Gold markets have pulled back just a bit during the trading session on Friday, as we continue to bounce back and forth. The gold markets have been very noisy, as the global situation continues to go back and forth between “risk on” and of course “risk off.” During the Friday session, Larry Kudlow stated that the US and China are getting closer to signing the deal. At this point, the market continues to buy that story, so as traders believe that the market may get more of a “risk on” type of move. However, when you look at the last several sessions, we have in fact formed a somewhat bullish pattern over the last week or so.

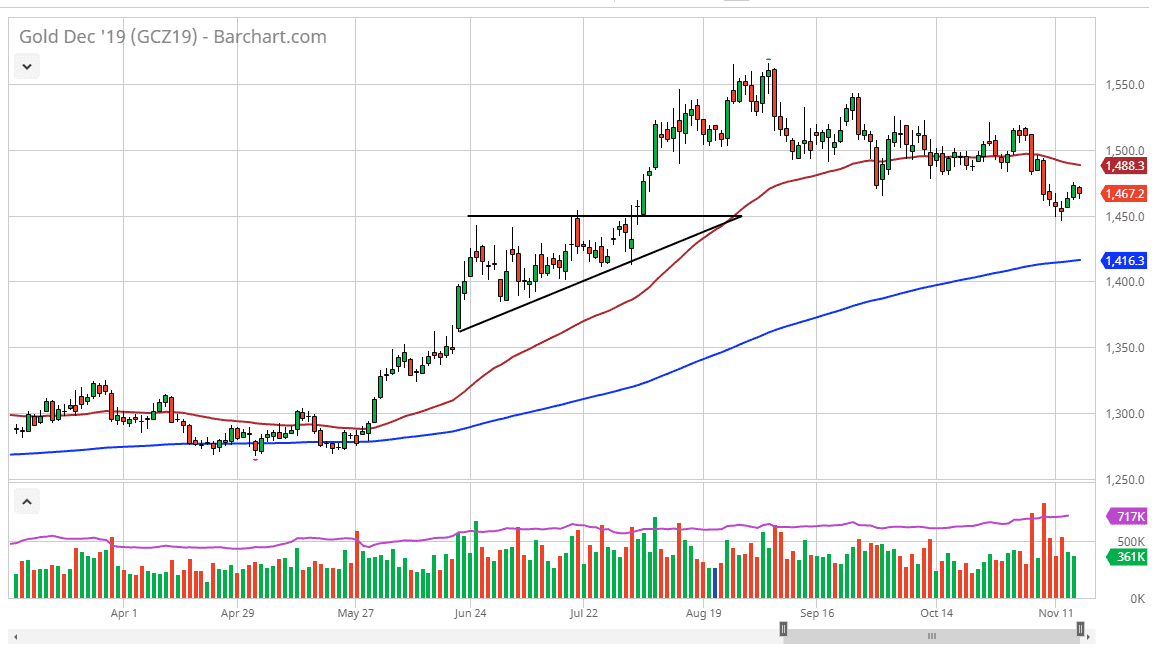

The $1450 level underneath is an area that has caused a lot noise in the past, as the market had formed an ascending triangle in June, and that the $1450 level was the top. As it was previous resistance, it should now be support. So far, we have seen that happen, and as a result it looks like the value hunters are starting to come back into the marketplace. All things being equal, the market looks as if it is probably going to go towards the 50 day EMA, and then possibly even the $1500 level.

Underneath, if we were to break down below the $1450 level, the market could very well drop down towards the 200 day EMA which is closer to the $1416 level. At this point, the market is likely to find buyers in that general vicinity as well, and as a result it makes sense that we have bounce from there. Now that we are dropping a little bit on Friday, it’ll be interesting to see whether or not that level holds. The alternate scenario of course is that we break above the highs from the Friday session and start taking off to the upside. Either way, I do like the idea of gold on the longer-term time frames but with the Federal Reserve standing on the sidelines recently, it suggests that gold may struggle a little bit.

At this point in time it’s likely that the market will probably be a longer-term “buy-and-hold” situation but if you are trading something that is levered like a futures contract, you will have to be a bit more cautious about this area just below and make sure that it holds. Ultimately, this is a market that is hanging on to the trend higher, and at this point it’s going to be very crucial to turn to the upside.