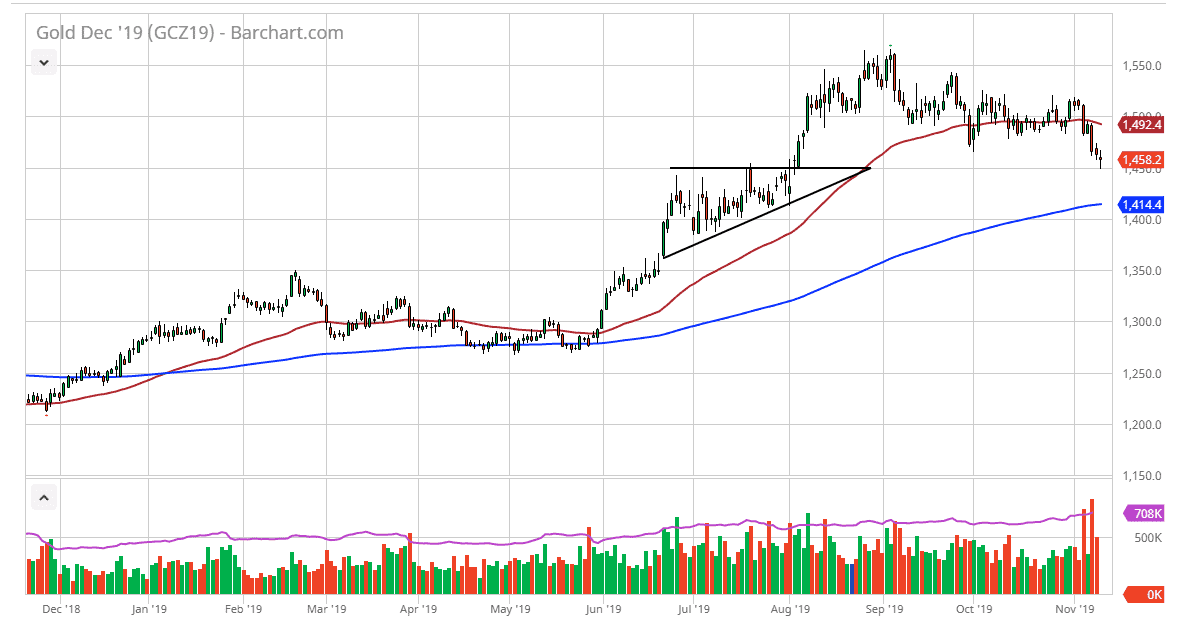

The gold market has fallen a bit during the trading session on Monday, reaching towards the crucial $1450 level. This was the top of an ascending triangle underneath, and now that we have found support at that level, it’s possible that we may have a bounce coming. Regardless though, what’s going to be interesting to watch is the next impulsive candle as it could dictate where this market goes much further.

If the market breaks above the highs of the Monday session, then we could see the market try to reach towards the 50 day EMA. The gold markets have struggled due to the US dollar strengthening and possibly even the markets taking on more of a “risk on” type of tone. Remember, the gold market is of course is very sensitive to the risk appetite globally, as a lot of people will jump into gold in order to try to play it safe. Ultimately, if the market does break down below the $1450 level, then it’s likely that we will then go to the 200 day EMA underneath, reaching down towards the $1415 region.

Ultimately, the 200 day EMA should continue to attract a lot of attention but if the market were to break down below there it could be serious trouble for the overall trend. All things being equal, typically the 200 day EMA will attract a lot of longer-term capital so we will have to pay attention to see whether or not we can bounce rather significantly from there. The Tuesday session will be crucial due to the fact that Monday was Veterans Day in the United States, and that of course would drive down a bit of the volume, giving you a bit of an argument for waiting in seeing what happens after the neutral candlestick.

I suspect at this point the market is probably going to continue to be very choppy but it’s possible that we could see an impulsive candlestick rather soon that can tell us which direction to trade. Quite frankly, we are still in an uptrend, but it most certainly has been threatened over the last couple of months. It comes down to what happens with the US dollar going forward, or perhaps whether or not there is some type of geopolitical concern out there. Pay attention and wait for an impulsive candlestick to determine whether or not the uptrend can be saved at this point.