarily going to be easy. This is probably a better trade for longer-term traders who can pick up little bits and pieces as they go along. That being said, if we were to break down below the 200 day EMA, then the market probably unwinds quite drastically. Overall though, I like the idea of buying gold more than selling it, but again, I need to see momentum.