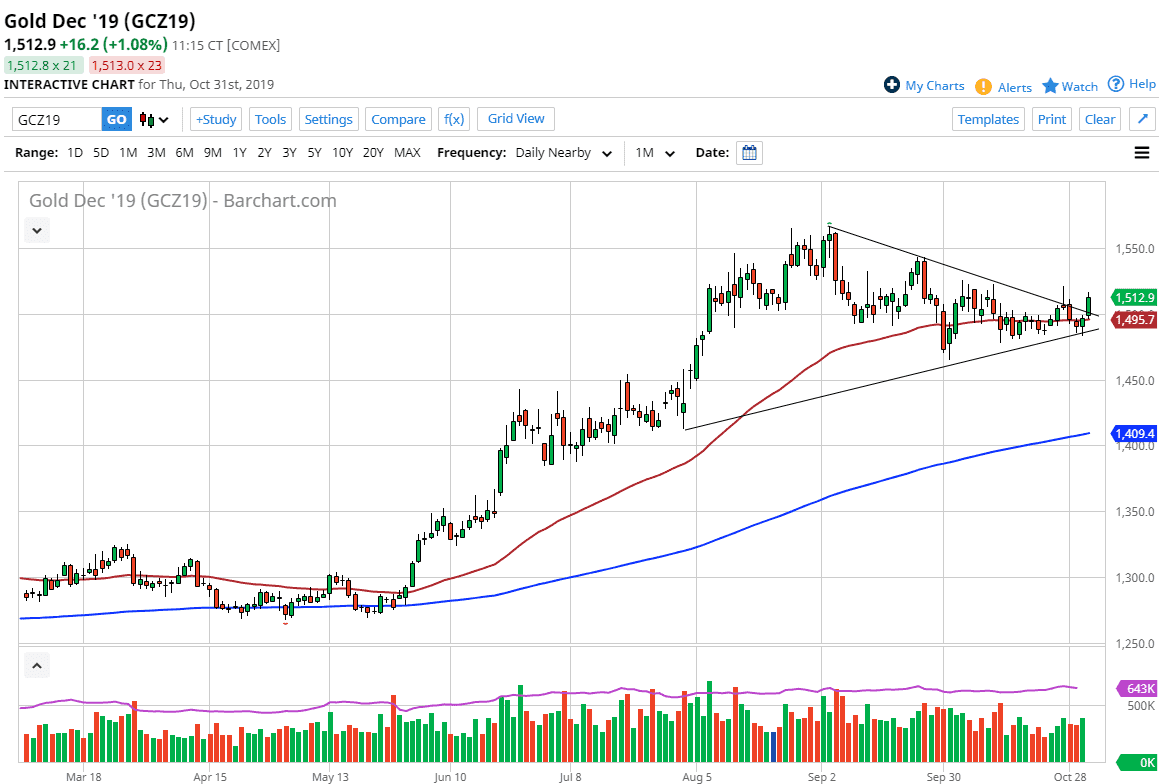

Gold markets rallied a bit during the trading session on Thursday as we are heading towards the jobs figure on Friday. That being said, the gold markets have been very bullish, and it looks as if we are starting to pick up some momentum. We have broken through a downtrend line, and that, of course, is a bullish sign as well. The $1525 level should be resistance, so if we can break above there is very likely that the market should continue to go higher. Short-term pullbacks should continue to offer buying opportunities based upon the fact that we have seen such a sharp drive to the upside.

Recently, the market has pulled back a bit in order to show signs digesting the gains that we have seen for some time. After that, it looks like the market is finally ready to go higher, perhaps reaching towards the upside. The 50 days EMA is just below and that, of course, shows signs of support and is likely that the uptrend line underneath there should continue to offer support as well. Ultimately, the market should continue to go looking towards higher levels over the longer term and I could even make an argument for the fact that the market has formed a bullish flag, and therefore could be signaling that it’s going to go as high as $1800.

Obviously, that’s not a short-term diagnosis, but the longer-term I could make an argument for gold to continue going higher as central banks around the world continue to keep monetary policy very loose, and of course interest rates vary small. As long as it’s going to be the case it does make an argument for gold to continue going higher and of course, we have the plethora of major issues around the world when it comes to geopolitical concern, trade wars, and global slowdown. With that being the case it’s very likely that central banks will continue the actions that we have seen so far, and therefore gold should continue to go much higher. That being said, the Friday session is going to feature the jobs figure out the United States so expect a certain amount of volatility in this market to continue to be a mainstay over the next 24 hours. Nonetheless, pullbacks should be buying opportunities on short-term charts, with an eye on the longer-term trend.