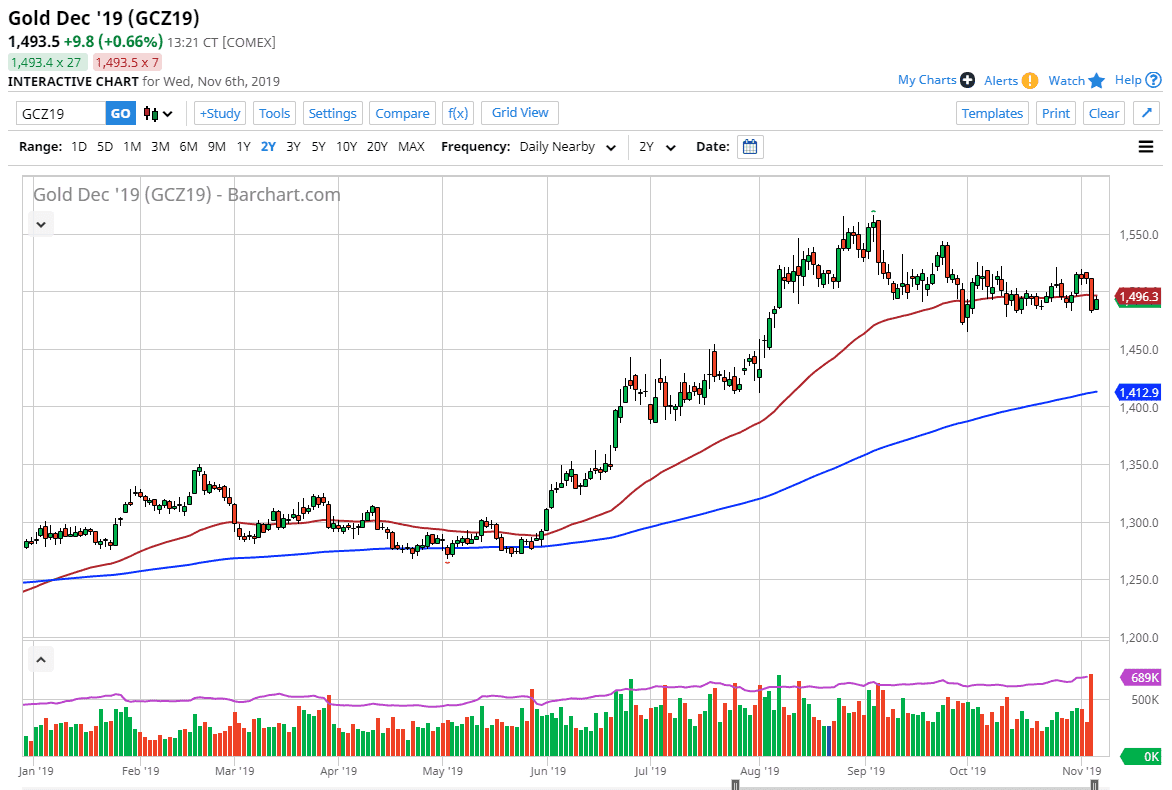

Gold markets rallied a bit during the trading session on Wednesday, as we continue to see mass chaos in the financial markets. At this point, it looks like the market will continue to consolidate in general, as we have seen it bounce from the bottom of the most recent range. It’s likely that the market will continue to go back and forth around the 50 day EMA, at least until we can decide what to do next. The overall uptrend still exists, but it most certainly has been threatened as of late. If we were to break above the highs from a couple of days ago, that would change everything, and we would go much further to the upside. For what it’s worth, silver looks as if it is ready to take out to the upside as well, so I think that precious metals will continue to get a bit of a bid.

Underneath I see the $1475 level as offering significant support, but I also see even more support at the $1450 level. If we were to break down below there, which was the scene of the top of an ascending triangle, then the market is likely to go much lower. In the short term though, I think we are simply grinding back and forth around the 50 day EMA as the market seems to be struggling for direction.

There are plenty of reasons to think that perhaps the central bank situation around the world will continue to propel gold higher, as the central banks around the world continue to cut interest rates and of course loosening monetary policy. This is typically good for precious metals as fiat currencies take a little bit of a hit. I think at this point gold is most certainly in an uptrend longer-term, but we could get the pullback from time to time that offers a bit of value. Quite frankly the market had gotten way ahead of itself for some time and now it seems like it’s just simply grinding away. If the market can stay above the crucial $1450 level, I do think it’s only a matter of time before the uptrend continues going much higher, perhaps even as high as $1800 based upon some technical work I’ve done in the past. If we were to break down below the $1450 level and perhaps even more importantly the 200 day EMA, the uptrend story in gold would be over.